Orbit Fab unveils $30K port to refuel satellites

Orbit Fab wants to build "gas stations" for satellites -- which means it needs the gas cap, a mechanism for transferring propellant from an orbital tanker to the customer spacecraft. That docking mechanism, called RAFTI, is now flight-qualified and on the market. The price tag for each port? Just $30,000.

The Colorado-based startup (and former TechCrunch Disrupt Battlefield finalist) has been in operation since 2018, and its CEO and co-founder Daniel Faber has been working in the space industry for decades; he’s likely best known for heading up Deep Space Industries (DSI), a company that was targeting asteroid mining. The company, which was founded in 2012, was acquired by Bradford Space seven years later.

“If you want [to talk about] something that’s too early, that’s it,” he joked during a recent interview. As part of the company’s efforts to eventually build tech capable of prospecting a distant asteroid, DSI built satellite thrusters for orbital maneuvering. This work, and subsequent conversations with customers and colleagues, eventually led Faber to believe that the next big opportunity was in-space refueling.

Part of it is simple math: Colleagues and former customers told him that they could squeeze as much as $1 million in marginal revenue from satellite missions from an extra kilogram of propellant.

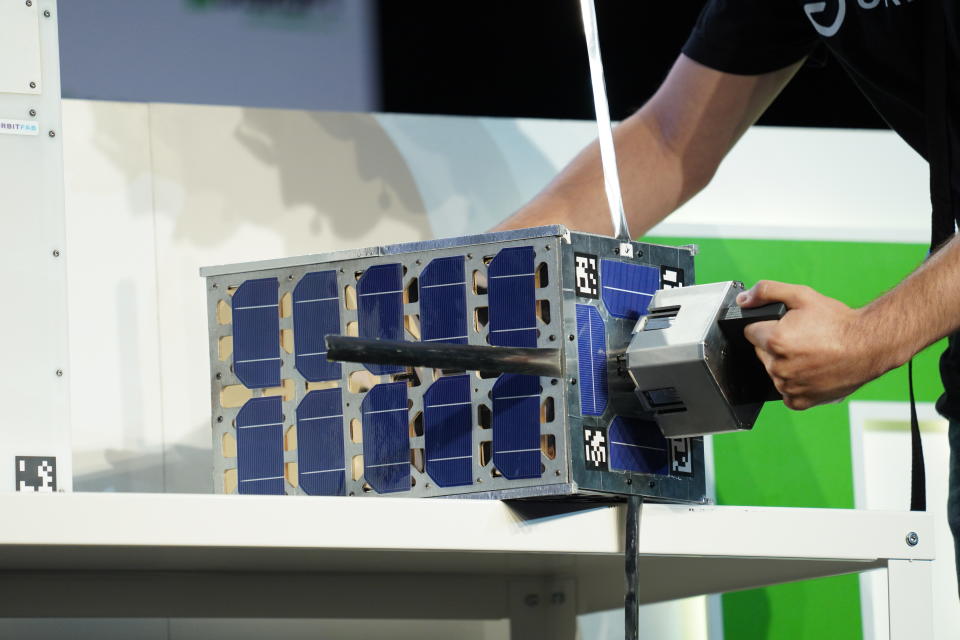

Image Credits: TechCrunch / Orbit Fab onstage at TechCrunch Disrupt in 2019

“Spacecraft are optimized with the amount of fuel they have, and when they get to the end of it, an extra kilo would give them a million dollars of marginal revenue,” Faber said. “We create so much value from that, we just have to do it.”

The 2010s also saw the emergence of a handful of satellite servicing companies, like Astroscale, which are developing technology for space debris removal, satellite life extension or last-mile satellite delivery. Faber calls these capabilities “tow truck applications,” and he realized that there would eventually be a need for orbital gas stations to complement this fleet.

So Orbit Fab was born. In the first year of operating, the company raised a $6 million seed round with contributions from Bolt and Munich Re Ventures, the VC arm of Munich Re Group, one of the biggest underwriters of satellites and rockets. In 2023, the company raised a $28.5 million Series A round.

The startup's technology is ambitious, but the architecture is fairly simple: The idea is to equip customer satellites with the refueling port (Faber referred to it as a "gas cap," but it's officially called RAFTI) while the hardware is still on Earth. RAFTI, which stands for “Rapidly Attachable Fluid Transfer Interface,” can also be used to fuel spacecraft on the ground prior to launch. Once a RAFTI-equipped satellite runs out of propellant, one of Orbit Fab’s tankers would be able to pick up some fuel from orbital depots and deliver it straight to the customer’s satellite for refueling.

The only two things the company sells are fuel and the fueling ports; as one might expect, the real money will come from the fuel sales. On its website, Orbit Fab says its hydrazine delivery service in geostationary orbit will cost $20 million for up to 100 kilograms.

Given the simplicity of the architecture, nailing each part of the hardware is critical; hence why it’s taken years for Orbit Fab to debut the refueling port. There are many variables to consider: the cost to the customer, versus the potential marginal revenue from extra life on orbit; the impact of fueling on the customer spacecraft; and the challenge of developing a docking mechanism that can also transfer propellant.

In addition to all of these challenges, the company had to ensure its component complied with standards from NASA, the Space Force and the American Institute of Aeronautics and Astronautics to ensure it is safe, reliable and able to withstand the harsh environment of space.

“This wasn't cheap,” Faber said. “It wasn't quick, but at the end of the day, we have an elegant design that meets those requirements and has a simplicity to it that comes from doing a design well.”

One of the biggest shifts from when he started the company to now, Faber said, is the standing up of the U.S. Space Force and the effects that’s had on the space industry writ large. Orbit Fab ended up pivoting much of its attention to addressing the nascent needs of the Space Force, which was very interested in orbital mobility to avoid space debris or rendezvous with other satellites.

The company anticipates the first RAFTIs will go to orbit on customers' satellites later this year. That will be followed by the first fuel shuttle going up next year, as part of a contract with the DOD to deliver fuel in geostationary orbit in 2025. Orbit Fab is aiming to sell 100 fueling ports this year, which will put the RAFTI “on a decent percentage of satellites going to orbit,” Faber said. Orbit Fab has an additional agreement with an unnamed commercial customer to deliver “a significant quantity of fuel” in a few years, he added.

Beyond these milestones, Faber intimated that the company already has plans to upgrade RAFTI, and to design variants that could support higher-pressure propellants. The team is also thinking about redesigning the grapple housing for larger spacecraft, should the market indicate that's where they should go next.

“SpaceX has made rockets reusable, Orbit Fab makes satellites reusable,” Faber said. “In this world today, if you're running a rocket company, and you're not working towards reusable rockets, you’re working to a dead end. The same is true of satellites: If you're not making your satellites reusable, you’re just putting preordained junk into orbit.”