Rand Crosses Milestone as South Africa Markets Endorse Ramaphosa

(Bloomberg) -- Hours before Cyril Ramaphosa begins another term as South Africa’s president, traders are giving him a vote of confidence.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Hedge Fund Talent Schools Are Looking for the Perfect Trader

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

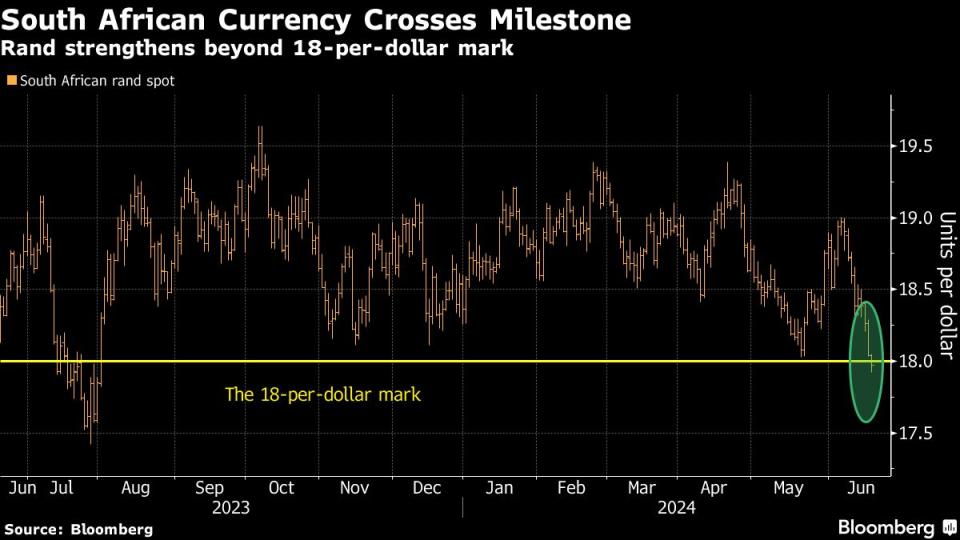

The nation’s currency rose the most in emerging markets Wednesday, trading at a level stronger than 18 per dollar for the first time in more than 10 months. The equity benchmark in Johannesburg jumped to a record high. The 10-year sovereign bond yield extended its decline toward the lowest close in 14 months.

That’s a turnaround for South Africa’s markets, which wobbled in the aftermath of general elections on May 29, when the ruling African National Congress lost its parliamentary majority by a greater degree than expected. But after tense coalition talks, the government that took shape proved to be to investors’ liking, who expect it to be market-friendly and implement reforms necessary to drive growth.

“The mood music around South African assets has changed considerably,” said Simon Harvey, the head of FX analysis at Monex Europe Ltd. “The outlook for fiscal consolidation and structural reforms looks constructive, as does the economic outlook.”

Investors are now awaiting news on appointments to ministries and key posts. Harvey said he expects the pro-growth stance to be affirmed by the appointments, while data may show the central bank gaining the capacity to cut interest rates and support growth by the year-end.

Ramaphosa will be sworn in at 11:25 am in Pretoria, according to an official communication. He will head a government of national unity that includes the Democratic Alliance, which investors consider market friendly. The left-leaning Economic Freedom Fighters and the newly formed uMkhonto weSizwe led by former president Jacob Zuma are not part of this coalition.

Here’s how South African assets were trading at 9:52 a.m. in Johannesburg.

Rand

The currency rose for the eighth time in the past nine days, trading as high as 17.9273 per dolalr on Wednesday.

“USD/ZAR remains heavy given the markets’ most favorable outcome came true,” said Robert Hoodless, co-head of FX and macro analysis at InTouch Capital. “A possible break below 18 is encouraging some to look toward 17.50 as a wave of optimism about better governance in South Africa continues,” Hoodless said.

The gains have more room to run, according to Barclays Plc strategists Marek Raczko and Sheryl Dong. The risk premium commanded by the currency pair has compressed to 2.5% from 10% earlier in the year, they wrote in a note to clients.

Stocks

The benchmark FTSE/JSE Africa All Share Index rallied as much as 2% to an all-time high of 81,364.39. Banking shares extended their rally to a sixth day, the longest winning streak in almost a year.

Local Bonds

The yield on South Africa’s local-currency bonds due 2035 fell as low as 11.23%, the lowest closing level since April 2023. The securities are the top performers among developing-nation peers this month, having returned 9.3% in dollar terms.

Dollar Bonds

South Africa’s international bonds also posted some of the biggest gains in emerging markets on Wednesday, with the dollar note due September 2047 trading at the highest level since Jan. 15.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.