Stronger-Than-Expected UK Inflation Tempers Rate Cut Bets

(Bloomberg) -- UK inflation slowed less than expected last month as fuel prices crept higher, prompting traders to further unwind bets on how many interest rate cuts the Bank of England will deliver this year.

Most Read from Bloomberg

Dubai Grinds to Standstill as Cloud Seeding Worsens Flooding

Red Lobster Considers Bankruptcy to Deal With Leases and Labor Costs

Tesla Asks Investors to Approve Musk’s $56 Billion Pay Again

Consumer prices rose 3.2% in March compared with a year earlier, down from 3.4% in February, the Office for National Statistics said Wednesday. While it was the lowest since September 2021, it was above the 3.1% that the BOE and private-sector economists had expected.

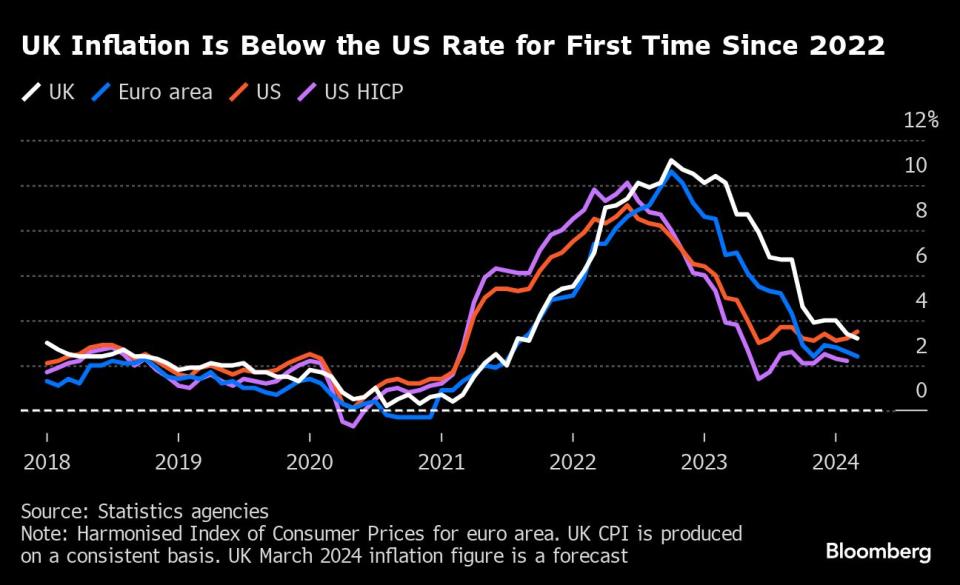

The figures underscored market uncertainty about when BOE policymakers led by Governor Andrew Bailey will be able to ease off on the highest interest rates in 16 years. A surprise jump in price pressures in the US last week prompted Federal Reserve Chair Jerome Powell to warn that rates there may stay higher for some time, reordering market expectations around the globe.

“UK inflation continues to trend in the right direction, but at a slower pace than expected,” said Matthew Landon, global market strategist at JPMorgan Private Bank. “This print shows that fairly broad-based upside surprises likely edges us in the direction of later cuts.”

Traders in the UK significantly pared bets on interest-rate cuts from the BOE, moving to favor just one quarter-point reduction this year. Swaps fully price a cut by November and briefly pared the chance of a second move to just over 30%, before indicating an additional cut is a coin-toss. That’s a sharp change from just a few weeks ago when three cuts were expected.

The pound gained as much as 0.4% to $1.2479, reversing earlier losses after the data and snapping three days of declines. The yield on two-year gilts, among the most sensitive to policy, rose as much as six basis points to 4.53%, the highest since February.

What Bloomberg Economics Says ...

“The upside surprise in the UK’s March inflation data doesn’t change our view that annual CPI is likely to reach the 2% target in coming months. Still, there were signs of continued stickiness in services prices. That reduces the chances there will be a sustained period of below-target inflation this year.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the REACT.

Prime Minister Rishi Sunak is counting on inflation coming back to the 2% target — and the BOE easing interest rates — ahead of a difficult election against a resurgent Labour Party. Chancellor of the Exchequer Jeremy Hunt told Bloomberg TV on Tuesday that cuts would help the “feel-good factor” ahead of an autumn election as “people start to feel higher real disposable income.”

Sunak told broadcasters on Wednesday “today’s figures show that after a tough couple of years, our economic plan is working and inflation continues to fall.”

While Britain had the worst inflation problem in the Group of Seven nations last year, it has brought down the pace of price increases sharply. Bailey and his colleagues on the Monetary Policy Committee are looking for firmer evidence that those pressures are easing, even though official forecasts already show price increases slowing to the target later this year.

Speaking at the International Monetary Fund in Washington on Tuesday night, Bailey noted a “divergence” between the US economy and those in Europe, a hint that the BOE might be able to ease policy before the Fed. Yet Wednesday’s figures were a reminder of his previous warnings that it may take some time to ensure inflationary forces are suppressed.

