Tech Powers Stocks as Adobe Surges in Late Trading: Markets Wrap

(Bloomberg) -- Stocks closed at a fresh all-time high as tech rallied, with Treasury yields sinking on bets the Federal Reserve will cut rates this year amid signs of disinflation.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Tesla Investors Get Behind Musk’s Fight for $56 Billion Pay Deal

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Bump Stock Ban Tossed Out by Supreme Court in Gun-Rights Win

Luxury Labels Slash Prices 50% to Lure Wary Chinese Shoppers

Equities rebounded after a brief drop, with the S&P 500 notching a fourth straight record — its 29th this year. In late trading, Adobe Inc. soared on a strong outlook. Treasuries climbed, with 10-year yields breaking below 4.3%. A $22 billion sale of US 30-year bonds saw strong demand.

The producer price index unexpectedly declined the most in seven months, adding to evidence that inflationary pressures are moderating. Several categories that are used to calculate the Fed’s preferred inflation measure — the personal consumption expenditures price index — were softer in May than a month earlier.

“The latest data in hand nudge the door a little wider open for the Fed to begin making an interest rate cut later this year,” said Bill Adams at Comerica Bank, which forecasts Fed reductions in September and December.

The S&P 500 topped 5,430. Tesla Inc. jumped after Elon Musk said shareholders backed his compensation package. Broadcom Inc. led a rally in chipmakers after announcing solid earnings and a 10-for-1 stock split. GameStop Corp. climbed as Keith Gill, known as “Roaring Kitty,” posted on X.

Treasury 10-year yields fell seven basis points to 4.24%. The European Union’s bonds got hit as bets they would soon be added to key sovereign benchmarks received a blow, undermining the bloc’s efforts to broaden the appeal of its debt. Heightened political risk in France drove the premium on the nation’s 10-year bonds to the widest since 2017 over German peers.

Fear of missing out on the technology rally is running as rampant among active mutual funds as it’s ever been.

Mutual funds have been upping their technology positions since the beginning of 2024 to catch the group’s rally — while cutting exposure everywhere else. That’s pushed their overweight on the group to to an all-time high, data compiled by Barclays Plc strategists show.

A historically strong start to the year for the US stock market should continue into the second half of 2024, according to JPMorgan Chase & Co.’s asset management division.

While the move may look more like a grind than a rocket ride after the S&P 500’s double-digit return since January, solid earnings, the end of the Fed’s monetary-tightening campaign and economic strength will continue to lift US equities in the coming months, strategists at the firm led by David Kelly wrote. They recommend buying large-cap shares and a mix of value and growth stocks.

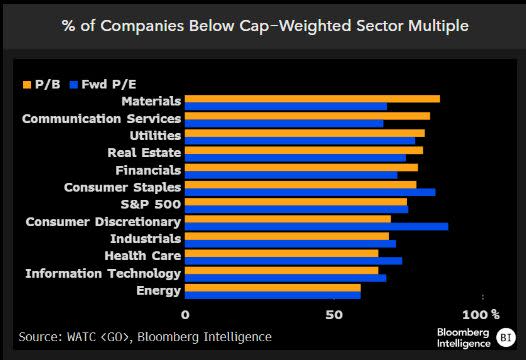

US large caps look more expensive relative to bond markets than at any point in the last two decades, though this may have little meaning for equity returns and may not imply a bubble has emerged in stocks, according to Bloomberg Intelligence strategists led by Gina Martin Adams.

“The most recent historical precedent shows relative value is a poor predictor of returns,” they wrote.

Stocks spent the better part of the bull market in the 1980s and ‘90s at worse relative value levels and still posted remarkable annualized growth, according to BI. Valuation excesses are also only evident via the market-cap weight, with the equal-weighted index near its pre-pandemic norm and nine of 11 sectors’ relative valuations below average.

Traders continued to keep a close eye on the macroeconomic picture.

The PPI report came on the heels of a soft reading on consumer prices that offered some reassurance that progress toward the Fed’s 2% inflation target has resumed.

