The ultra-rich will be snapping up luxury property in these global cities

With the housing market recovering healthily from the national downturn that bottomed out halfway this year, property investors are keeping their eyes peeled for the next property hotspots (as well as areas to avoid).

However, the luxury residential property market – defined as the top 5 per cent of the market by value – is quite a different ball-game altogether, and typically doesn’t move in line with the ‘mainstream’ market.

So when the ultra-rich invest in property, where do they invest?

Related story: 5 Sydney suburbs where property prices are tipped to explode in 2020

Related story: 8 Australian property regions to avoid in 2020

Related story: 10 city trends in 2020 that will shape property prices

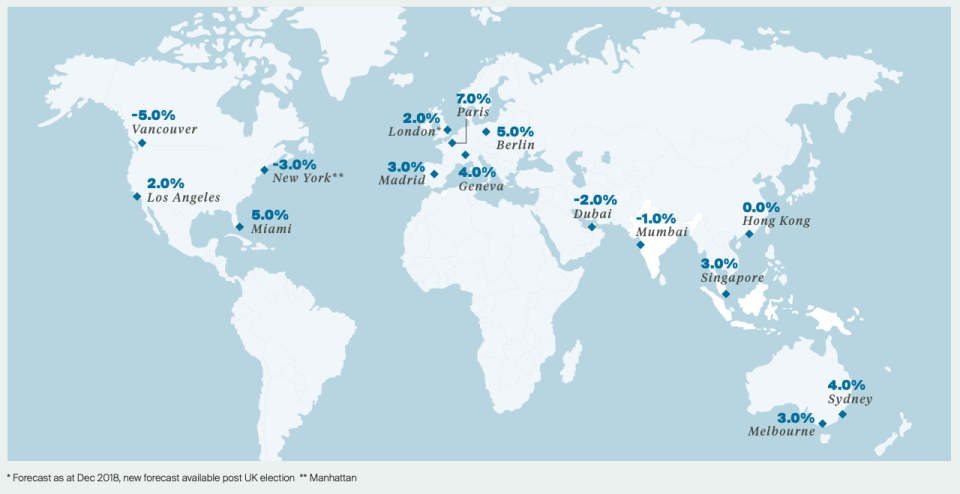

According to the Prime Global Forecast 2020 report by Knight Frank, some of Europe’s luxury property markets are slated to grow strongly, with Paris forecast to have the highest luxury property price growth at 7 per cent.

“Economic stability, low interest rates, constrained prime supply and strong tenant, as well as second home demand, will underpin price growth,” the report said.

“Home to Europe’s largest infrastructure initiative, the Grand Paris Project, as well as the 2024 Summer Olympics, both events will provide further stimulus.”

Miami and Berlin come in second place, with both markets set for 5 per cent prime price growth in 2020.

Geneva and Sydney rank equal third place at 4 per cent, with price growth recovering after a dip in the last few years.

“Confidence in both residential markets has returned due to lower interest rates and a limited supply pipeline. Both cities are also the recipients of significant transport investment; the Leman Express (CEVA) in Geneva and in Sydney, the CBD & South East Light Rail,” the report said.

Other cities include Madrid, Singapore (3 per cent) and Los Angeles (2 per cent).

On the other side of the spectrum, ultra-rich property buyers should avoid investing in the luxury property markets of Vancouver and New York, where prime property price growth is expected to fall by 5 per cent and 3 per cent respectively.

The number of wealthy Aussies is rising

A separate report by Knight Frank revealed that the population of rich people in Australia is set to grow – and their wealth itself set to grow, too.

The number of millionaires in Australia (worth US$1 million), will grow by 18 per cent in the next five years and hit nearly 400,000 people, while the number of ultra-wealthy individuals (worth US$30 million) will balloon by 20 per cent by 2023 to more than 1,000 individuals. The number of billionaires in Australia – at 43 individuals in 2018 – is expected to grow by 14 per cent by 2023.

The global ultra-high net worth population is moving around: among those intending to emigrate from Asia, nearly half said that Australia was their top country of choice.