Halliburton (HAL) Q3 Earnings Top Estimates, Sales Miss Mark

Halliburton Company HAL delivered better-than-expected third-quarter 2020 bottom-line performance as the Completion and Production segment outperformed the Zacks Consensus Estimate.

The world's second-largest oilfield services company after Schlumberger SLB reported earnings of 11 cents per share, beating the Zacks Consensus Estimate of 8 cents.

However, the bottom line tumbled 67.6% from the year-ago figure of 34 cents per share due to lower revenue contribution from North America activities.

Operating income of $142 million also fell from $536 million in the same period last year.

Revenues of $2.98 billion further slumped 46.4% from the year-ago quarter’s sales and missed the Zacks Consensus Estimate of $3.09 billion too. Additionally, North America revenues plunged 66.6% year over year to $984 million. Moreover, revenues from Halliburton’s international operations fell 23.5% from the year-ago period to $1.99 billion.

Outlook

Management at this world’s biggest provider of hydraulic fracking noted that although the activity levels in North America during the September quarter ramped down, the company continues to benefit from the changing market dynamics through an excellent execution and regulation of the controllable factors. As operations in the global markets slow down, the North America industry structure steadily improve with stabilizing activities.

This Houston, TX-based industry player maintains an efficient North America service delivery improvement strategy, a prudent capital management policy and a responsible and competent team. The steady deployment of cutting-edge digital technologies will enhance Halliburton’s efficiency and aid its cost-saving efforts to bode well both for the company as well as its customers. Importantly, Halliburton will not only gain traction from its key concerted efforts but also continue to monitor the commodity price movement, further adjusting itself to the revised capex plans in response to a volatile price scenario.

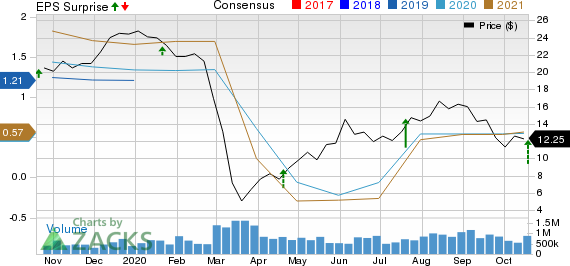

Halliburton Company Price, Consensus and EPS Surprise

Halliburton Company price-consensus-eps-surprise-chart | Halliburton Company Quote

Segmental Performance

Operating income from the Completion and Production segment came in at $212 million, significantly dropping 52.5% from the year-ago level of $446 million but beating the Zacks Consensus Estimate of $187 million.

The division’s performance was affected by weakness in completion tool sales, internationally, along with lower cementing activity in the Middle East/Asia and North America. These negative impacts were partly offset by an improved stimulation activity and artificial lift sales in North America land, higher activity across multiple product service lines in Argentina as well as increased pipeline services, internationally.

Drilling and Evaluation unit profit declined from $150 million in the third quarter of 2019 to $105 million in the corresponding period of 2020. Moreover, the segmental income underperformed the Zacks Consensus Estimate of $117 million, thanks to ramped-down drilling-related and wireline operations in North America and the Eastern Hemisphere alongside muted project management activity in the Middle East/Asia, partly compensated by a better drilling activity in Latin America.

Balance Sheet

Halliburton’s capital expenditure in the third quarter was $155 million. As of Sep 30, 2020, the company had $2.11 billion in cash/cash equivalents and $9.63 billion in long-term debt, representing a total debt-to-total capitalization of 65%.

Zacks Rank & Key Picks

Halliburton currently carries a Zacks Rank #3 (Hold). Investors interested in the energy space can look at some better-ranked stocks like Gulfport Energy Corporation GPOR and Range Resources Corporation RRC, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Gulfport Energy Corporation (GPOR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research