Warning signs for a US recession mimic pre-GFC levels – and we need to be worried

Australia hasn’t had a recession in nearly three decades.

While we emerged from the 2008-9 global financial crisis largely unscathed, various parts of the world economy are still recovering from it, and experts have nonetheless been on high alert for the first signs of the conditions that could lead to another recession of that magnitude.

But the recession doesn’t even need to happen to Australia for us to be hit hard by it.

History tells us that another recession is only a matter of time – and it looks like the chances of a US recession in the near future are increasing.

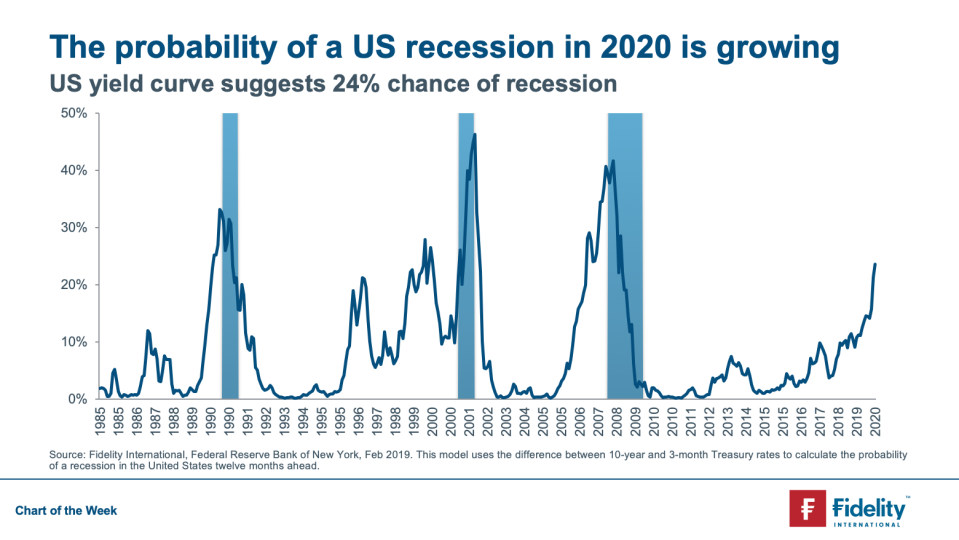

The chart is derived from a model by the Federal Reserve of New York which calculates the difference between the 10-year Treasury note and three-month Treasury bill as a forecasting tool for the odds of a US recession.

According to Fidelity International investment specialist Anthony Doyle, the slope of the yield curve is very close to inverting – in fact, it’s 0.4 per cent away from inverting.

Why does it matter if the US yield curve inverts?

It’s significant as it’s historically been a sure-fire sign that a recession is imminent.

An inverted yield curve preceded each of the last seven US recessions.

Danger zone

“This indicator is flashing amber,” Doyle told Yahoo Finance.

“It’s 40 basis points from inverting. It’s a clear warning signal that investors should be aware that the US could potentially face a recession,” he said.

The model predicts four months into the future and is currently predicting a potential slowdown in economic growth that could lead into a recession in 2020.

“The last time we saw this indicator at this level was actually August 2008.

“That’s even worse given what happened in September 2008. The Lehman Brothers went bust on 15 September.”

While Lehman Brothers’ collapse wasn’t the cause of the GFC (although it’s often incorrectly cited as such), it’s become emblematic of the start of the crisis.

In other words, the last time we saw the likelihood of a US recession so high (24 per cent), it was just one month before the major crisis that rocked the world.

“The fact that it’s spiking in terms of the next 12 months have got a lot of investors and market watches concerned again that the US economy could potentially face a recession.”

However, it’s not necessarily time to sound the alarm: Doyle made it clear a recession wasn’t Fidelity’s base case. And at a 24 per cent probability, there’s only a one in four chance of happening.

More warning signs

But the yield curve isn’t the only sign that things could be going bottoms-up: global debt is also at elevated levels.

And while it’s not yet as high as the GFC, a failure to address the debt levels of countries like Hong Kong, China, France, Canada and Chile could have massive consequences for the global economy.

The US isn’t the only one in danger of a recession: Europe is looking like it could enter into a recession at the end of this year, Doyle said.

What this means for Australia

So how worried do we need to be?

“There’s a famous saying that if the US sneezes, Australia catches a cold,” Doyle said.

Australian investment will suffer, and the Aussie dollar likely will too. “But the main impact will be through China.”

The US have a lot of exports from China that’s driven China’s growth.

But if there’s less demand for those Chinese exports coming from the US, then China will demand less from what AUstralia produces, which is predominantly resources and commodities.

As a result, commodity prices would start to fall; Australian trade would begin to deteriorate; and we could see some impact on the current account deficit.

“A US economic recession would clearly not be a favourable outcome for global economic growth,” Doyle said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: This recession indicator is predicting one in 18 months

Now read: Major investment firm says NOW is the time to invest in Crypto