Did Changing Sentiment Drive Unum Therapeutics's (NASDAQ:UMRX) Share Price Down A Painful 77%?

Unum Therapeutics Inc. (NASDAQ:UMRX) shareholders will doubtless be very grateful to see the share price up 53% in the last month. But that hardly compensates for the shocking decline over the last twelve months. During that time the share price has plummeted like a stone, down 77%. Arguably, the recent bounce is to be expected after such a bad drop. The real question is whether the company can turn around its fortunes.

See our latest analysis for Unum Therapeutics

Unum Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Unum Therapeutics saw its revenue grow by 37%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 77% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

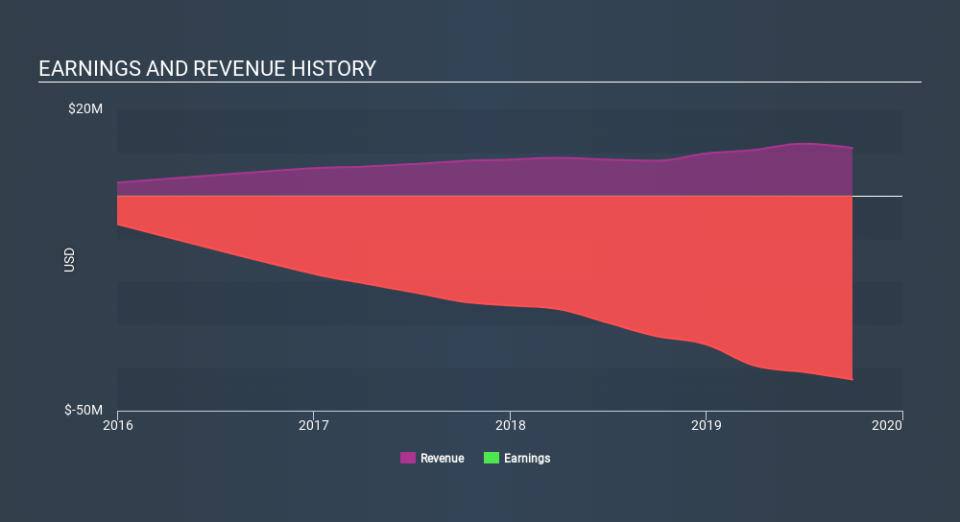

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Unum Therapeutics's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 26% in the last year, Unum Therapeutics shareholders might be miffed that they lost 77%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 35% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Unum Therapeutics better, we need to consider many other factors. Take risks, for example - Unum Therapeutics has 6 warning signs (and 3 which shouldn't be ignored) we think you should know about.

But note: Unum Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.