UK Election Dividing Lines Exposed as Parties Clash Over Economy

(Bloomberg) -- The first wave of UK economic data published since Prime Minister Rishi Sunak called a snap general election is already revealing the key dividing lines that separate the two main parties.

Most Read from Bloomberg

India’s Markets Brace for Selloff as Modi’s Poll Goals in Doubt

Qatar Airways Jet Encounters Severe Turbulence, Leaving 12 Hurt

Sunak National Service Plan Faces Enforcement, Funding Questions

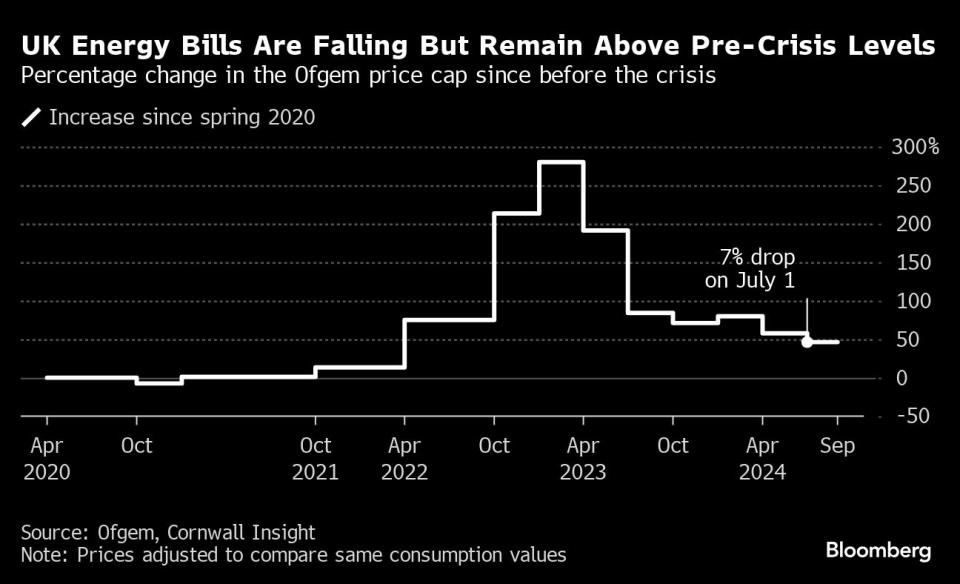

Figures on inflation, migration, private-sector activity, retail sales and consumer confidence have all been published since Wednesday morning, hours before the election was called. On Friday, energy regulator Ofgem also announced that household energy bills will fall by 7% from July 1. That’s just three days before the vote.

The ruling Conservative Party — in office since 2010 and trailing badly in opinion polls — is focused on early signs that the economy and living standards are improving. The Labour opposition, by contrast, insists that the UK is mired in a longer-term malaise. While the Tories say things are getting better, Labour argues it is simply too late and it’s time for a change.

The energy announcement highlighted the political divide. Energy Secretary Claire Countinho said the typical household is on track to be almost £400 ($509) better off than in March. “We have turned a corner,” she said on X. Reacting to the same data, Labour leader Keir Starmer countered during a visit to Scotland that households would remain “a staggering £400 a year worse off” than in 2021.

