Sunak May Struggle to Turn Key Inflation Victory Into Votes

(Bloomberg) -- Of the five goals Rishi Sunak set for himself at the start of 2023, he met just one — halving inflation by the end of last year. On Wednesday, he may be able to go further and declare victory over the cost-of-living crisis, with the consumer price growth forecast to drop to near the 2% target and hit its lowest level since July 2021.

Most Read from Bloomberg

Iran State TV Says ‘No Sign of Life’ at Helicopter Crash Site

Hims Debuts $199 Weight-Loss Shots at 85% Discount to Wegovy

Jamie Dimon Says Succession at JPMorgan Is ‘Well on the Way’

Speedier Wall Street Trades Are Putting Global Finance On Edge

One of the Last Big Bears on Wall Street Turns Bullish on US Stocks

A bigger challenge will be convincing the electorate he deserves the credit for another upbeat number from the Office for National Statistics. Sunak will likely use the inflation data — expected to fall to 2.1%, according to a Bloomberg survey of economists — to claim that Britain is “turning a corner,” with the economy pulling out of recession faster than anticipated and living standards once again on the rise.

Nineteen months ago, inflation was at a 41-year high of 11.1% and the UK faced the worst price shock of all major advanced economies. The decline since then has been the fastest since the 1970s and raises the prospect of an interest-rate cut from 5.25% as early as next month, easing costs for both mortgage borrowers and businesses.

With the ruling Conservatives trailing Labour in opinion polls by around 20 points and the party still reeling from being routed in recent local elections, Sunak and Chancellor of the Exchequer Jeremy Hunt are counting on a “feel-good factor” as they prepare for a general election expected to be held later this year.

“We are winning the battle against inflation,” Hunt said during a campaign-style event on Friday in Westminster. “Working with the Bank of England, we have delivered the soft landing many thought impossible.”

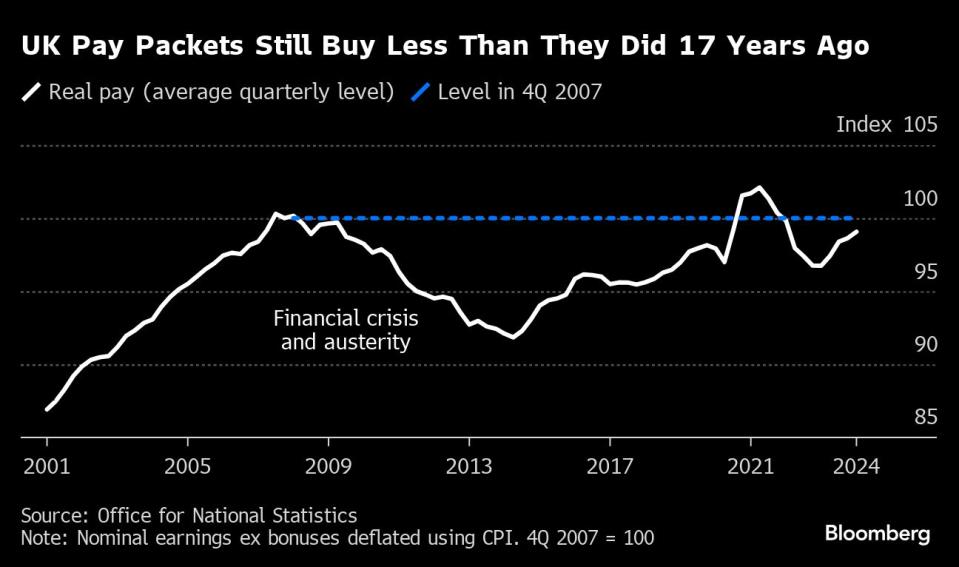

Still, a painful legacy remains. While Sunak and Hunt point to recent flows – slowing inflation, rising real pay – Labour is focusing on levels. Real wages remain lower than before the financial crisis, meaning pay packets still buy less than they did in 2007.

Similarly, inflation may be poised to return to target but the price level is 23% above its starting point in 2019 when the current parliamentary term began. Food prices have risen around 30% in three years since the start of 2021. It took 13 years for an equivalent increase before that, according to London School of Economics calculations.

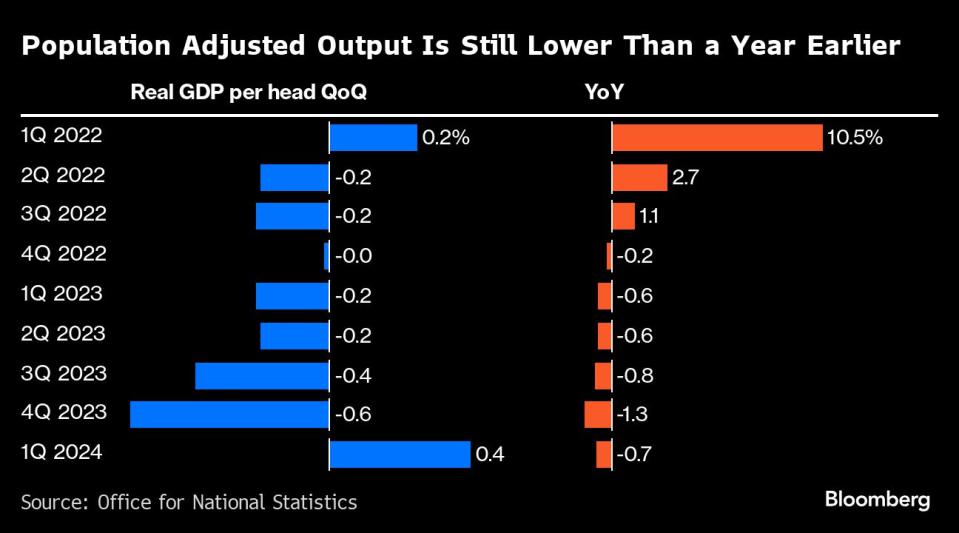

GDP is also being boosted by a rising population. Output per head paints a less flattering picture. The historic seven-quarter slide ended with a bounce at the start of this year. But GDP per capita was still 0.7% weaker than a year earlier.

