Sika (VTX:SIKA) Shareholders Booked A 37% Gain In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Sika AG (VTX:SIKA) share price is 37% higher than it was a year ago, much better than the market return of around 12% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Sika for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Sika

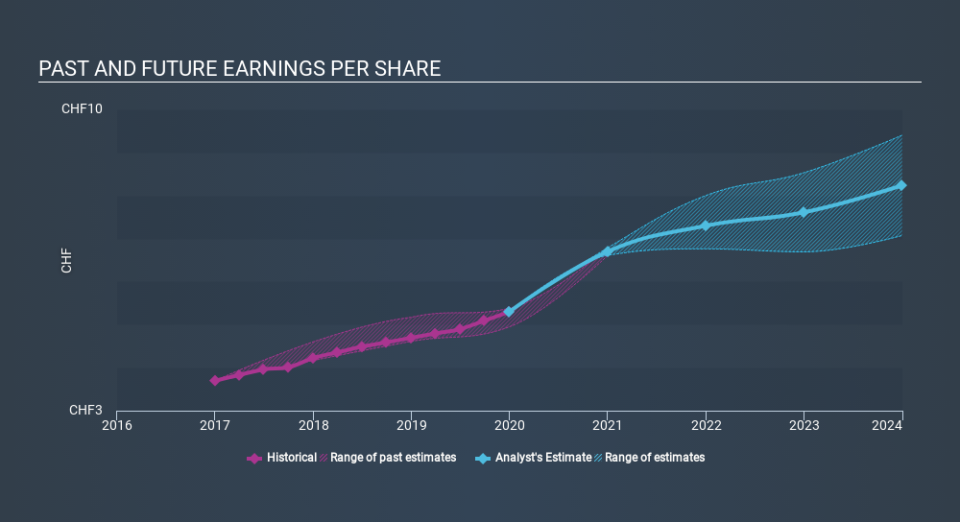

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Sika was able to grow EPS by 13% in the last twelve months. The share price gain of 37% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Sika has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Sika will grow revenue in the future.

A Different Perspective

It's nice to see that Sika shareholders have gained 39% over the last year , including dividends . The more recent returns haven't been as impressive as the longer term returns, coming in at just 3.8%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). Before deciding if you like the current share price, check how Sika scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.