Did The Underlying Business Drive Embracer Group's (STO:EMBRAC B) Lovely 640% Share Price Gain?

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Embracer Group AB (publ) (STO:EMBRAC B), which is 640% higher than three years ago. And in the last month, the share price has gained 7.7%.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Embracer Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

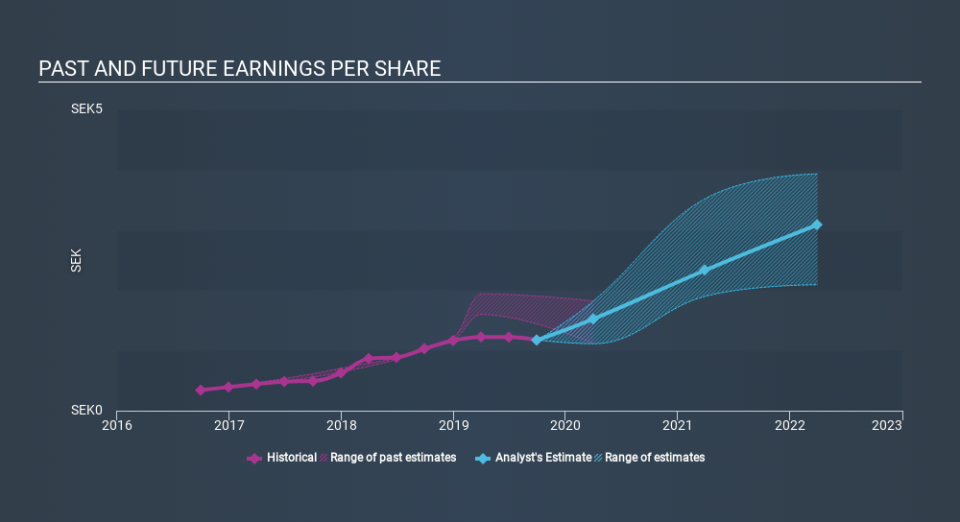

During three years of share price growth, Embracer Group achieved compound earnings per share growth of 51% per year. This EPS growth is lower than the 95% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 66.12.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Embracer Group has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Embracer Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Embracer Group rewarded shareholders with a total shareholder return of 37% over the last year. That falls short of the 95% it has made, for shareholders, each year, over three years. It's always interesting to track share price performance over the longer term. But to understand Embracer Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for Embracer Group that you should be aware of before investing here.

But note: Embracer Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.