On tax cuts, the story is the same. Hunt has knocked 4 percentage points off national insurance, a payroll levy, since November. But the £20 billion ($25.4 billion) giveaway is dwarfed by frozen thresholds that mean that the overall tax burden will continue to rise. Households will be better off this year, but worse off after that.

On Friday, Hunt acknowledged that living standards have fallen “over the course of this parliament.”

Voters have increasingly favored Labour to manage the economy after former Prime Minister Liz Truss’s disastrous “mini-budget,” upending a traditional dynamic in British politics. A YouGov survey released earlier this month found that 27% of the public think a Labour government would safeguard the economy, ahead of the 20% who trust the Tories. Labour’s lead is even larger when it comes to stewarding public services

Another reason Sunak and Hunt may struggle to claim credit for lower inflation is because the job ultimately falls to the BOE. “If inflation does land at 2.1%, or lower still, this will provide the cover the Monetary Policy Committee needs to start cutting interest rates in June,” said Thomas Pugh, economist at RSM UK.

Hunt and Sunak are right to claim the economic backdrop is improving. Real wages are now climbing at the fastest pace since September 2015, excluding distortions caused by the furlough payments during the pandemic. Economic output has rebounded sharply from the mild technical recession in 2023 to hit a new high.

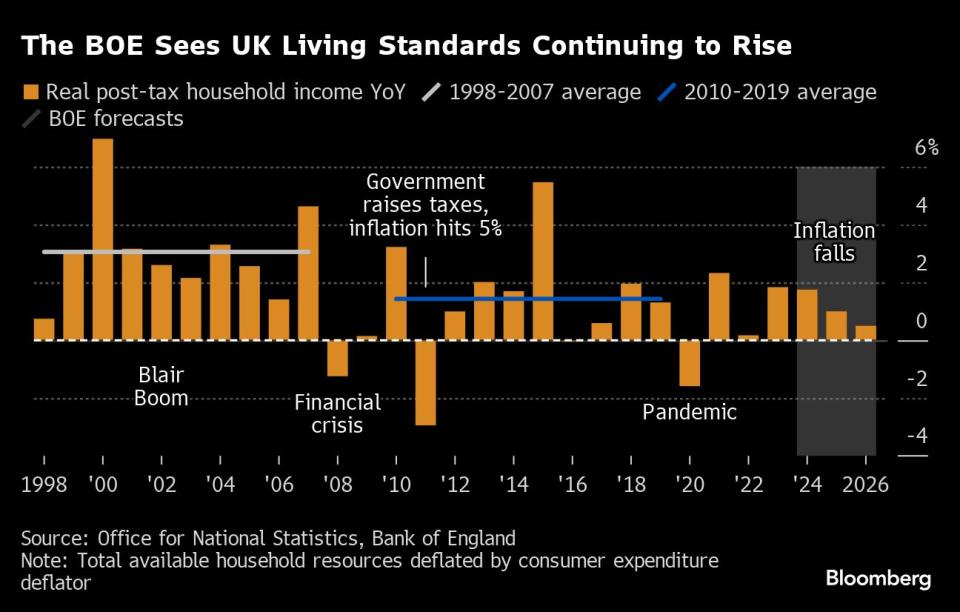

Energy bills fell 12% last month to a two-year low, with a further 7% reduction forecast from July. Food inflation has also dropped sharply. That will take some pressure off lower income households who bore the brunt of the price shock. The BOE forecasts living standards, as measured by post-tax real household income, to improve faster this year than the annual average over the decade before the pandemic.

Investors and economists see the odds of the BOE cutting rates in June at about 50%. But the MPC remains concerned about underlying price pressures, particularly in the services sector where inflation is forecast to remain well above 5% in April. That’s more than double the 2.1% predicted for CPI inflation as a whole.

Many household bills are linked to past inflation data, such as mobile phone contracts, and were uprated in April. On top of which, the 10% increase in the minimum wage in April may have fed into prices at pubs, restaurants and shops. Deutsche Bank AG estimates that 15% of the services inflation basket will reset due to the former factor.

Beyond next week, there is one more inflation print before the bank’s rate decision on June 20. Next month’s wage data could still upend a rate cut as it is not clear how a near-10% hike in the minimum wage has affected salaries in general.

“The key thing really is what happens to services inflation,” said James Smith, developed markets economist at ING. “April is just this very volatile month just because there’s so many different areas that are resetting their prices and obviously wage growth has been quite high.”

After dropping to around 1.9% in the second quarter, consumer price growth will rise back to 2.2% by the end of the year, according to Bloomberg’s survey of economists. Even so, neither the BOE nor the Bloomberg survey anticipate inflation climbing to 3% again. As inflation settles close to target, the economists expect the BOE to cut rates to 4.5% by the end of 2024.

According to one government official, there is relief that for the first time since before the pandemic the economy is returning to normal. Covid and the inflation shock are in the rear view mirror. The question is whether recent short-term improvements register with the electorate more than the longer-term decline.

--With assistance from Harumi Ichikura.

Most Read from Bloomberg Businessweek

Netflix Had a Password-Sharing Problem. Greg Peters Fixed It

Millennium Covets Citadel-Size Commodities Gains, Just Not the Risk

©2024 Bloomberg L.P.