Warning about 'buy now, pay later' schemes ahead of Christmas

With Christmas just around the corner, financial experts are warning about the new ways of paying for presents.

Afterpay and Zip Pay are now available through many retailers, but there’s a sting in the tail and and it could cost you.

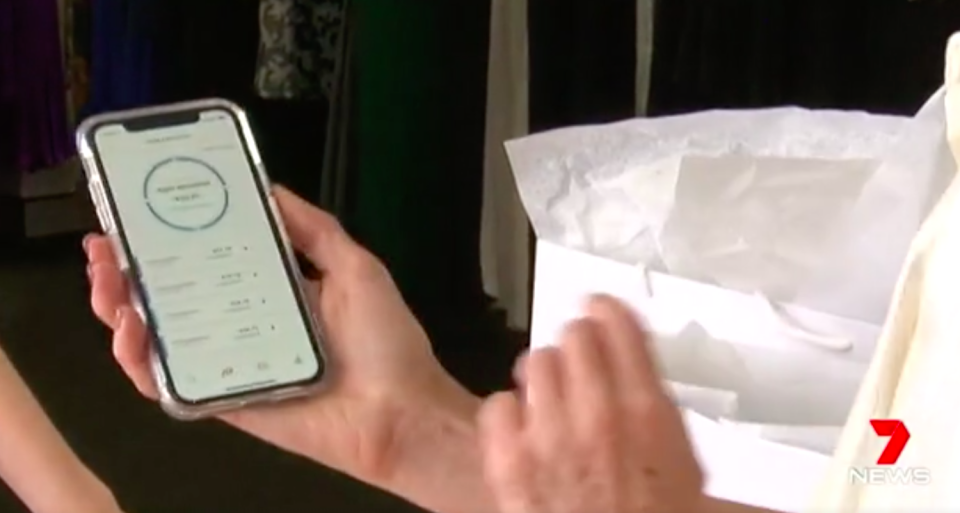

A buy-now, pay-later app, Afterpay is an online payment system that allows to you pay off your purchase in four equal instalments.

Providing the payments are made on time, there’s no charge to you.

But experts warn these new forms of payment can take advantage of consumers.

“It can disguise what you’re buying, because you’re buying it in the moment and then you’re stuck with the debt,” financial counsellor Shiobhan Meerman says.

If you miss a payment or are late with a payment, they apply charges instead of interest.

The experts are calling it loophole lending, because whether you call it interest or a charge, it still costs you money.

“Loophole lending exists outside of the consumer protection laws,” Ms Meerman says.

Those laws exist to protect you if something goes wrong.

That might include assessing whether you can actually afford credit in the first place or negotiating easier repayment terms if you’re finding things tough.

But fashion fan Lynette, who uses Afterpay for her clothing purchases, is a convert.

“You feel like you’ve got more control over how you can spend your money and your budgeting,” she says.