RBA’s $18,000 dinner before rate rise

The Reserve Bank of Australia is under fire for spending tens of thousands of taxpayer dollars on food and booze while the nation grappled with a worsening cost-of-living crisis.

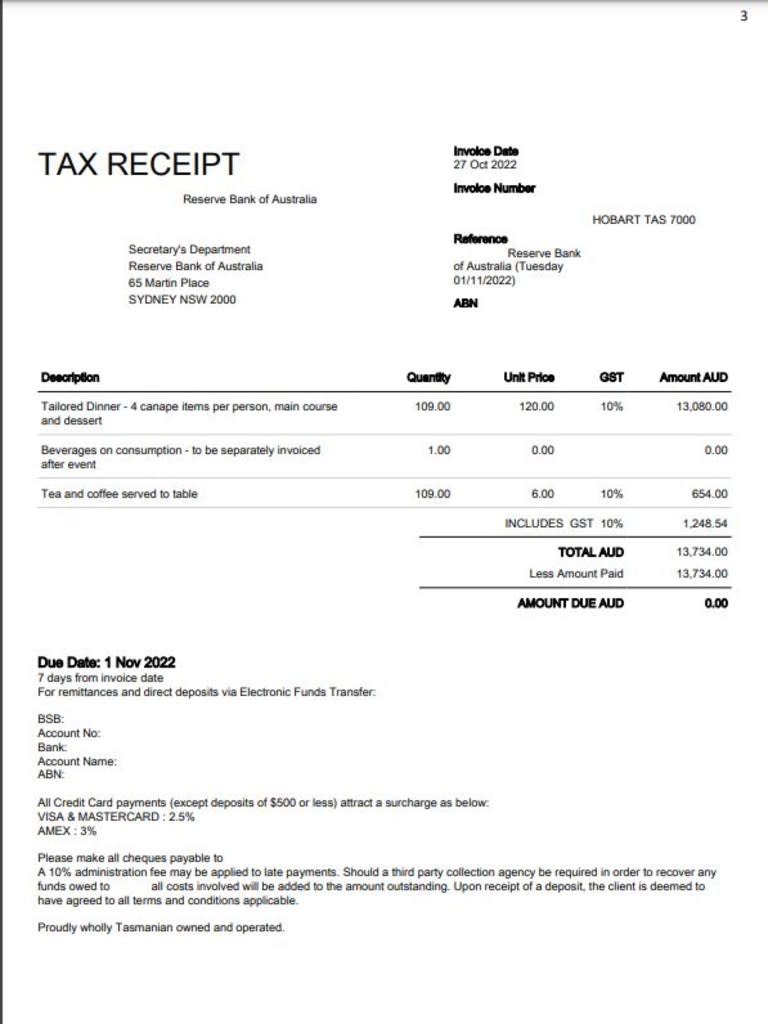

Freedom of information documents showed the central bank spent $13,700 on food and nearly $4000 on alcohol for board dinner in Hobart, just hours before it increased cash rates for the seventh time.

Guests sipped on glasses of $68-per-bottle Freycinet Louis chardonnay and pinot noir, receipts show.

The RBA then spent $11,400 for a governors’ meeting held at the Lagoon Suite at the beachfront Ramada resort in Vanuatu, held under the theme “Rebuilding Our Economies Post Covid”.

Days after the RBA announced a 3.10 per cent interest rate rise in December, the bank held its annual Christmas party, where guests enjoyed kingfish ceviche, lamb cutlets and potato gnocchi.

Back-and-forth emails show executives considering a photo booth with “funny hats” to “add a bit of variety from the party in August”, a move eventually decided against.

“Seems like everyone is very much back into the swing of things like it is 2019!” an RBA staff member wrote in an email to an organiser.

When asked about the documents on Monday, Environment Minister Tanya Plibersek said public institutions should be “careful” with the way they spend their money.

“One of the changes that Jim Chalmers has proposed to when it comes to the Reserve Bank is that it should be more transparent and should give regular press conferences, for example, to explain the decisions it’s making to Australians,” Ms Plibersek said.

The RBA also attracted backlash in June after reports showed it spent nearly $25,000 on an exclusive 30-person dinner in May after raising the cash rate for the 11th time.

Nationals MP Barnaby Joyce said he had “no problems” with the bank splashing out on lunches and dinners, as long as it was upfront about it.

“If you are spending on a $4000 grog bill and a $13,000 food bill, then make sure you put it out into the papers the next day,” Mr Joyce said on Monday.

“We are not that stupid. They are a professional organisation.”

Australia’s interest rate of 4.1 per cent sits at its highest level since 2012 despite the RBA pausing its regular hikes in August.

New ABS data shows that a record number of Australians are working more than one job to keep up with surging living costs, with levels of mortgage stress at their highest since 2008.