War’s Aftershocks Are Forcing Israelis to Reckon With Inflation

(Bloomberg) -- The Israeli town of Ofakim is just a short distance from Gaza, where war has raged for eight months. But it’s taken until now for the inflationary fallout of the conflict to hit home.

Most Read from Bloomberg

Dozens of CVS Generic Drug Recalls Expose Link to Tainted Factories

Fed’s Higher-for-Longer Stance Hits Firms That Expected Rate Cut

As tens of thousands fled the areas near Israel’s southern and northern borders after Hamas’s attacks on Oct. 7, the housing stock shrank by nearly 5% overnight, a setback for an economy whose pre-war cost of living already topped Switzerland’s as the most expensive among the OECD’s 38 member countries.

After months spent crammed into hotel rooms, many evacuees are starting to lease longer term — just when housing is already in short supply. For Shahar Zvolon, a resident of Ofakim, that contributed to a 30% increase in her rent, an expense that accounts for more than a quarter of Israel’s monthly consumer price basket.

Israel’s worst armed conflict in half a century has set off an inflationary chain reaction that’s finally coming into view. “Help, We Are Out of Air, We Are Collapsing,” blared a headline on the popular news website Walla in June — an appeal for help against inflation as the public outcry grows.

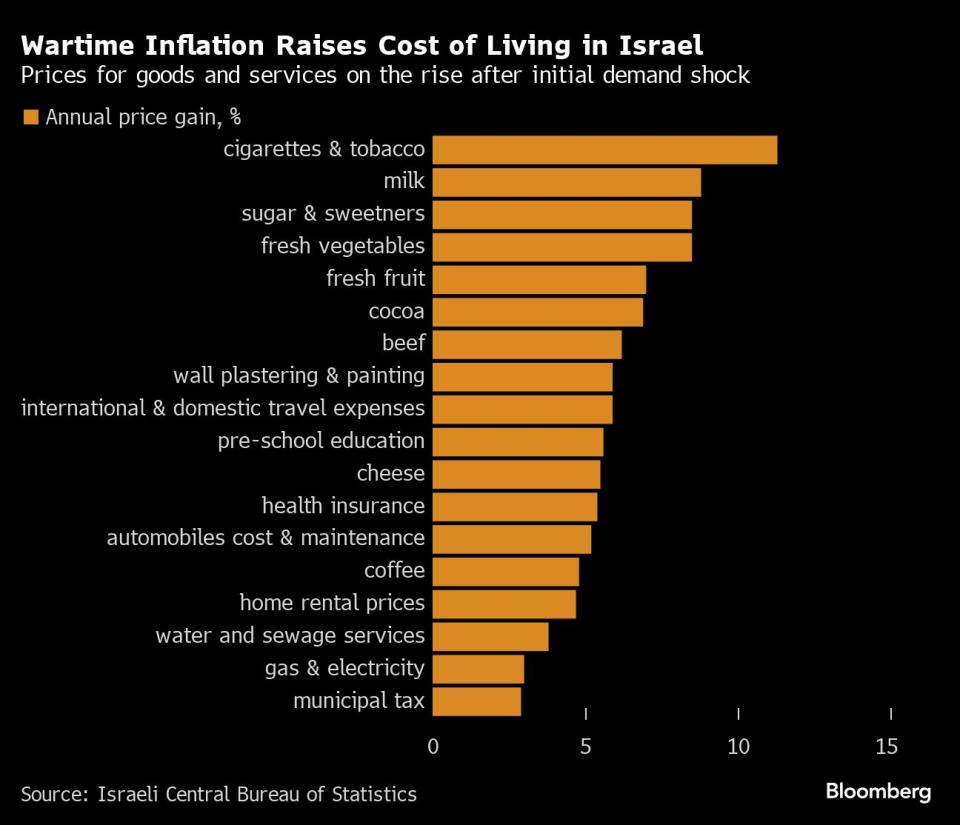

The initial shock to consumer spending was so big that it kept inflation from accelerating despite disruptions in the economy. But now that domestic demand is bouncing back, the cost of everything from groceries to travel is taking off.

