Buyer beware: These are Australia’s 16 worst-performing suburbs

Australia’s worsening house price declines has already been likened to pre-GFC levels, but for some suburbs, the story is even worse.

New research from property investment specialist firm, Suburbanite has revealed the suburbs which suffered the worst negative growth in the 12 months to November 2018.

Suburbanite founder and director, Anna Porter said she released the report to help Australians “steer clear from the danger zones”.

“Each year, there are suburbs that are enlisted in the negative growth report that a number of investment firms still pitch to clients (often incentivised by hefty kickbacks),” she warned.

“I compile this report every year to empower people to make decisions on actual numbers, not shopping centre models and spruikers.”

These were the worst-performing suburbs across each state (suburb/percentage price decline):

NSW

Church Point houses / -25.3 per cent (2105)

Mangerton units / -43.9 per cent (2500)

Victoria

St Kilda houses / -28.7 per cent (3182)

Aberfeldie units / -35.8 per cent (3040)

Queensland

Sunset houses / -27.9 per cent (4825)

Beachmere units / -49.8 per cent (4510)

Western Australia

Kambalda West houses / -35.9 per cent (6442)

West Busselton units / -31.6 per cent (6280)

South Australia

Port Macdonnell houses / -22.8 per cent (5291)

Allenby Gardens units / -28.7 per cent (5509)

Tasmania

Shorewell Park houses / -26.9 per cent (7320)

East Launceston units / -14.2 per cent (7250)

Northern Territory

Bakewell houses / -19.8 per cent (832)

Nightcliff units / -32.2 per cent (810)

Australian Capital Territory

Mawson houses / -8.7 per cent (2607)

Phillip units / -26.4 per cent (2606)

Softening market

Across the country, the auction clearance rate rose slightly last week to 55.2 per cent, but this is still down significantly from the same period last year when 66.1 per cent of homes cleared at auction.

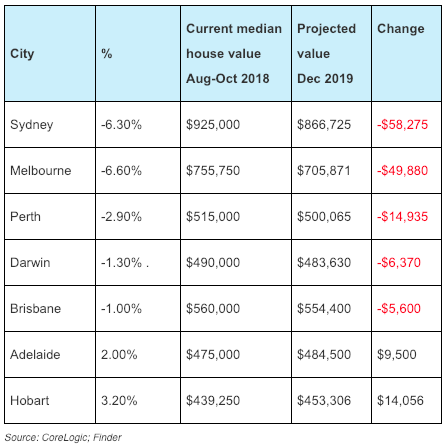

And according to finder.com.au analysts, homes across the country are set to plummet in price even further.

This means buyers are steadily gaining more bargaining power, insights manager at Finder, Graham Cooke observed.

“Remarkably, should these price drops eventuate as forecast, this would make Sydney and Melbourne property the cheapest it has been in four years,” he said.

“If you’re buying in a falling market, negotiate to the point where you think it will turn.

“In other words, bargain for at least 6 per cent under the asking price in Sydney, or 7 per cent in Melbourne.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Here’s what really fuelled Australia’s property boom