With EPS Growth And More, Mangold Fondkommission (STO:MANG) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Mangold Fondkommission (STO:MANG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Mangold Fondkommission

Mangold Fondkommission's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Impressively, Mangold Fondkommission has grown EPS by 30% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

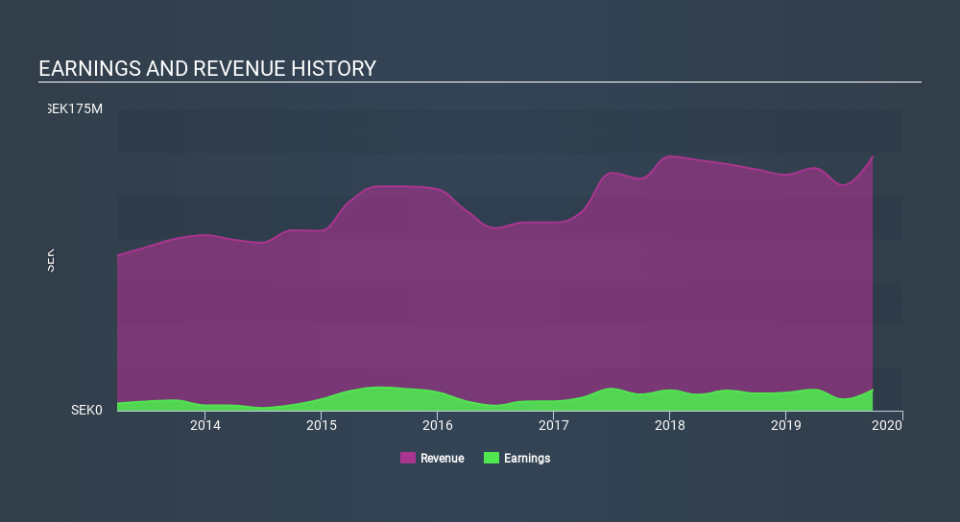

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Mangold Fondkommission's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Mangold Fondkommission's EBIT margins were flat over the last year, revenue grew by a solid 5.3% to kr148m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Mangold Fondkommission is no giant, with a market capitalization of kr574m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mangold Fondkommission Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -kr173.9k worth of sales, Mangold Fondkommission insiders have overwhelmingly been buying the stock, spending kr4.6m on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was CEO & MD Per-Anders Tammerlöv who made the biggest single purchase, worth kr2.4m, paying kr630 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Mangold Fondkommission insiders own more than a third of the company. In fact, they own 81% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have kr466m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Mangold Fondkommission Worth Keeping An Eye On?

You can't deny that Mangold Fondkommission has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. Of course, just because Mangold Fondkommission is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Mangold Fondkommission is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.