Streaming Bundles Are All the Rage — but They Can’t Bring Back Pay-TV’s Glory Days

The next evolution in the streaming wars? It’s a new spin on the old cable TV model: cross-company bundles of streaming services.

Consumers like bundles, especially if they’re getting a price break. Media companies like bundles because they help reduce churn (i.e., cancellation rates) and lower customer-acquisition costs, even it means working with would-be rivals.

More from Variety

Disney and Warner Bros. Discovery are teaming for a Disney+-Hulu-Max combo to bow this summer, and Disney, WBD and Fox Corp. are hoping to launch the Venu Sports bundle of live channels in the fall. (Pricing for those packages is TBD.) And on May 29, Comcast started selling StreamSaver — a bundle of Peacock, Netflix and Apple TV+ at a discount of 35% or more — exclusively to its TV and broadband customers.

The Disney and WBD partnership “presents a powerful new road map for the future of the industry,” WBD’s JB Perrette, CEO and president of global streaming and games, said in announcing the deal in May.

But does it? Exactly how powerful these streaming bundles will be remains to be seen. In any event, this won’t mark a revival of the highly profitable pay-TV fat bundles of the past. The way the streaming landscape has evolved means the dynamics are different than with cable TV. Today you can’t get, say, the full complement of live sports on ESPN without taking a whole bunch of other networks you don’t really care about, whereas you don’t have to buy a bloated streaming bundle just to get, for example, Netflix.

“It all started with Netflix going direct-to-consumer,” says Frank Boulben, chief revenue officer for Verizon Consumer Group. “Once you do that, you cannot do those forced bundles.”

For more than two years, Verizon has been steadily building out its lineup of streaming add-ons. Current perks available to the telco’s wireless customers include discounts on a Netflix-Max bundle (both with ads) for $10 a month (a 40% savings) and a bundle comprising Disney+ with no ads, Hulu with ads and ESPN+ for $10 a month (which is 33% less than a package Disney offers that includes Disney+ with ads). Says Boulben: “It’s a big difference from the traditional cable TV bundle where you get 200 channels and you only watch 15.”

The new bundles and offers are part of the “streaming market repair,” as Morgan Stanley analyst Ben Swinburne put it in a research note last week. The trade-off for content owners and distributors: lower churn but also lower revenue per subscriber.

For WBD chief David Zaslav, who has been promoting the idea of cross-company streaming bundles for the past year, synthetic bundles (meaning the services aren’t integrated into a single app) such as the Disney+-Hulu-Max offering will lessen the pressure for companies to spend on content at Netflix’s level in order to attract a high-scale user base. In other words, WBD doesn’t have to try to make Max all things to all people (even as it has attempted to expand the streamer’s appeal by mixing in content from Discovery’s networks, CNN, and live sports from TNT and TBS).

“As we look at what happens ahead, there likely will be a restructuring of how people view content,” Zaslav told analysts on WBD’s May 9 earnings call. “And there’s a lot of irrationality in the market that’s getting shaken out in terms of the amount of money spent.”

Another factor driving companies like WBD and Disney into streaming partnerships: All the major platforms are pushing ad-supported tiers, and they are hungry for eyeballs. “Advertising works when you can achieve reach — and that’s determined by how many subscribers you have. That’s an important part of the profitability equation,” says John Harrison, EY’s Americas media and entertainment leader. Legacy media companies, in particular, are eager to retain ad dollars that are dropping out of linear TV, he adds.

Some observers don’t think the new bundling will move the needle. “It’s hard to see in the long term how the bundles will appeal to a large enough number of people that it will make a material difference to the bottom line,” says Colin Dixon, founder of independent analyst firm nScreenMedia.

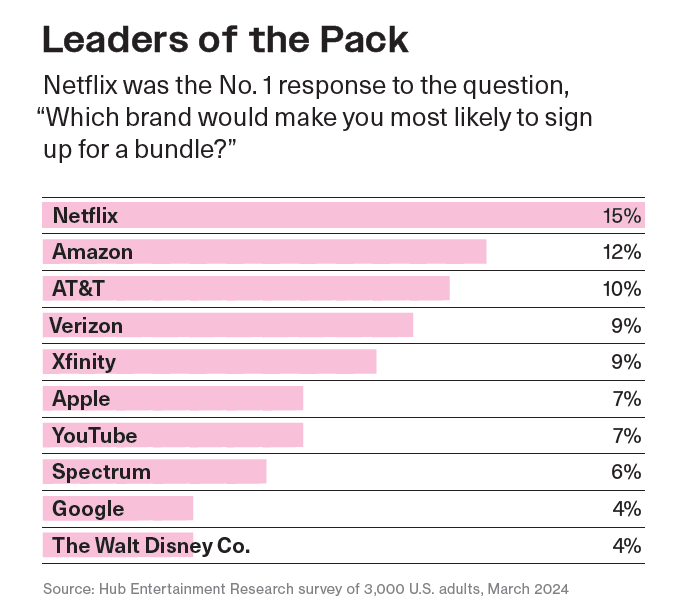

The one player to watch here is Netflix. “Netflix is the biggest draw in any bundle,” Dixon says. “If they see net revenue decline with subscribers no longer paying full rate [as part of a bundle], they are going to get out of them pretty quick.”

Meanwhile, Charter Communications is looking to use streaming to prop up the traditional cable TV bundle. The operator has thrown Disney+ and ESPN+ into its premium TV tiers for no extra charge — and Charter just cut a similar deal with Paramount Global to bundle Paramount+ and BET+ with Spectrum TV.

VIP+ Analysis: New Bundles Point to Broadband’s Growing Power in SVOD Packaging

It’s unclear if total revenue per subscriber under the Paramount-Charter pact is up, down or flat. But “we believe leverage increasingly lies with [pay-TV providers] in these relationships,” Swinburne noted. “Charter has been quite public that it is unwilling to have its customers ‘pay twice’ for the same content,” he wrote, pointing out that Paramount+ includes “significant content overlap” with Paramount linear networks including CBS.

The old-fashioned pay-TV bundle is likely to take a major hit next year, as Disney is aiming to introduce a stand-alone ESPN streamer by fall 2025. And the new streaming bundles are “only going to make cord-cutting worse,” says Ross Benes, eMarketer’s senior analyst for TV and streaming. Comcast’s pushing a bundle with Netflix, Peacock and Apple TV+ “is a sign they don’t care if you leave linear TV,” he says. “They just want to upsell you to a higher internet package.”

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.