How to save $100,000 in 3 years

US entrepreneur and Shark Tank judge, Kevin O’Leary made us all feel pretty terrible about ourselves when he said by the time we’re 33 we should have $100,000 in the bank.

But If you’re a little (or a lot) off the $100,000 mark, fret not.

Yahoo Finance enlisted Finder to help us work out exactly how much we need to be putting away to save $100,000 in just three years.

For the average Aussie to reach $100,000 in three years, they’ll need to put around 37 per cent of their salary into a savings account which earns 2 per cent interest per year.

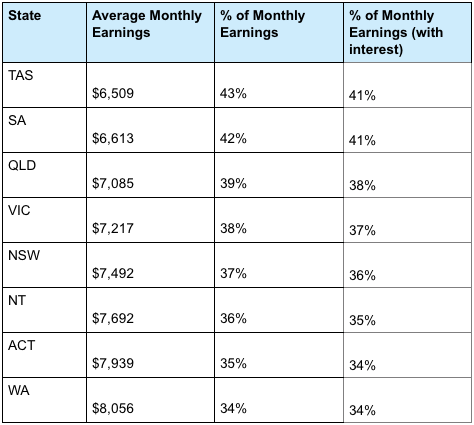

Here’s the percentage of your pay you’ll have to save if you want to reach $100,000 in three years:

Those earning the average salary in Western Australia ($8,056 per month) are in the best position of each state to achieve this, needing to put away the lowest percentage (34 per cent) of their salary in savings.

Surprisingly, those in New South Wales aren’t the worst off, with the average Sydney-sider needing to put away 37 per cent of their salary compared to the average Tasmania worker who would need to put away 43 per cent.

If your deadline to reach the magic number is a little further off, you could stick to saving just 20 per cent of your pay, meaning you’d reach $100,000 in savings in around five years.

Take a look at how long it would take Aussie saving 20 per cent of their pay in each capital city to reach $100,000:

Again those in WA would be better off, reaching $100,000 in five years and two months, while those in Tasmania would need over a year more (six years and five months) to reach that goal.

How can I start saving more?

“Saving $100,000 is an ambitious goal – even $10,000 is a tall order for many Australians,” Finder’s money expert, Bessie Hassan said.

“Getting into the habit of saving on a regular basis is more important than how much you’re putting away each time – you can chat to your payroll team to have a portion of your salary auto-transferred into a separate account each pay day to fast-track your savings.

Hassan said having a target to work towards can increase your motivation to save, and can come in handy if you’re ever tempted to dip into your savings for a non-essential splurge.

Getting your cash into a high-interest savings account will also help you fast-track your goals, as will getting rid of your unused subscriptions.

“You’d be surprised at how much it adds up – Finder reveals you could save up to $3,000 a year just by re-evaluating your phone, energy, broadband and health insurance,” Hassan said.

“Loyalty doesn’t always pay off. There are always new deals on offer, so ideally you should be looking to switch at least every year.”

The Yahoo Finance All Markets Summit will be held on the 26th of September 2019 in the Shangri-La, Sydney. Check out the full line-up of speakers and agenda for this groundbreaking event here and buy tickets here.