5 biggest money worries causing anxiety among Australians

Australians are growing increasingly anxious about finances, and how to fund retirement tops the list of worries.

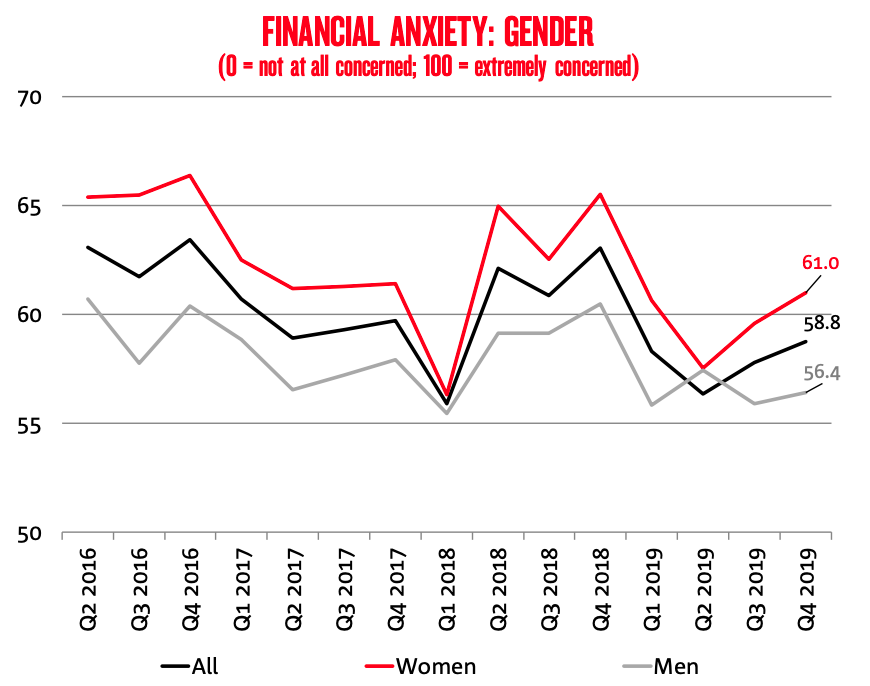

According to NAB’s latest Financial Anxiety Index, our concerns about future spending and savings plans have risen from 57.8 points last quarter to 58.8 points.

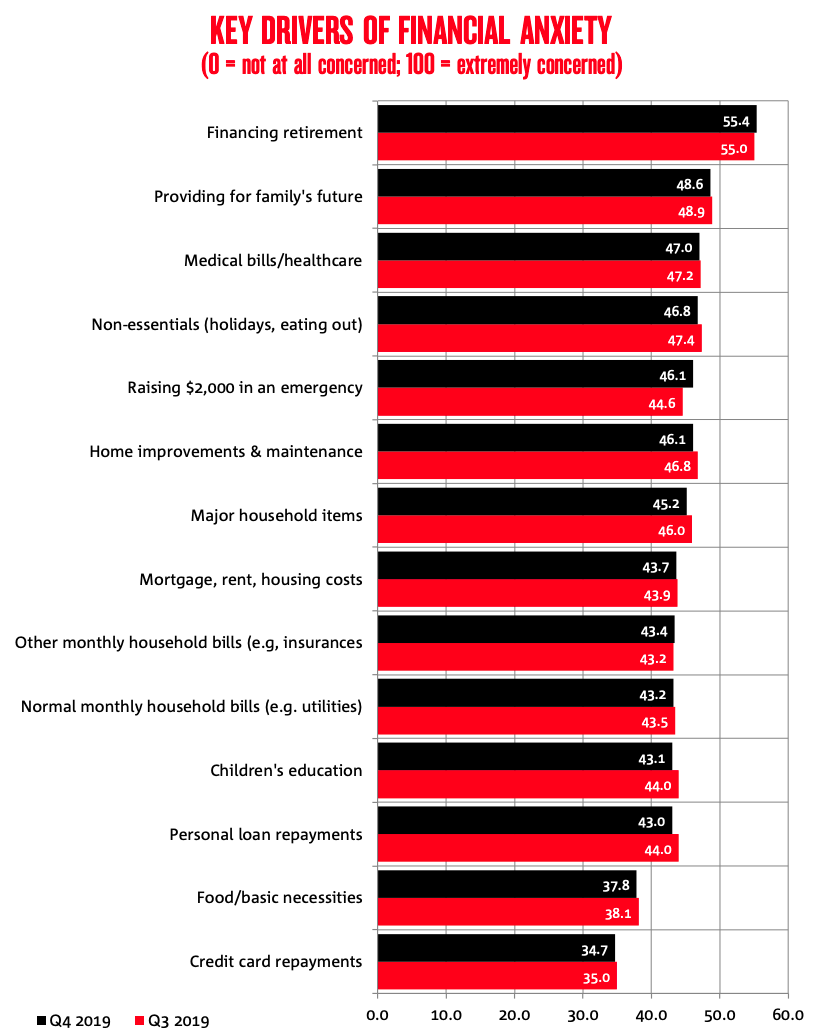

Financing retirement is the top driver of anxiety, followed by providing for your family’s future and paying for medical bills.

Related story: Aussies are worried about money: So why aren’t we seeing financial advisers?

Related story: What you can actually do if you’re stressed about your finances

Related story: Stressed about your finances or your mortgage? There’s an app for that

Non-essentials, such as holidaying or eating out, are also a major source of stress, followed by the prospect of hustling together $2,000 in an emergency.

At the bottom of the list of financial worries are credit card repayments, and paying for food and basic necessities are also down the ladder.

Women continue to be more anxious than men, the index reveals, and the gender gap has widened to its highest level in a year.

Aussies worried about money, but aren’t getting help

A previous report found nearly two in three Australians worry about their financial situation, and say it’s impacting their mental and physical health, yet aren’t reaching out for help.

According to Fidelity’s Value of Advice report, the biggest barrier to seeing a financial adviser is due to the costs associated with financial advice.

Advice fees can easily reach $3,000 a year, according to the Financial Planning Association. That would eat up nearly a tenth of the average Australians’ savings, which is $28,602 per person, according to a Finder study.

According to financial adviser Helen Baker, everyone should see an adviser no matter their financial situation, but clients who have upwards of $20,000 could probably start considering getting advice.

What can I do if I’m stressed about my finances?

Speaking to Yahoo Finance, social researcher Claire Madden said there are a few things we can do if we’re anxious about our financial situation and not in a position to see an adviser.

You’ll need to get a clear picture of your financial situation – and you can do this with the help of online resources, blogs, articles and podcasts.

Do some research around which budgeting apps can help you keep track of your spending to help you save better.

Also, it doesn’t hurt to swap notes with people you know. Don’t be afraid to ask advice from any friends, family and colleagues who have excelled in financial management.

Go over your insurance, as well, and consider exploring meditation apps to help you manage stress.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.