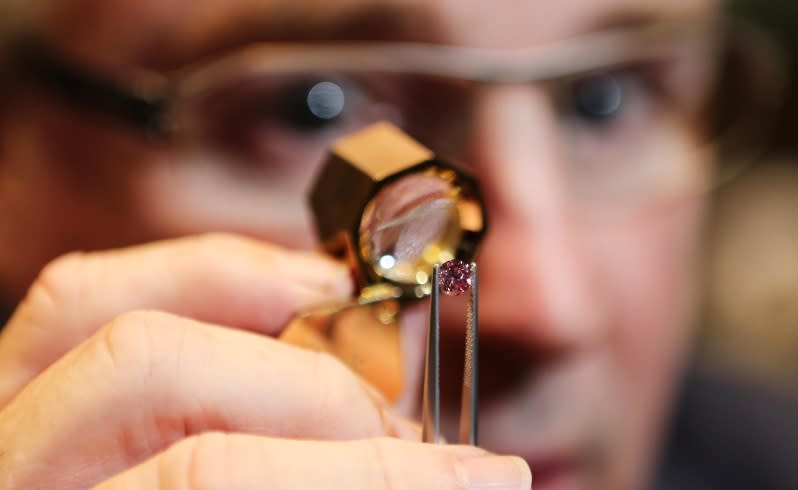

Jeweller displays precious pinks

Linney's will display some of its rare pink diamonds at its store this week ahead of the annual tender as it seeks to capitalise on growing scarcity in the lead-up to the closure of the Argyle mine.

The jewellery company's chief executive David Fardon claimed pink diamonds had appreciated between 10 per cent and 15 per cent annually in recent years, while the standard whites had remained static.

This was in part because of the impending closure of Rio Tinto's Argyle Diamond mine, which is the world's biggest source of the precious stones, in 2020.

With the pinks exceeding the value of an equivalent white diamond by about 50 times, they are among the most concentrated form of wealth in the world.

Most of the diamonds on display at the Subiaco store were purchased in last year's annual tender, where every diamond is literally one in a million.

For every million carats of rough diamonds produced at the mine, only one carat is offered for sale at the invitational tender.

Rio Tinto also achieved two record-breaking prices for its Argyle pinks diamonds tender held in October last year.

Jeweller de Beers set a record last year when one of its pink diamonds from South Africa sold at auction for US$83.2 million.

However, the buyer later defaulted in the sale and it is understood Sotheby's has since added the so-called "Pink Dream" to its own collection, paying a rumoured $US61 million for the stone.

The Linney's display will run from today until Monday.