Fed to keep stimulus taper on course, end QE3 by December

By Deepti Govind and Yati Himatsingka

(Reuters) - The recent rout in emerging markets will not deter the U.S. Federal Reserve from trimming its monthly asset purchases in steps of $10 billion (6.07 billon pounds) at each upcoming policy meeting, shutting down the program by year-end, a Reuters poll showed.

All 70 economists in the latest survey - an extraordinary display of unanimity among forecasters - expect the Fed to maintain the pace of the taper and reduce the total by $10 billion at each of the seven remaining FOMC meetings this year.

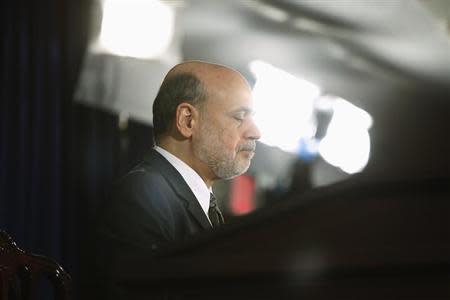

Ben Bernanke, who steps down as Fed Chairman on Friday, announced on Wednesday the second consecutive cut to the program under which the central bank was originally spending $85 billion a month buying U.S. Treasuries and mortgage-backed securities.

It first pared that to $75 billion starting January and announced on Wednesday a further $10 billion cut starting next month, equally divided between Treasuries and mortgage bonds.

All of the economists also expect the Fed to close the program before the end of the year, in line with a poll of 17 U.S. primary dealers conducted immediately after the January 29 Fed policy meeting.

"The Fed is not on auto-pilot as a lot of people would suggest," said Gennadiy Goldberg, economist at TD Securities, referring to expectations that the Fed will be out of the stimulus program by the end of 2014.

"They are reconsidering their approach to quantitative easing at every single meeting and I think they would only pause if the emerging market crisis threatens to spill over to U.S. growth. But the bar is set very high."

With Wednesday's decision, however, the Fed made no reference to the turmoil in emerging markets that has hurt U.S. stocks over the past few days.

Although the cut announced at Wednesday's Fed policy-setting meeting was widely expected, a sell-off in emerging markets during the past week had given rise to some expectations the Fed might hold off on shaving the size of purchases.

Central banks from Turkey to South Africa to India have raised key benchmark rates this week to arrest the steep fall in their respective currencies as well as safeguard against high inflation.

While proceeding with plans to scale back its bond buying, the Fed made no changes to its other main monetary policy tool, its pledge to keep interest rates low for "a considerable time after the asset purchase program ends and the economic recovery strengthens.

Only a minority of respondents, 20 of 63, expect the Fed under the new leadership of incoming Fed Chair Janet Yellen to change the unemployment rate threshold of 6.5 percent for when it will consider raising rates. Five of the rest said it might abandon the guidance altogether.

The poll showed the Fed will leave the target for its federal funds rate on hold at least until the second half of 2015, according to a firm majority of the economists.

The Wednesday Fed policy statement suggests it would take a serious threat to the U.S. economy before the Fed backs down from a resolve to shelve the asset-purchase program later this year.

"We're going to have enough growth where the Fed is going to continue on this path. Growth is strong. You've got a lot fewer headwinds than you've had in the last few years," said Scott Brown, chief economist at Raymond James.

The U.S. economy grew at a 3.2 percent annual rate in the last three months of 2013 on robust household spending and rising exports, data showed on Thursday.

The poll was conducted mostly before the growth data was published.

(Additional reporting by Sumanta Dey in Bangalore; Editing by Chris Reese)