Imagine Owning Synergis Holdings (HKG:2340) And Trying To Stomach The 80% Share Price Drop

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So consider, for a moment, the misfortune of Synergis Holdings Limited (HKG:2340) investors who have held the stock for three years as it declined a whopping 80%. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 55% lower in that time. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

See our latest analysis for Synergis Holdings

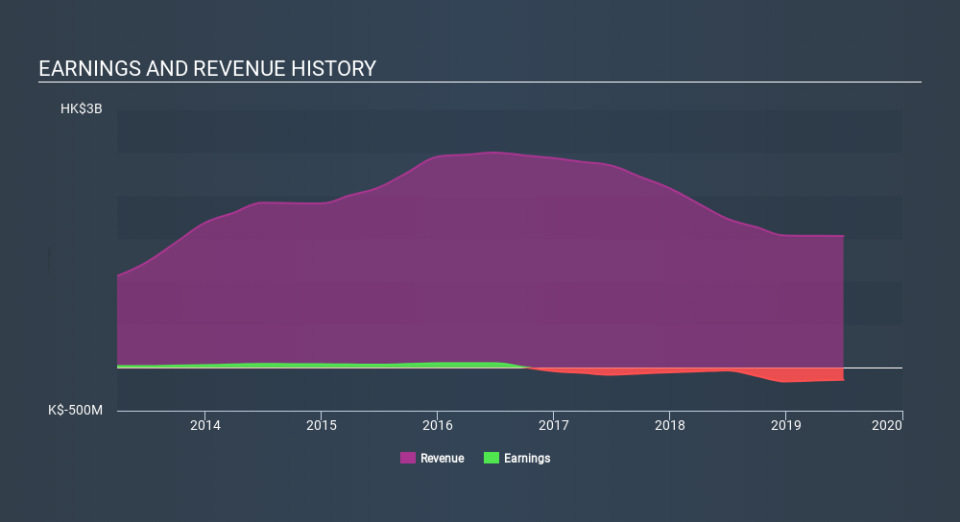

Because Synergis Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Synergis Holdings saw its revenue shrink by 19% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 41%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Synergis Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 0.2% in the twelve months, Synergis Holdings shareholders did even worse, losing 55%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 25% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Synergis Holdings better, we need to consider many other factors. For instance, we've identified 4 warning signs for Synergis Holdings (1 is a bit unpleasant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.