Gold prices hit all-time high: What that means for you

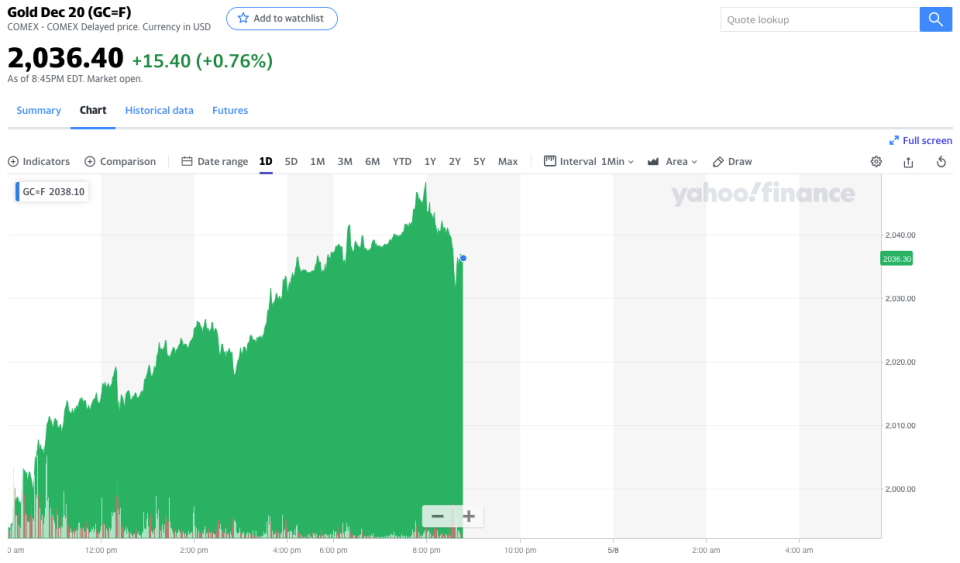

The price of gold has hit an all-time record high, smashing its ‘ceiling’ of US $2,000 overnight.

Investors piled in amid hopes of another US stimulus package and confidence in the US dollar fell, pushing up the value of the safe-haven asset.

And according to the experts, the value of the precious metal has further room to rise.

The highest value gold has hit is US $2,048.30 at 7:59pm EDT.

31 July 2020

The price of gold has hit a nine-year high, with investors increasingly turning to the element as a safe haven against the falling US dollar.

On 29 July, gold prices rose to US $1,971.40 per ounce, beating the $1,920 peak in September 2011.

As the US dollar declines in value relative to other currencies, both the value of gold and the AUD increase, according to AMP Capital chief economist Shane Oliver.

“The recent surge in gold and the Australian dollar have one thing in common – namely an emerging breakdown in the US dollar,” he said.

“The US dollar surged during the early phase of the coronavirus panic in response to safe haven demand.”

A falling US dollar typically means that the global economy is righting itself and growth is picking back up, he added.

Other factors pushing up the price of gold include a rising number of people buying gold as a hedge against inflation; gold being perceived as a good alternative to paper currencies, which some see as risky.

Is it a good thing?

Rising gold prices are usually correlated with bad news around economic growth.

So, during times of uncertainty, gold prices usually jump as it’s traditionally considered a safe haven investment.

“When interest rates are at or near zero investors in gold aren’t missing out on anything much so it makes gold relatively more attractive as a safe haven destination,” Oliver explained.

But whether the rise in gold prices this time around is positive or negative news isn’t so clear-cut.

“Given the mixed factors driving it higher it's ambiguous as to whether it's good or bad,” Oliver said.

“But the fall in the US dollar is more clearly a positive than a negative in terms of what it signals about the global economy and falling safe haven demand from investors.”

What higher gold prices means for you

The price of gold fluctuates every day, but what do these recent highs mean for the regular Aussie?

“The lift in the gold price [has] shown up in jewellery prices,” CBA senior economist Ryan Felsman told Yahoo Finance.

According to Commonwealth Bank economists, the price of jewellery has actually risen as of late: the Australian Bureau of Statistics reported a 3.3 per cent rise in the price of ‘clothing and footwear accessories’ (jewellery) in the June quarter due to the passing of gold price increases by jewellers.

Where are gold prices headed?

"People are continuing to pile into gold because that weak economic picture is going to continue to drive interest rates lower," US-based chief market strategist Phil Streible told Bloomberg.

And according to Oliver, the price of gold still has room to rise: “gold likely has more upside until central banks start to tighten and bond yields rise significantly, which looks to be a while off.”

It could even break another record in the near future, Felsman added.

“Gold seems well on its way to cross the US $2,000 per ounce mark in coming months based on the current drivers,” he said.

“We’ve been particularly surprised by the rise in US 10 year inflation expectations. However, we think for the gold price rally to continue well above US $2,000 per ounce, we need to see the US Federal Reserve consider negative interest rates.”

How to invest in gold

There are a few ways of owning gold: physical gold, gold futures, or gold shares.

In mid-May, online gold trading platform SendGold saw an eye-watering 648 per cent increase in gold transactions since the coronavirus pandemic, with the average value of transactions rising 339 per cent.

“Investors can get access to gold through exchange-traded funds (ETFs) or miners listed on the ASX – such as Newcrest Mining, Northern Star, et cetera,” said Felsman.

Bell Direct market analyst Jessica Amir said investors could consider gold ETFs such as ETFS Physical Gold (ASX:GOLD), Perth Mint Gold (ASX:PMGOLD) and BetaShares Gold Bullion ETF (ASX:QAU).

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.