Norway Dials Up Spending of Oil Wealth as Inflation Eases

(Bloomberg) -- Norway plans to spend more of its $1.6 trillion sovereign wealth fund than planned earlier, helping the Nordic nation’s economy overcome a soft patch amid an expected delay in interest rate cuts.

Most Read from Bloomberg

Trump Vows ‘Day One’ Executive Order Targeting Offshore Wind

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

Biden Accuses China of ‘Cheating’ on Trade, Imposes New Tariffs

S&P 500 Gets Close to All-Time High Before Key CPI: Markets Wrap

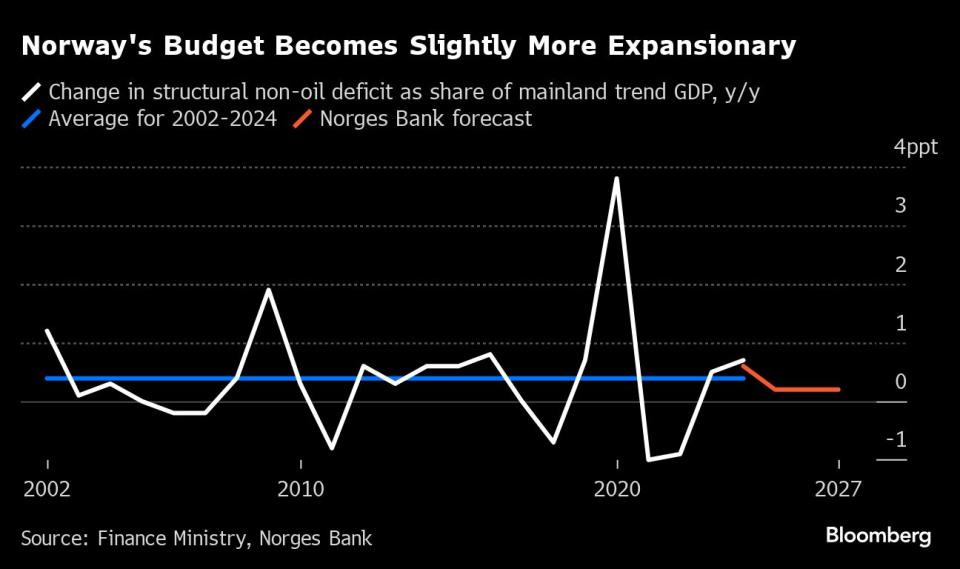

Labor Prime Minister Jonas Gahr Store’s cabinet is widening its so-called structural non-oil fiscal deficit for 2024 to 419 billion kroner ($39 billion), compared with 410 billion kroner seen in October, according to revised budget figures published on Tuesday. The budget withdrawals, as a share of mainland trend gross domestic product, will increase by 0.7 percentage point from last year, slightly more than the 0.6 percentage-point gain projected by the central bank in March and also higher than last year’s increase of 0.5 percentage point.

Even as Norway’s inflation rate remains among the highest in western Europe, it is gradually slowing, while the mainland economy has largely ground to a halt. That means there’s less pressure on the government to rein in spending at a time the NATO member is boosting outlays on defense to counter risks posed by neighboring Russia.

Read More: Norway to Nearly Double Defense Spending by 2036 in New Plan

“A new geopolitical situation requires that Norway prioritizes security at home and abroad, to a greater extent than before,” the government said. “While remaining fiscally responsible the government proposes to significantly increase investment in defense, security and policing.”

Norges Bank said earlier this month that a string of factors, including a weaker-than-forecast krone and a more resilient economy, suggest that the first interest-rate cut may need to be delayed beyond autumn.

“The effect of increased spending in the revised budget to the economic activity in 2024 is probably modest,” DNB Bank ASA’s senior economist Kyrre Aamdal said in a note to clients. Still, “the revised budget is more likely to add a few points to a higher rate path than to a lower rate path.”

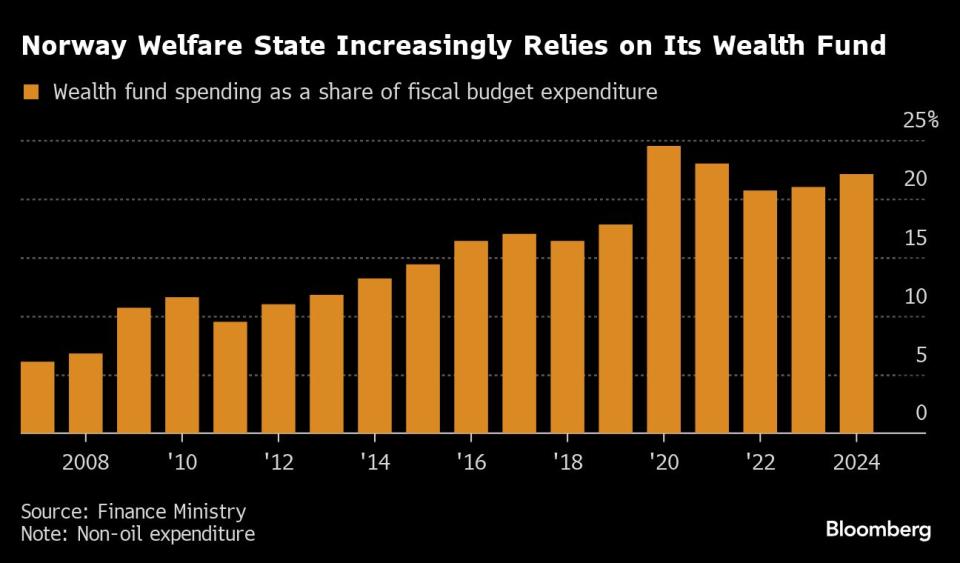

Under Norway’s so-called fiscal rule, the government’s annual spending of the fund is capped at 3% over time, or the expected real return of the fund. Still, fiscal policy is “more vulnerable to permanent reductions in fund value than before” due to the growing size of the fund, the ministry said last October. The fund has paid for more than a fifth of budget spending since the pandemic, with the share tripling after the 2008 financial crisis.

To get the budget approved by lawmakers, Store’s minority government depends on the Socialist Left, a party that’s not formally part of the ruling coalition. That party’s representatives criticized the budget revisions as falling short on Norway’s climate pledges and on higher child subsidies to reduce inequality, according to an emailed statement.

As a share of wealth fund, the withdrawals will decline from last year’s level to 2.7%, matching the October estimate of 2.7% and just below the central bank’s projection of 2.8%.

Mainland gross domestic product, which adjusts for Norway’s oil and offshore industry, is expected to grow 0.9% this year, the ministry said, in line with its March estimate. That compares with the central bank’s latest forecast of 0.5% growth and a median estimate of 0.6% in a Bloomberg survey of economists last month.

--With assistance from Stephen Treloar and Kari Lundgren.

(Updates with comments from analysts, minority government’s budget ally from 6th paragraph.)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

©2024 Bloomberg L.P.