Northern Star swoops on Tanami

Northern Star Resources looks to have pipped Metals X in a surprise bidding war for Tanami Gold's Central Tanami project in the Northern Territory.

Earlier this month, Tanami announced a deal with Metals X that would see it take a 75 per cent stake in the project as part of a staged cash and scrip deal.

Under the terms of the agreement, Metals X would take an immediate 25 per cent stake in the project for $11 million in cash and four million shares.

It would earn a further 50 per cent stake in the project by sole funding all expenditure and costs to bring it back into production.

But Tanami announced this morning it favoured an alternate proposal from Northern Star to progressively acquire a 60 per cent stake in the project.

The deal would involve Northern Star acquiring an initial 25 per cent holding for $20 million, comprising an $11 million cash payment and $9 million in scrip.

Northern Star would then earn a further 35 per cent interest by sole funding all expenditure and costs required to bring the project back into production.

Tanami would be granted two put options to sell its remaining interests in Central Tanami for a combined value of $52 million.

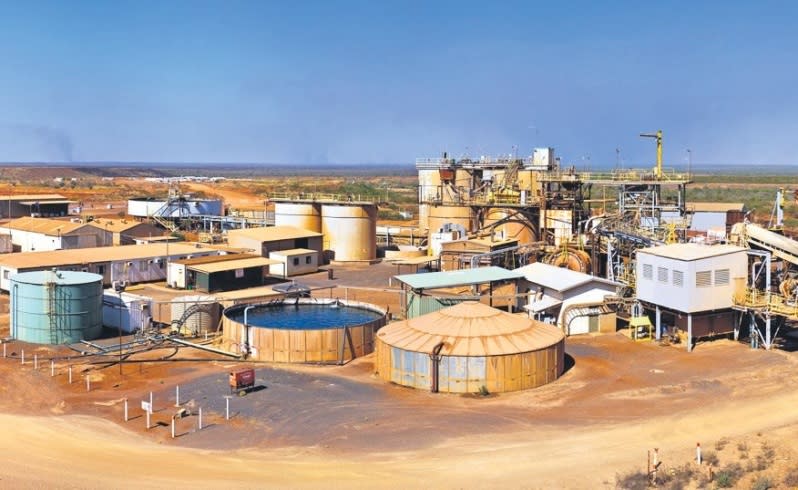

The project, which covers 2268sqkm, has been mined in 43 separate open pits from the 1980s until 2004 when it was placed on care and maintenance by previous owner Newmont Mining.

The project was sold to Tanami Gold in 2010.

Tanami has previously announced a total mineral resource of 25.5 million tonnes at three grams per tonne gold, containing 2.625 million ounces.

News of the Northern Star deal put a bomb under Tanami's share price as investors bet on a bidding war erupting between Northern Star and Metals X.

At 8am, Tanami shares were up 1.4 cents, or 82.35 per cent, to 3.1 cents after touching an earlier high of 3.6 cents.

Tanami shares have been under pressure in recent years because of a lower gold price, lack of cash and heavy debt burden.

Northern Star shares were up one cent to $2.21 while Metals X shares were steady at $1.20.