Sunak Presses Thames Water to Clean Up Own Financial Mess

(Bloomberg) -- Rishi Sunak’s administration is pressing Thames Water and its troubled parent to resolve their financial difficulties alone, raising the prospect that the crisis gripping the UK’s largest water utility will deepen in the coming weeks.

Most Read from Bloomberg

Texas Toll Road Takeover to Cost Taxpayers at Least $1.7 Billion

S&P 500 Falls 1% as Oil Jump Spurs Flight to Bonds: Markets Wrap

Apple Explores Home Robotics as Potential ‘Next Big Thing’ After Car Fizzles

Biden Tells Netanyahu US Support Hinges on Protecting Civilians

Ministers are so far rejecting pressure for the government to bring the company into special administration, according to people familiar with the matter who requested anonymity discussing commercial issues. They don’t think it should be up to the government and taxpayers to help a private company that’s been poorly run, they said. Instead, they want Thames — which has £16 billion ($20.2 billion) of debt — to resolve its problems through negotiations with shareholders and water regulator Ofwat.

While the message from government will be seen as an attempt to bounce Thames Water and its parent, Kemble Water Holdings Ltd. into finding a private sector solution to their financial woes, it also conveys a lack of urgency from Sunak’s administration to stop the UK’s largest water and sewage company from going bust. That raises the question of who will blink first: the utility’s investors say it’s now in the hands of the government, but ministers are indicating they don’t see it as their problem.

At stake is the operation of a company that supplies 25% of England — including London — with water. Thames Water’s future was plunged into doubt last week when shareholders declared it “uninvestable,” refusing to stump up £500 million of equity after the regulator Ofwat indicated there was no leeway on the terms for the company’s investment plan.

The money was supposed to be the first tranche of £750 million promised by this time next year. Moody’s Ratings downgraded the credit ratings of Thames Water and Kemble’s financing arm, Thames Water (Kemble) Finance Plc, on Wednesday, citing a near-term default risk for the latter entity.

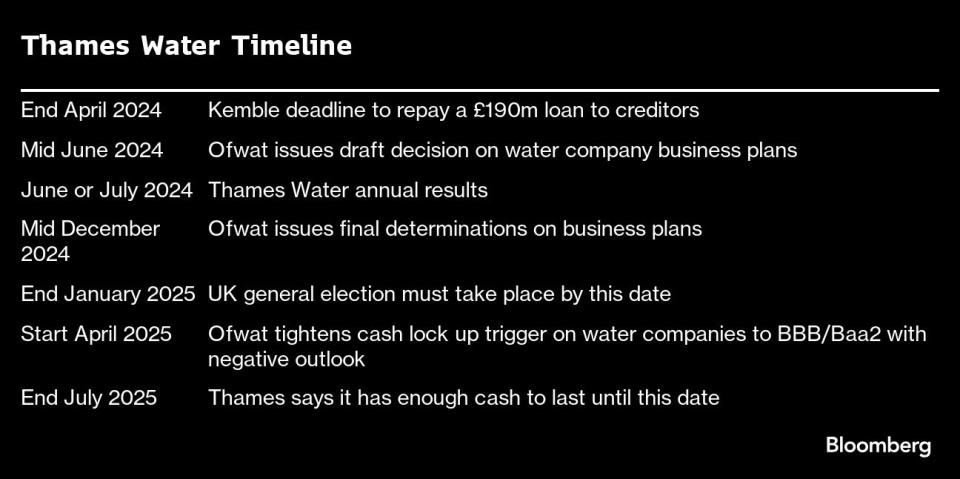

In total, Thames needs £2.5 billion in equity to deliver on its plans out to the end of the decade. It says it has enough cash to survive until the end of July 2025. That sort of time line raises the prospect that Sunak’s administration is kicking the can down the road and hoping a full-blown crisis doesn’t materialize before a general election due by January.

How Debt and Sewage Pushed Thames Water to the Brink: QuickTake

With polling indicating Keir Starmer’s opposition Labour Party is set to take power, a decision on spending billions of pounds of taxpayer money preventing Thames Water from going under could fall to the next government rather than the current one.

Putting Thames Water into a special administration regime — effectively a temporary nationalization — is undesirable for the Tories because the premier is looking to spend his limited fiscal headroom on tax cuts. Moreover, the privatization of water was a flagship policy of former Conservative Prime Minister Margaret Thatcher.

Water companies and ministers have also been on the receiving end of voter anger over sewage pumped into Britain’s rivers and coastlines, so a taxpayer-funded rescue package may not be viewed as a likely vote winner.

Some Tories — including former Business Secretary Jacob Rees-Mogg, have said the government should let the company fail. “The shareholders and the bondholders should take the hit, not the consumer,” Rees-Mogg told GB News late Tuesday.

Tory general election candidate Nick Timothy, a former adviser to Theresa May when she was premier, agreed, writing in the Telegraph that Thames Water is “a case study in everything that is wrong with our economy” and railing against “rapacious foreign investors stripping monopoly utilities of every spare penny, all while ripping off customers and degrading our environment.”

Labour says the government should “do everything in their power to stabilize the company” but “without taxpayers being left to foot the bill.” Unions representing the company’s workers plan to meet with Thames Water on Thursday.

Special administration has not been ruled out as an option, but ministers are a long way from endorsing that outcome, the people familiar with their thinking said.

“The government always prepares for a range of scenarios,” Sunak’s spokeswoman, Camilla Marshall, told reporters on Tuesday, declining to be drawn on what that preparation entailed.

There is recent precedent. In 2021, the UK took the nation’s seventh-largest energy supplier, Bulb Energy Ltd into special administration. It was the first time the tool was used in the energy market and was the first forced nationalization of a British company since the 2008 banking crisis.

Environment Secretary Steve Barclay, who’s ultimately in charge of water policy, wants to give Thames Water’s new management the time and space to end the stand-off with its investors and Ofwat, the people said. He hasn’t spoken to the utility in a week, and day-to-day work in the department is being led by a junior minister, Robbie Moore, and civil servants, they said. Communications between Defra officials and Thames Water are taking place no more than weekly, and Sunak’s business adviser Franck Petitgas is not involved on a day-to-day basis, they said.

Those sorts of noises from government signal that ministers are working to a longer time-frame, but there’s a risk of miscalculation if the crisis comes to a head on their watch. One such moment is approaching: Kemble has an end of April deadline to repay a £190 million loan to creditors.

None of the options for Thames Water look easy, with any new buyer facing billions in costs to improve the company’s performance. An IPO is another option, with Thames Chief Executive Officer Chris Weston saying it could “go to the market” after Ofwat provides its first draft determination on all water companies’ investment plans on June 12.

The government says it’s holding the water industry to account including setting new targets on storm overflows, increasing inspections and announcing plans to block some water bosses’ bonuses. But that’s done little to silence critics, including the Liberal Democrats, who are leveraging the industry’s wider problems — especially with sewage outflows — in campaigns for marginal seats on the periphery of London.

“The government has been woefully inadequate on the water industry in general and on Thames Water in particular,” Liberal Democrat leader Ed Davey said in an interview. “They’ve failed to say anything publicly and properly. And that’s left Thames Waters customers, investors and the wider part of London and the southeast, not knowing what’s going to happen. And that’s disgraceful.”

--With assistance from Ellen Milligan, Eamon Akil Farhat and Josyana Joshua.

(Updates with Moody’s downgrade in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.