Russia’s Seaborne Crude Exports Drop Ahead of OPEC+ Meeting

(Bloomberg) -- Russia’s four-week average crude exports fell for a third week, with shipments hitting a two-month low before a virtual meeting of the OPEC+ producer group to be held on Sunday.

Most Read from Bloomberg

Treasuries Hit as US Sales Struggle to Lure Buyers: Markets Wrap

For Private Credit’s Top Talent, $1 Million a Year Is Not Enough

Israeli Airstrike and Egyptian Guard’s Death Ratchet Up Tensions

Mortgages Stuck Around 7% Force Rapid Rethink of American Dream

Increased flows from the country’s Pacific ports were more than offset by lower volumes from the Black Sea and the Arctic. Cargoes from Russia’s Baltic ports were unchanged week on week, but are scheduled to drop this month compared with April.

Russia has pledged to compensate for overproduction against its April target, which it blamed on the “technicalities of making significant output cuts.” Reduced output will feed through into lower overseas shipments, unless refinery runs also fall. But Russia processed 5.45 million barrels a day of crude in the first 15 days of May, 4% higher than the April level, following repairs to refineries hit by Ukrainian drone strikes.

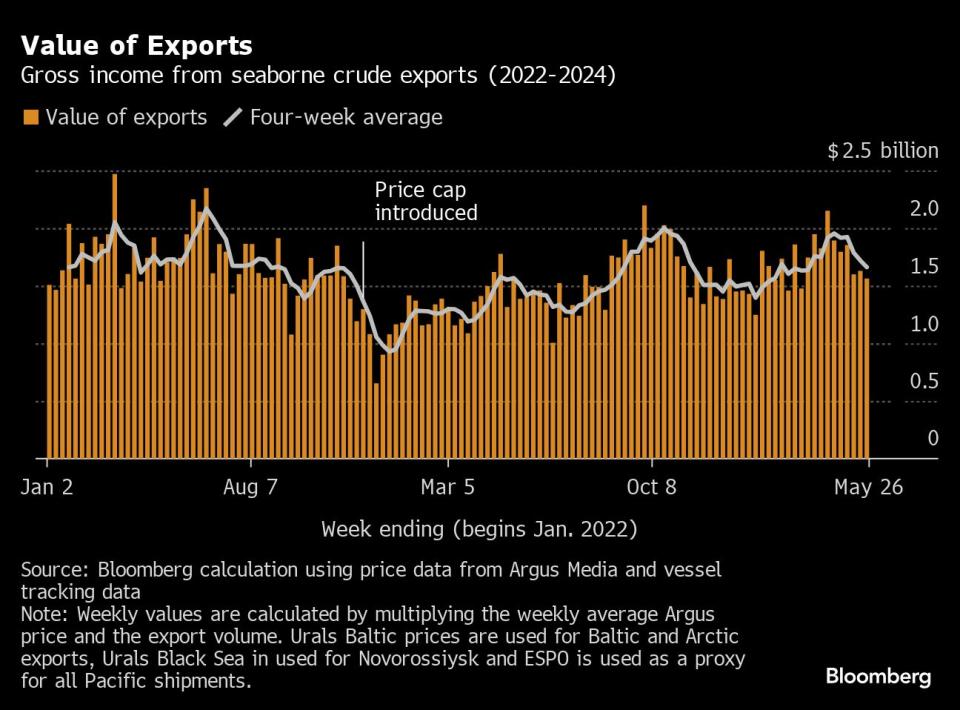

Lower volumes were compounded by another small week-on-week decline in prices, driving the value of Russia’s shipments to a 10-week low.

Moscow is continuing to test US-led restrictions on its oil shipments. A second sanctioned Russian tanker loaded a cargo of crude at Novorossiysk last week. The Bratsk, until recently named the NS Burgas, took on about 1 million barrels of Urals crude and is now headed toward the Suez Canal. The first sanctioned vessel to load, the SCF Primorye, has disappeared from AIS tracking east of Singapore, a popular location for hidden ship-to-ship oil transfers.

If the Primorye’s cargo ultimately ends up being delivered to an oil refinery, it could pave the way for other sanctioned tankers owned by state-controlled Sovcomflot PJSC to return to work. The company has renamed and reflagged at least 10 of its 21 ships that have been listed by the US Treasury Department for breaching the G7-led price cap on Russian oil.

Crude Shipments

A total of 30 tankers loaded 22.54 million barrels of Russian crude in the week to May 26, vessel-tracking data and port agent reports show. That was down by about 1.16 million barrels from the previous week.

