If You Had Bought Magnetite Mines (ASX:MGT) Stock Three Years Ago, You'd Be Sitting On A 98% Loss, Today

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Magnetite Mines Limited (ASX:MGT); the share price is down a whopping 98% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 80% lower in that time. Furthermore, it's down 80% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Magnetite Mines

Magnetite Mines hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Magnetite Mines finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Magnetite Mines has already given some investors a taste of the bitter losses that high risk investing can cause.

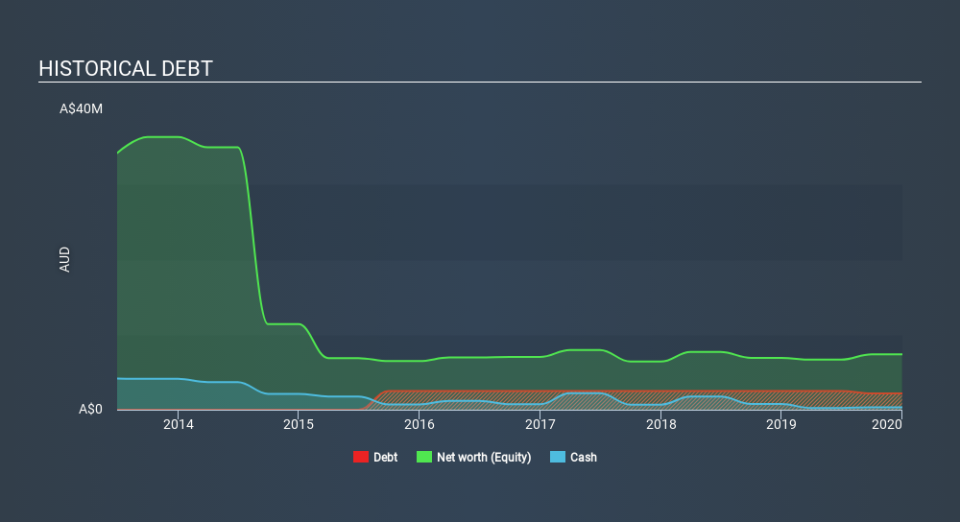

Our data indicates that Magnetite Mines had AU$2.1m more in total liabilities than it had cash, when it last reported in December 2019. That makes it extremely high risk, in our view. But since the share price has dived -72% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how Magnetite Mines's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

We've already covered Magnetite Mines's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Magnetite Mines's TSR, at -97% is higher than its share price return of -98%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We regret to report that Magnetite Mines shareholders are down 75% for the year. Unfortunately, that's worse than the broader market decline of 19%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 38% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Magnetite Mines has 6 warning signs (and 4 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.