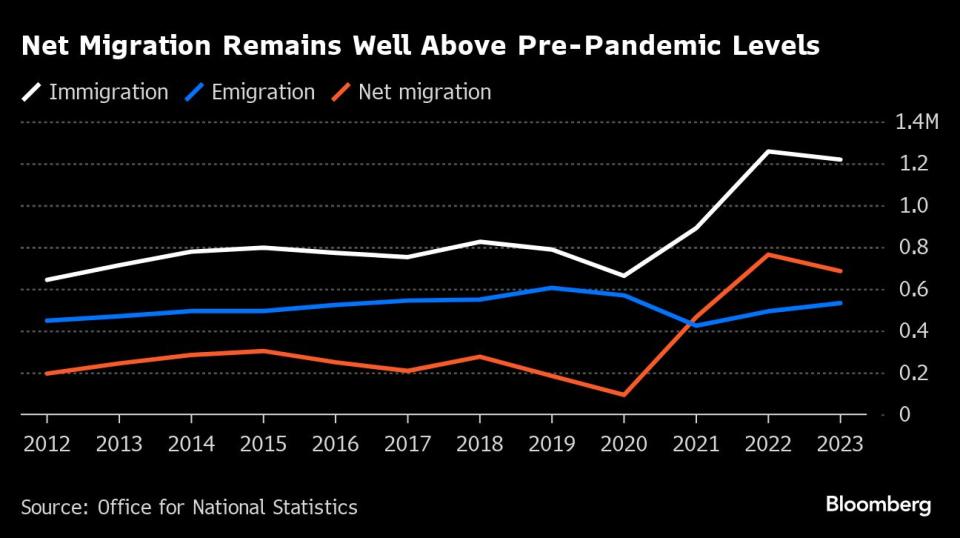

The splits were evident after other data releases, too. Net immigration remains more than twice as high as pre-Brexit levels, but figures released on Thursday showed that it fell 10% in 2023 to 685,000. Home Secretary James Cleverly focused on that change, saying the reduction showed the government’s plan was working while conceding that “there is more to do.” Labour’s Yvette Cooper pointed to the absolute level, which she said revealed “total Tory chaos and failure.”

The economic data have been mixed. The steep fall in inflation to 2.3% allowed Sunak to say that the long-running price shock was over and declare that things are “back to normal.” But persistent underlying inflationary pressures in the figures nevertheless convinced markets to scrap bets for a summer interest-rate cut.

Strong UK Inflation Diminishes Sunak’s Hopes for June Rate Cut

Figures on Thursday and Friday suggested the economic recovery may be slowing down. S&P Global said its composite purchasing managers index, covering services and manufacturing, slipped to 52.8 in May from a 12-month-high of 54.1 in April. A reading above 50 signals growth but the pace of recovery was weaker than expected.

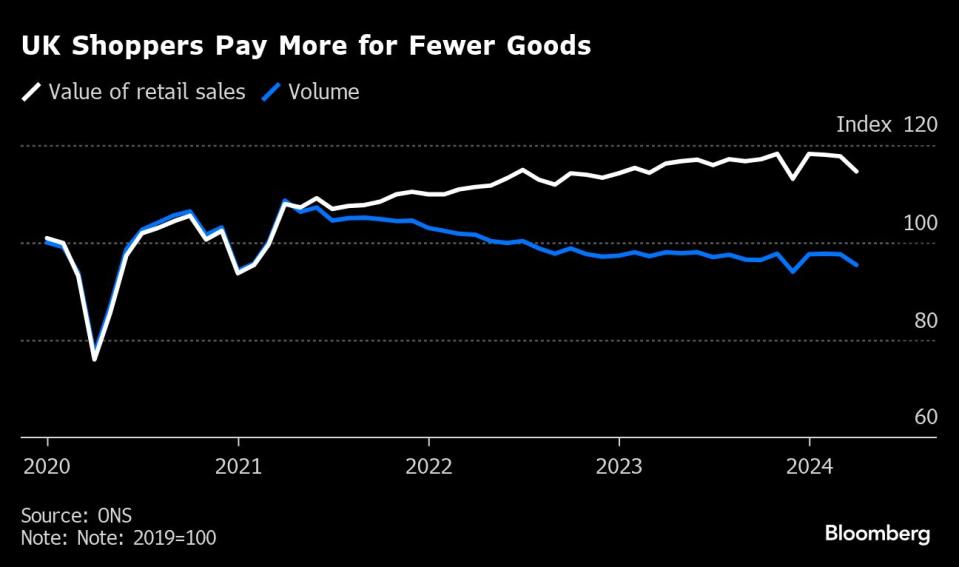

Retail sales plunged 2.3% in April, according to the Office for National Statistics, a much steeper decline than the anticipated 0.5% fall. The ONS pointed to poor weather, and households may have spent more on leisure and entertainment, but the data also underscored the cost-of-living squeeze, which has seen Britons endure the worst inflation in four decades. Shoppers are paying about 20% more than in early 2021 to buy the same basket of goods.

Consumer confidence has recovered to levels last seen at the end of 2021, shortly before Russia’s invasion of Ukraine drove inflation higher. Within that, though, the major purchase index which measures whether people think now is a good time to buy big ticket-items, slumped below last year’s level – showing households are not confident enough to spend.

Most Read from Bloomberg Businessweek

TikTok Video Playing on Finance Bro Stereotype Becomes a Viral Hit

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

©2024 Bloomberg L.P.