How much should I have in my superannuation by now?

Retirement could be days or months away. But even if it’s years or decades away, you’ve probably wondered whether you have as much in superannuation as your peers.

A couple seeking to retire with a comfortable living standard should retire with $640,000 together, and a single person will need $545,000, according to the Association of Superannuation Funds of Australia (ASFA).

Related story: Increase your superannuation by $200k with this one tip

Related story: New plan could put extra $200k into your super

Related story: Is investing in super a complete waste of time?

The Australian Securities and Investments Commission (ASIC) also has a calculator which shows how much your projected retirement income will be based on your current salary, age and super balance.

But if you want to know how your super stacks up right now, there are a few guides available.

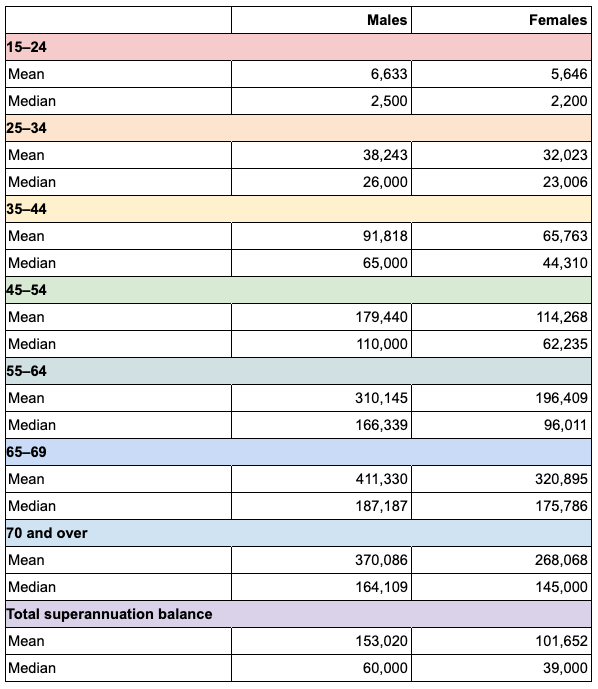

According to the ABS’ Gender Indicators for September 2018, the answer differs between genders, with men across all age groups enjoying higher balances.

Superannuation balance by age group (years) in 2015-16 in $

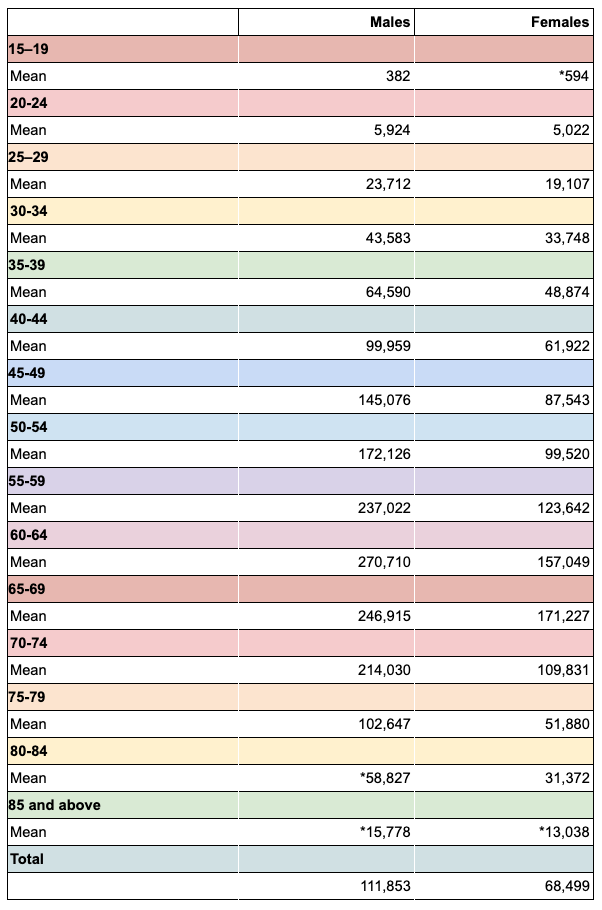

Breaking it down by five year intervals, ASFA also provides an idea of what Australians in each age group have. The super fund association used the ABS Survey of Income and Housing data from 2015-16 to come to these figures.

Superannuation balance by age group (years) in 2015-16 in $

How can I boost my superannuation?

There are a few steps you can take if your superannuation is well below these figures. The first is to see if your super fund is performing as well as it could be.

According to Stockspot, Aussies could retire with an extra $200,000 if they moved from a ‘Fat Cat Fund’ – which charges around 2 per cent in fees every year while performing poorly – to a ‘Fit Cat Fund’, which charges 1 per cent in fees and performing better.

“Superannuation is something that Australia should be proud of, yet these high fee ‘Fat Cat Funds’ continue to take advantage of thousands of Australians and their hard-earned money,” Stockspot CEO Chris Brycki said in August.

“One of our golden rules of superannuation is; the less you pay, the more you get. Always pay less than 1 per cent p.a. in fees so your super isn’t eroded by high fees.

“I know 1 per cent doesn’t sound like a lot, but for the Aussies stuck in these ‘Fat Cat Funds’, they’ll be worse off by $200,000 or more compared to their friends who are in a low-fee fund.”

It’s also a good idea to seek out any super you might have forgotten about from old jobs and consolidate. Otherwise, you run the risk of paying two sets of fees and paying for two sets of insurance.

You can roll over your super using the government’s MyGov portal or if you choose to roll your super over into a current fund, it will often be able to do this for you.

But before you move all of your super into one fund, you should compare fees and performance to make sure you’re in the best fund. That isn’t always the fund which has the most of your money in it; it could be one with a smaller amount of savings in it or a completely new one.

Additionally, you can make extra superannuation contributions to top up a low balance. The good thing about this is that superannuation contributions are taxed at a lower rate than your marginal tax rate. However, you generally can’t access this money until you retire.

If you’re comfortable, you can also shift your investment option to a more aggressive portfolio that aims to deliver higher returns. However, these options also come with higher risk.

Yahoo Finance’s All Markets Summit is on the 26th of September 2019 at the Shangri-La, Sydney. Check out the full line-up of speakers and agenda for this groundbreaking event here.