Yen Falls Through 161 Per Dollar, Putting Intervention in Focus

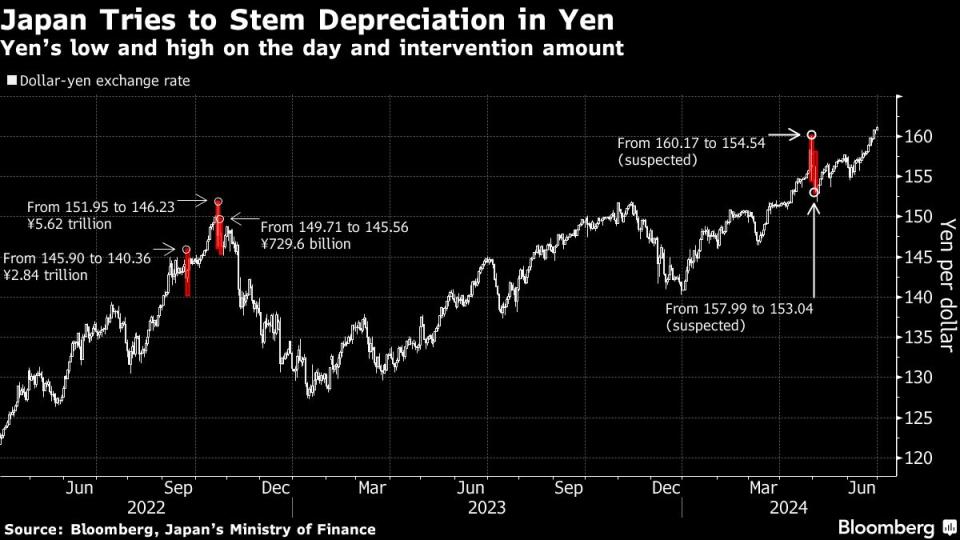

(Bloomberg) -- The yen weakened through 161 per dollar on Friday for the first time since 1986 amid broad strength in the greenback, raising the specter of Japan intervening in the market.

Most Read from Bloomberg

Supreme Court Overturns Chevron Rule in Blow to Agency Power

‘I Was Afraid of This’: Biden Debate Debacle Rocks US Allies

The Asian nation’s currency depreciated as much as 0.3% to 161.27 per dollar in Tokyo trading, before trimming the slide to 160.93 at 3:21 p.m. The greenback’s gains came ahead of data on the Federal Reserve’s preferred inflation gauge, and as traders mulled the first US presidential debate.

The yen risks falling further if the core PCE measure proves stronger than market expectations. Volatility spreads have shown that investors are demanding a premium to guard against sudden moves, bearish yen wagers have piled up, and a measure of active trader positioning went to its most negative since 2022.

Even if Japan does wade into the market, as it did in April-May, it may have limited long-term impact. “Unless we see a change in fundamentals, intervention will only result in a temporary yen reprieve,” National Australia Bank Ltd. strategists led by Ray Attrill wrote in a research note this week.

The nation’s top currency official, Masato Kanda said this week that authorities stand ready 24 hours a day if necessary. Finance Minister Shunichi Suzuki said Friday that he was deeply concerned about the impact of rapid and one-sided currency moves on the economy, and that the government was watching market developments with a high sense of urgency.

Suzuki also announced personnel changes for the ministry’s key roles, including the appointment of Atsushi Mimura as Kanda’s successor, effective on July 31. The change won’t affect the country’s broad currency policies.

The yen’s decline to 161 per dollar reflected strong demand for the US currency going into the end-of-quarter Tokyo fixing, said Hiroyuki Machida, director of Japan FX & commodities sales at Australia & New Zealand Banking Group.

Japan spent a record ¥9.8 trillion ($61 billion) during its last round of interventions, which appear to have taken place on April 29 and May 1.

Some traders have suggested that the yen is at risk of slumping as far as 170 per dollar, with no immediate catalysts to reverse its momentum in a sustainable way. The yen is down about 12% so far this year, the worst performance among Group-of-10 currencies.

The pace of currency moves is also important to Japanese officials. Kanda has said moves of 10-yen over the course of a month would be rapid, and a 4% move over two weeks wouldn’t reflect fundamentals.

--With assistance from Daisuke Sakai.

(Updates prices, adds comment from strategist and history of intervention)

Most Read from Bloomberg Businessweek

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.