Coronavirus just sent the Dow crashing 1,100 points and it could get worse

The disturbing coronavirus driven selloff across global stock markets this week may be the tip of the iceberg for one simple reason.

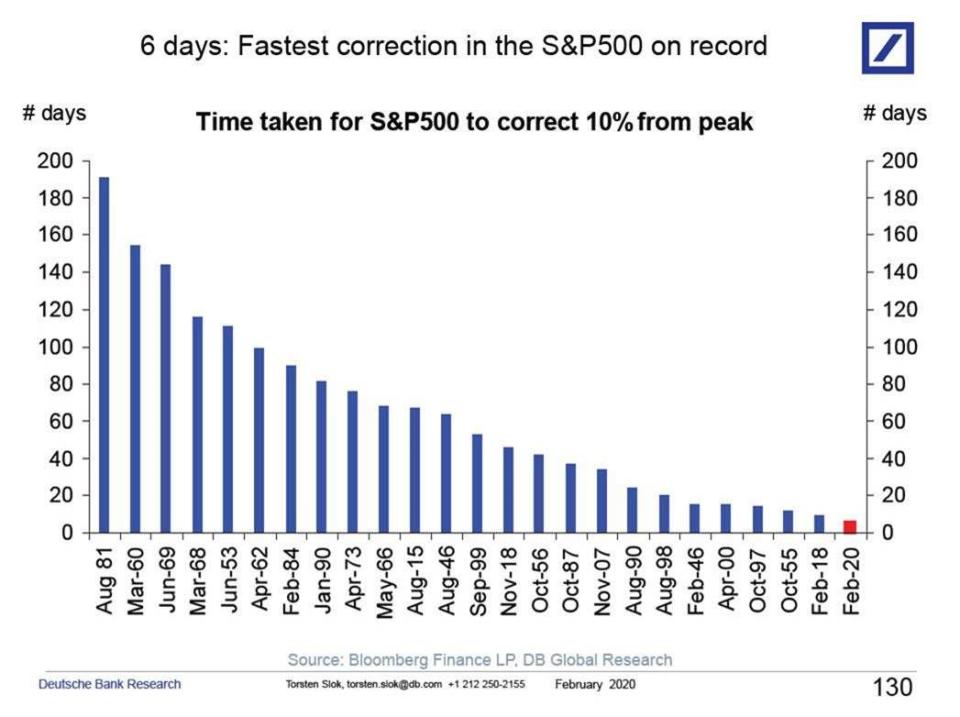

Stocks have yet to price in a mild — or somewhat bruising — recession in the U.S. as coronavirus infection cases pile up and bring consumer activity and businesses to a standstill. Up until now, equity strategists Yahoo Finance have talked with, say the stock market’s six-day drubbing largely reflects de-leveraging by hedge funds and speculators on momentum names (see Microsoft, Apple, etc.).

That suggests there could be another shoe to drop in stocks soon as (1) more strategists severely slash S&P 500 earnings growth targets as Goldman Sachs did Thursday; and (2) investors digest what is likely to be terrible global macroeconomic data in the weeks and months to come.

“It’s [the market] pricing in a significant economic slowdown and it’s pricing in corporates — especially the multinationals —being hit by both lower revenues and higher costs. And finally, it’s pricing in some de-leveraging,” explained Allianz Chief economic advisor Mohamed El-Erian on Yahoo Finance’s The Final Round. “It’s not yet pricing in the worsening prospects for the economy and the corporate sector that I believe unfortunately will result from this coronavirus scare.”

Words like that from a market veteran like El-Erian are hardly comforting for investors dealing with a major case of shell shock this week. Without question, Thursday’s session did little to alleviate concerns on the market’s near-term direction. In fact, an argument could easily be made the acceleration of losses in the final hour of trading only ratchets up the jitters gripping Wall Street.

The Dow Jones Industrial Average tanked 1,191 points, or 4.4% on the session while the Nasdaq shed 4.6%. The S&P 500 dropped 4.4%. Declining stocks outnumbered advancing stocks by a more than 4-to-1 ratio on the New York Stock Exchange.

Both the Dow and S&P 500 are now below their key 200-day moving averages. As it stands, stocks are on track for their worst week since 2008.

Selling picked up in the afternoon as California officials said over 8,000 people are being monitored for the coronavirus.

“Stocks got extremely oversold by almost every short-term measure today, but the end of the session was outright ugly, so caution is still warranted, even as this kind of panicky conditions rarely last for long,” said Gorilla Trades strategist Ken Berman.

Programming note: Yahoo Finance’s The First Trade will be live 30 minutes early on Friday, at 8:30 a.m. ET, to bring you all the analysis you need on this topsy turvy market. You can tune in on the Yahoo Finance network on Verizon FIOS channel 604, yahoofinance.com, the Yahoo Finance app, Apple TV, Roku, and Samsung TV.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.