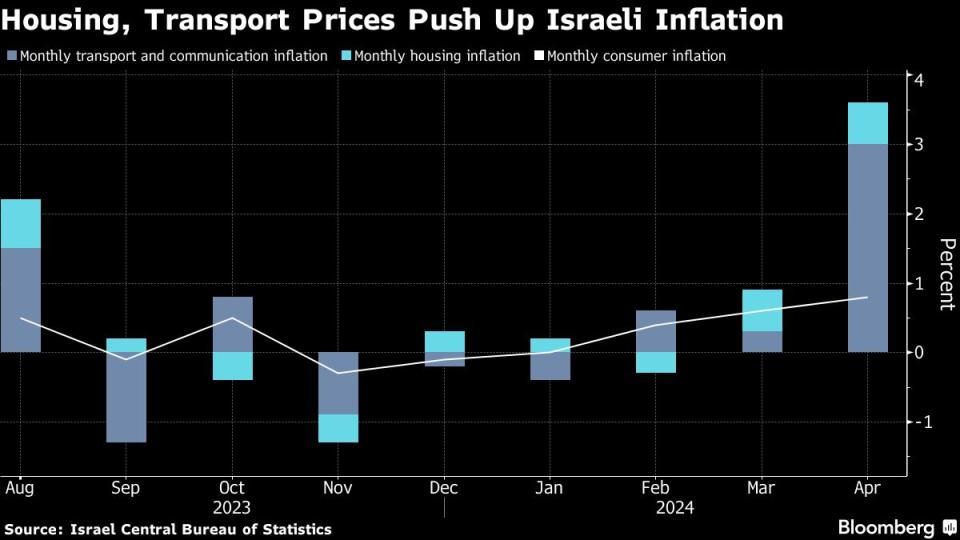

Intensifying price pressures have reversed a six-month slowdown in inflation, which probably quickened in May beyond the official 1%-3% target range for the first time this year. The latest monthly reading is due on Friday.

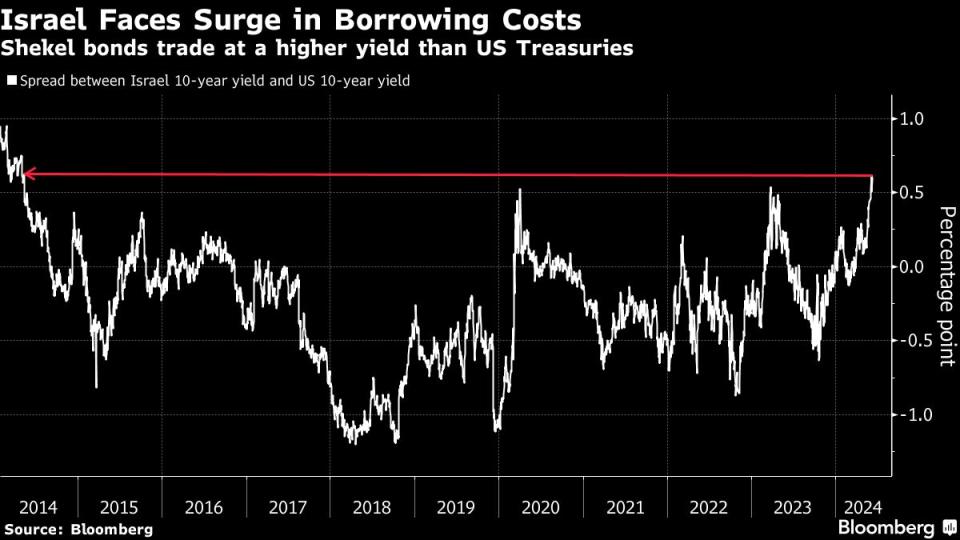

The bleaker outlook is also rewriting the timeline for the central bank’s plans to ease monetary policy further, threatening to keep borrowing costs higher for longer just as the government looks to the debt market to fund the bulk of its massive spending needs.

