Bank issues urgent warning over new scam

A major Australian bank has issued a warning to customers over an elaborate remote access scam which tricks users into losing control of their devices.

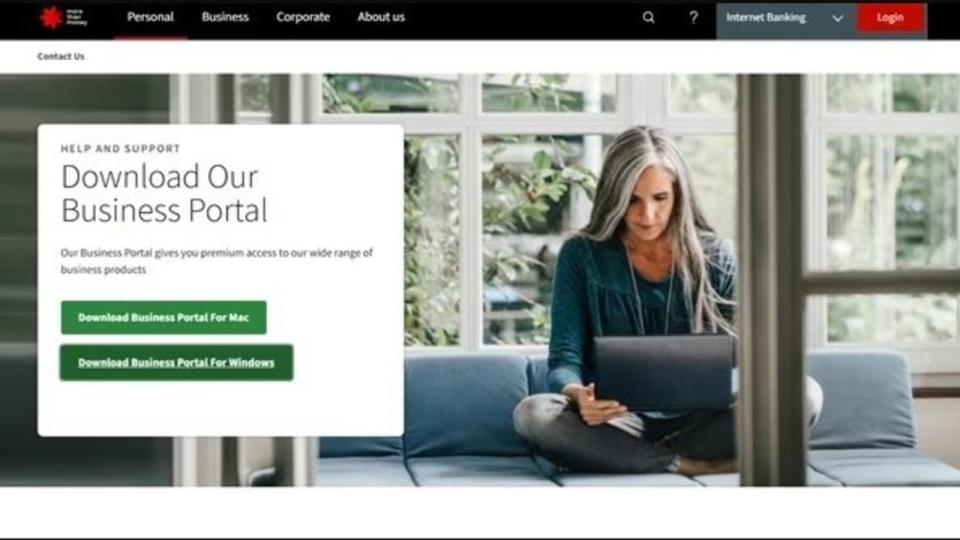

NAB made the announcement on Wednesday, saying they were aware of a number of fake websites connected to the bank which have been created by cyber criminals.

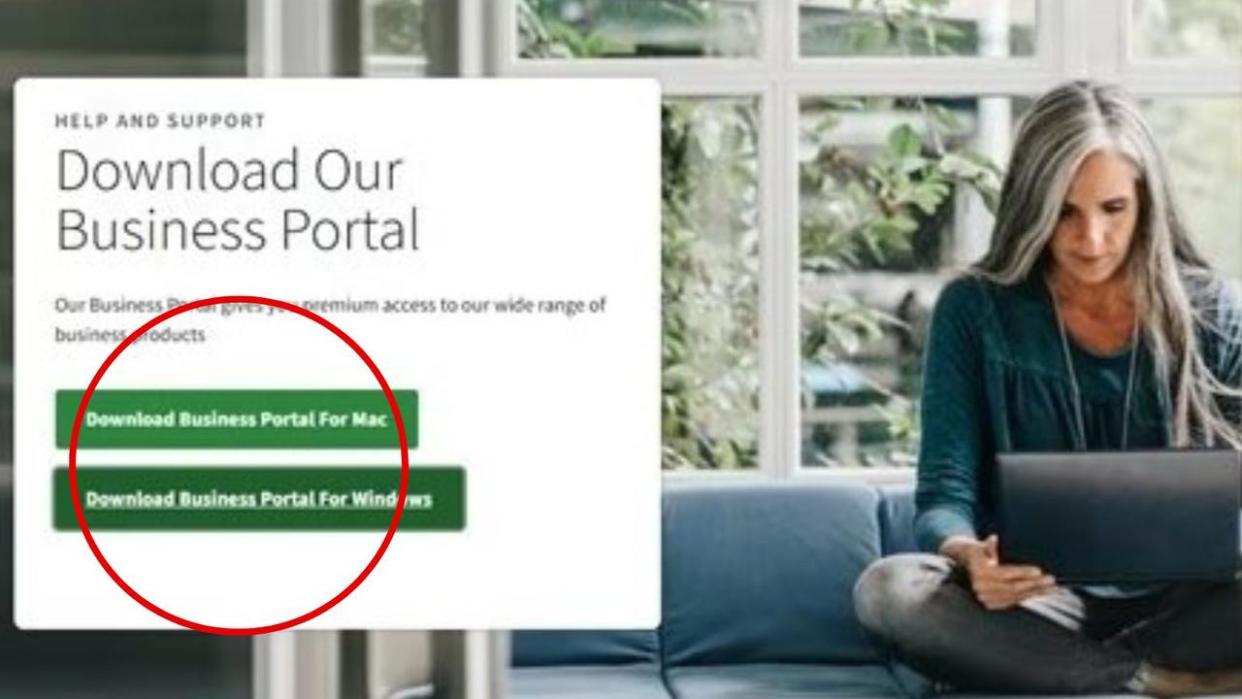

The scam page then lures customers into downloading a ‘”Business Portal” through a link, or a live chat option, which gives criminals remote software access and allows them to take control of the devices.

NAB warned customers not to “click anything on the page and close the window immediately”.

“NAB will never ask customers to download programs directly from our site,” the bank said.

“NAB will always direct you to the appropriate download source.”

The bank urged anyone who has unwittingly downloaded a link, or may believe their account in compromised to contact NAB on 13 22 65 or visit their local branch immediately.

We’re aware of fake NAB-branded websites which are misleading people into downloading remote access software which can give a criminal control of their devices. Please read our security alert at https://t.co/3klFYBTBBW for details on this new scam.

— NAB (@NAB) June 14, 2023

The Australian Competition and Consumer Commission (ACCC) says Australians have lost a record $3.1b in 2022, with total losses increasing by 80 per cent from 2021.

Investment scams were overwhelmingly the highest loss category totalling $1.5b, followed by remote access scams, which cost Aussies $229m.

ACCC Deputy Chair Catriona Lowe said the impact was more than just financial.

“Australians lost more money to scams than ever before in 2022, but the true cost of scams is much more than a dollar figure as they also cause emotional distress to victims, their families and businesses,” she said.

“As scammers become increasingly sophisticated in their tactics, it is clear a co-ordinated response across government, law enforcement and the private sector is essential to combat scams more effectively.”