Labour data released Tuesday also showed wage pressures persisting more strongly than economists had expected.

“More concerning for the Bank is the stickiness we continue to see in wage data and services inflation, pointing to signs of deeper inflation persistence,” said Zara Nokes, global market analyst at J.P. Morgan Asset Management. “While the Bank should feel able to take its foot off the brake this summer given considerable progress has been made on inflation at the headline level, if these signs of deeper persistence continue, the pace of further rate cuts may be slow and the magnitude limited.”

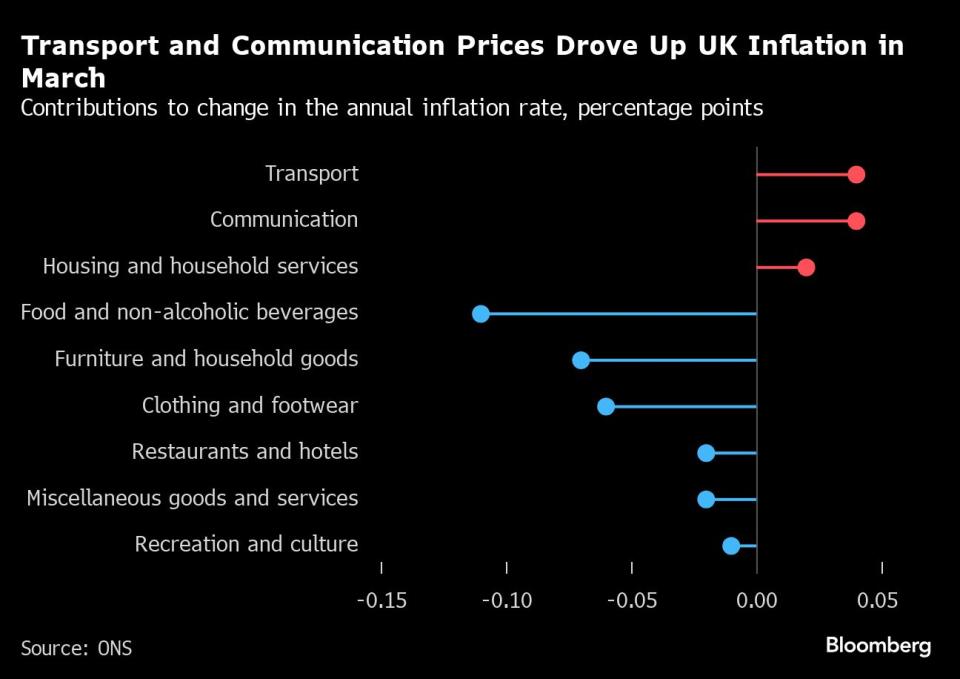

The ONS said food prices rose less than a year ago, putting downward pressure on inflation. This was partially offset by an increase in the cost of motor fuel.

Core inflation, which excludes energy, food, alcohol and tobacco, fell to 4.2% last month from 4.5%. That also was stronger that economists had expected. Meanwhile, inflation in the services sector — watched by the BOE for indications of domestically driven price pressures — eased to 6% from 6.1%. The BOE and economists had expected a decline to 5.8%.

“Today’s core inflation indicates that underlying inflationary pressures continue to ease, but remain above their historical average,” said Paula Bejarano Carbo, an economist at the National Institute of Economic and Social Research. “With inflation set to fall further in April, the MPC will be closely watching movements in core CPI ahead of its upcoming meetings.”

Bailey has since February opened the door to lower rates. But others on the nine-member MPC have urged caution. Those include Megan Greene, who warned last week that a reduction “should still be a way off.”

Separate data showed pipeline price pressures easing, with the cost of fuel and raw materials used by producers falling 2.5% in March from a year earlier. The price of goods leaving factory gates rose just 0.6%.

There were stronger pressures in the services sector, where producer prices rose 3.6% in the first quarter from a year earlier. That’s up from 3.5% in the previous quarter.

The economy also picked up momentum in the first two months of the year after a recession at the end of 2023, even as unemployment edged higher. Businesses and consumers are hoping rate cuts will bolster that growth.

“Inflation is going in the right direction, but we can’t be complacent about the state of the economy,” said Pranesh Narayanan, research fellow at Institute for Public Policy Research. “Unemployment is ticking up. We still have record levels of people who are too sick to work, a cost-of-living crisis and stagnant growth. It’s time for the Bank of England to cut interest rates.”

--With assistance from Andrew Atkinson, Harumi Ichikura, Aline Oyamada, Mark Evans and Alice Gledhill.

(Updates to add Sunak comment in eighth paragraph. An earlier version corrected the year of recession in the second to last paragraph.)

Most Read from Bloomberg Businessweek

Aging Copper Mines Are Turning Into Money Pits Despite Demand

The AI Chatbot That Could Transform Business School Accreditation

©2024 Bloomberg L.P.