The momentum of inflation will be harder to slow with unemployment back near pre-pandemic lows and a near 8% growth in wages during the first two months of 2024. Higher taxes and utility costs — combined with an expansive fiscal policy and a more volatile shekel — are also putting a strain on prices.

The Finance Ministry now expects inflation to end the year at 3.3%, nearly a full percentage point higher than forecast by the central bank in January. The biggest contributors are housing, transportation and food — categories that together account for over half of Israel’s consumer price basket.

Spiraling food prices are an especially stark case of how echoes of the war resonate through the economy.

Once the fighting erupted, demand surged because people looked to stock up on food while the government boosted its own purchases to provide for soldiers and other security forces. Food prices rose by an estimated 2% in the first weeks of the war alone.

There has been little let-up since. Roughly half of Israel’s 29 largest food companies - local producers and importers - have marked up prices by as much as 30% since January.

Amid exchanges of fire, access has been limited to as much as a third of Israel’s agricultural land, according to BDO Consulting, further unsettling a farming industry whose workforce shrank by 40%.

A halt of exports by Turkey, higher global commodity prices and rising cost of transportation due to Houthi attacks on Red Sea shipping made matters worse.

“This has increased dependency on imports, which on their part, have grown costlier due to rising transportation fees and the Turkish trade ban on Israel,” said Chen Herzog, chief economist of BDO Consulting.

Spillovers into the rest of the economy have pushed up restaurant prices by over 3% in each of the past four months.

The head of an association of restaurant owners recently admitted to breaking competition laws by attempting to collude with peers and raise prices by at least 5%-10%, arguing that profitability in the business “has eroded and prices need to be updated.”

Industries like aviation are suffering a similar squeeze, a worry because transportation and communication have the second-highest inflation weighting after food.

The number of international carriers with services to Israel is down by a third since the war began, cutting the average volume of daily flights by 40%. As a result, air ticket prices were the biggest driver of inflation in April with an 11% surge.

With more people returning from reserve duty in the army, demand is set to grow further.

“Airlines seek certainty,” said Nir Mazor, deputy chief of Kishrey Teufa, a tourism company. “The next window of opportunity for their return is October. If things haven’t settled down by then, that could be delayed to April 2025.”

The housing market shows why relief from inflation is likely a long way away.

A ban on Palestinian workers means an estimated one-third of building sites remains shuttered, with a steep drop in productivity hurting the rest. More than two-thirds of Palestinians employed in Israel before the war worked in construction.

The risk is that the supply of new homes won’t begin to recover for at least the next two years, pushing more potential buyers to rent — just as an increasing number of Israelis displaced by the war look to settle down.

As hostilities with Iran-backed Hezbollah heat up on Israel’s northern border with Lebanon, more than half of those who left the area say they have no intention of going back, according to a Ruppin Academic Center poll.

The price for an average apartment in Israel was up 3.1% in the first quarter from the prior three months. Relative to pre-war levels, the rental cost of a three-bedroom property has gone up by 6% in Tel Aviv and 13% in Jerusalem, data from the Madlan real estate website showed.

“The fact that residents of the north have been away from home for over six months, with no end in sight, is bringing many of them to seek long-term housing solutions in safer locations,” said Tal Kopel, head of Madlan. “And this is putting pressure on the rental market.”

Though political tempers have long run high around Israel’s cost of living, the government’s priorities are elsewhere in wartime, with the budget stretched by expenditure on defense. To stabilize public finances, a percentage point increase in value-added tax will go into effect in January.

The political blame game over inflation is already in full swing.

Finance Minister Bezalel Smotrich and Economy Minister Nir Barkat have been criticized for “being a complete failure when it comes to the cost of living” by Moshe Gafni, a fellow member of the ruling coalition.

Government inaction could have consequences, especially after a surprise acceleration in prices in April, said Idan Azoulay, chief investment officer at Sigma Investment House.

“To not hear even a faint voice saying that price increases will be examined and steps may be taken can in itself accelerate increases,” he said.

(Updates with restaurant prices starting in 16th paragraph.)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.