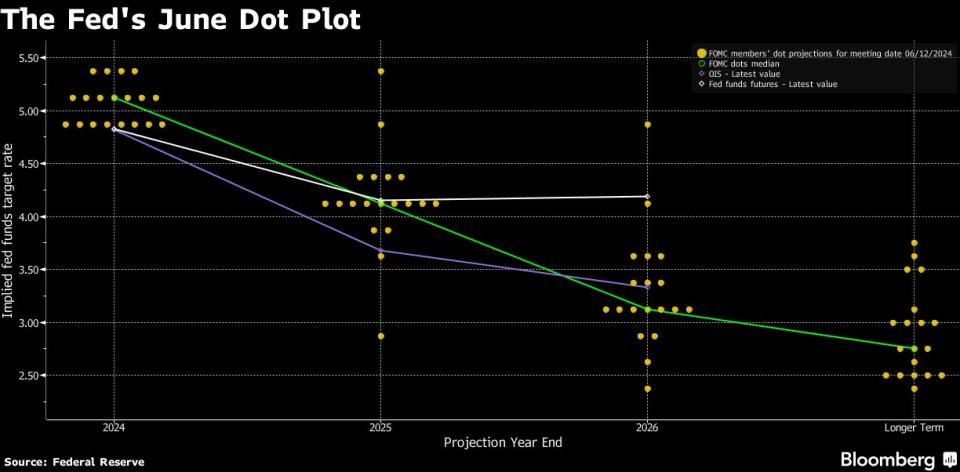

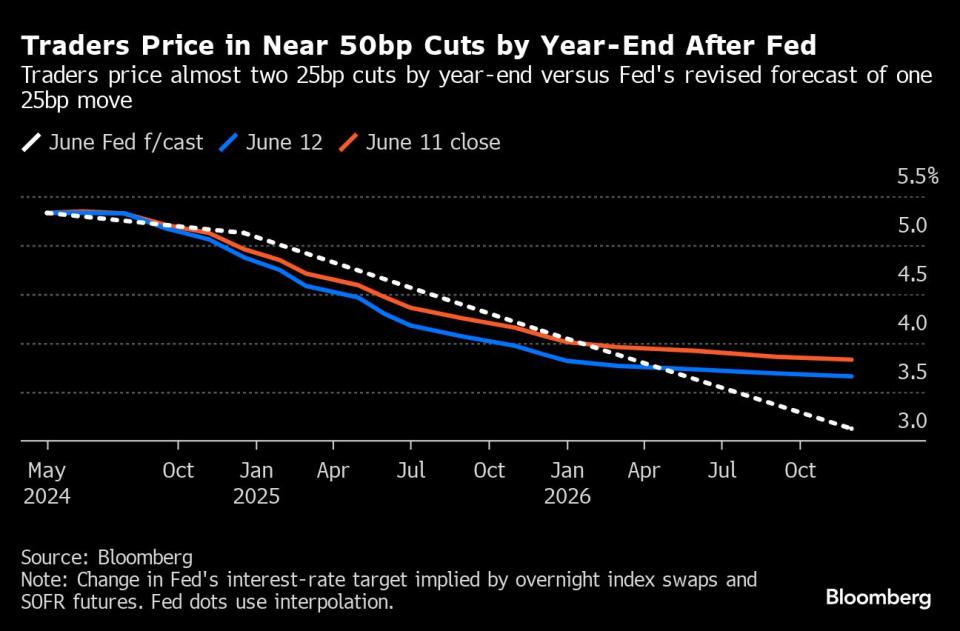

US officials penciled in just one interest-rate cut this year and forecast more cuts for 2025, reinforcing policymakers’ calls to keep borrowing costs high for longer to suppress inflation. The Fed’s “dot plot” showed four policymakers saw no cuts this year, while seven anticipated just one reduction and eight expected two cuts.

“This is still just one month and the takeaway from the June Fed meeting stands: a much more sustained downshift extending across the coming months will be needed for the Fed to move on rates,” said Krishna Guha at Evercore. But this is exactly the kind of data Jerome Powell needs to steer a wary FOMC to two cuts, he added.

The Fed’s favored inflation gauge is set for the smallest advance since November following two better-than-expected reports on prices out this week. Several analysts expect the so-called core PCE gauge, due later this month, advanced just 0.1% in May. Such a print would help bolster the case for two interest-rate cuts this year.

Corporate Highlights:

Boeing Co. said it’s inspecting undelivered 787 Dreamliners after discovering that fasteners were incorrectly installed on a section of the carbon-composite aircraft, underscoring the heightened scrutiny on quality lapses at the embattled manufacturer.

Ford Motor Co. will sell its lineup of electric vehicles through all 2,800 of its US dealers in a bid to boost sales of battery-powered models now being shunned by mainstream buyers.

Snowflake Inc. plans to close its own investigation this week into a hacking campaign that ensnared as many as 165 of its customers.

John R. Tyson was suspended from his role as chief financial officer of Tyson Foods Inc. after he was charged with alleged drunken driving — the second arrest involving intoxication charges in the past two years.

The US Supreme Court sided with Starbucks Corp. over the National Labor Relations Board in a decision that will make it more difficult for the agency to win temporary reinstatement of workers fired during labor disputes.

Key events this week:

Bank of Japan’s monetary policy decision, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 4 p.m. New York time

The Nasdaq 100 rose 0.6%

The Dow Jones Industrial Average fell 0.2%

The MSCI World Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.6% to $1.0741

The British pound fell 0.3% to $1.2765

The Japanese yen fell 0.2% to 157.07 per dollar

Cryptocurrencies

Bitcoin fell 2.1% to $66,632.76

Ether fell 2% to $3,482.52

Bonds

The yield on 10-year Treasuries declined seven basis points to 4.24%

Germany’s 10-year yield declined six basis points to 2.47%

Britain’s 10-year yield was little changed at 4.12%

Commodities

West Texas Intermediate crude fell 0.6% to $78.03 a barrel

Spot gold fell 0.9% to $2,303.53 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.