Russia’s seaborne crude flows in the week to May 26 fell by about 170,000 barrels a day to 3.22 million from 3.39 million for the week to May 19. The less volatile four-week average also dropped, down by about 50,000 barrels a day to 3.38 million, for the third straight decline.

The decline in the weekly figures was driven by fewer shipments from the Black Sea port of Novorossiysk and the Arctic terminals at Murmansk, which were partly offset by two more departures from the Pacific ports of Kozmino and Prigorodnoye.

Crude shipments so far this year are running about 10,000 barrels a day above the average for 2023.

Russia told OPEC+ that it would cut crude exports during April by 121,000 barrels a day from their average May-June level, while May shipments would be 71,000 barrels a day below the same starting point. Weekly shipments were about 290,000 barrels a day below the target for this month, while the four-week average was about 130,000 barrels a day below. Seaborne shipments in the first three months of the year exceeded Russia’s target level for that period by just 16,000 barrels a day.

OPEC+ oil ministers are scheduled to meet virtually on June 2 to discuss production policy for the second half of the year. The meeting was delayed by a day and moved online last week, with the group giving no reason for the change. Ministers are expected to extend voluntary cuts made by several countries including Russia. Group-wide cuts of almost 2 million barrels a day are already scheduled to run until the end of the year.

One cargo of Kazakhstan’s KEBCO was loaded at Novorossiysk during the week.

Flows by Destination

Asia

Most Read from Bloomberg

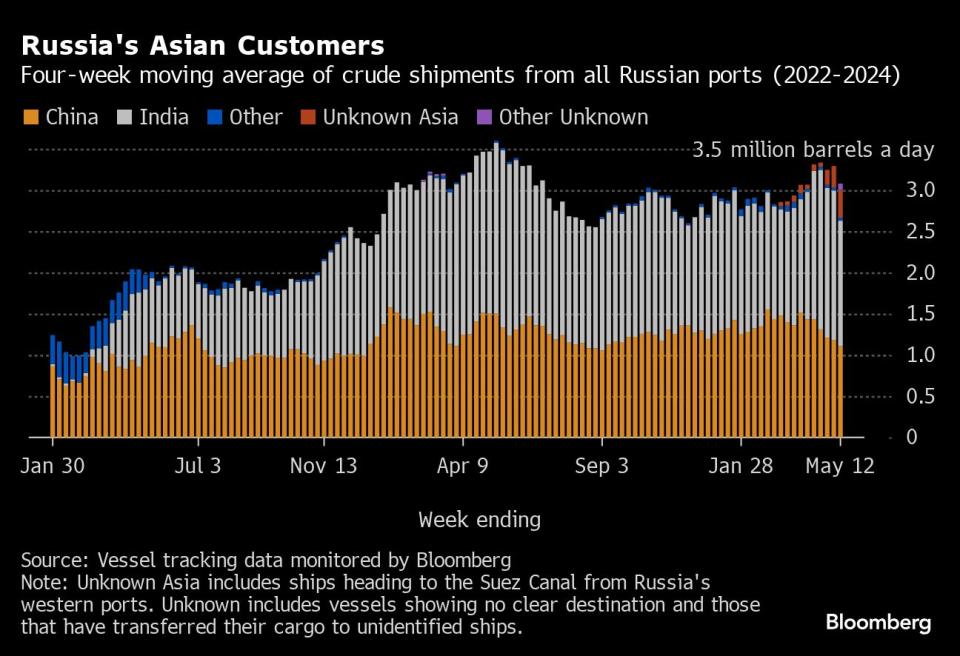

Observed shipments to Russia’s Asian customers, including those showing no final destination, fell to a nine-week low of 2.96 million barrels a day in the four weeks to May 26, from 3 million in the previous four-week period.

About 1.23 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.49 million barrels a day.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 140,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 100,000 barrels a day in the four weeks to May 26, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, or more recently off Sohar in Oman.

Russia’s oil flows were also complicated once again by the Greek navy carrying out exercises in an area that’s become synonymous with the transfer of the nation’s crude. The activities, which briefly halted on May 19, have resumed and will continue until June 3.

Europe and Turkey

Most Read from Bloomberg

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to May 26 slipping to about 420,000 barrels a day.

Export Value

The gross value of Russia’s crude exports fell to $1.56 billion in the seven days to May 26 from about $1.63 billion in the period to May 19. Four-week average income was also down, dropping by about $60 million to $1.66 billion a week. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

A decline in the amount exported was compounded by a small drop in prices week on week to drive the decrease in oil revenues. Four-week average export value saw its third straight drop, falling to a nine-week low.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, June 4.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.