Mexico Gets Hit by More Frustrating Economic Data Just Days Before Presidential Election

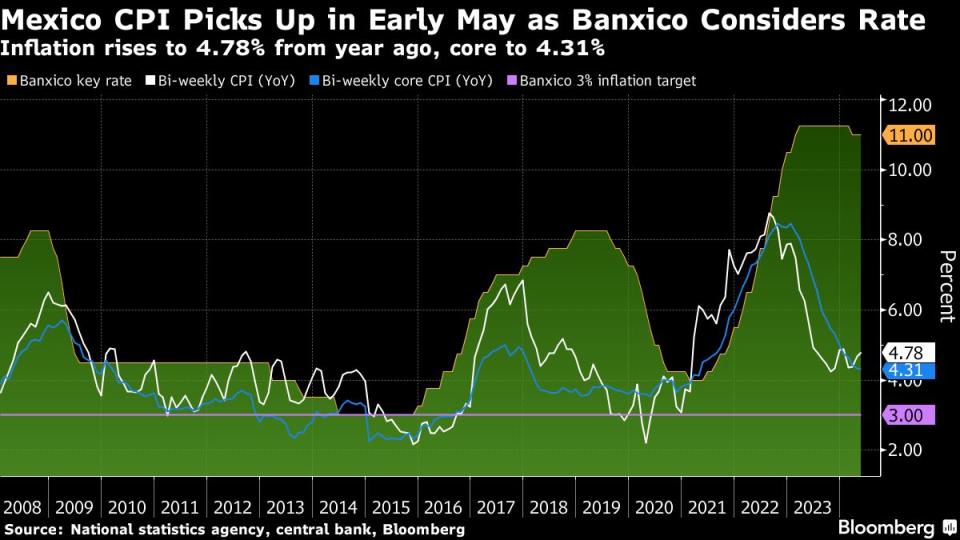

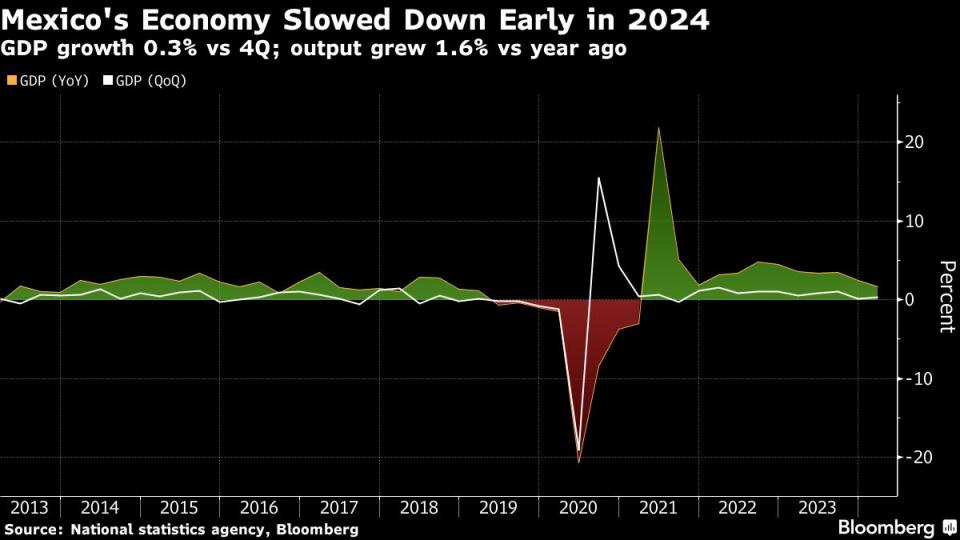

(Bloomberg) -- Mexico’s economy eked out weak growth at the start of the year as inflation sped up further above target in a fresh sign of the challenges its next president will face after the June 2 election.

Most Read from Bloomberg

Gross domestic product expanded 0.3% in the first quarter from the previous three-month period while activity slowed down in March, the nation’s statistics institute reported on Thursday. At the same time, headline annual inflation accelerated to 4.78% at the start of May, further above the 3% target.

After beating expectations during much of last year, Mexico’s economy has lost momentum on weakening demand for its exports and the effects of bad weather on agriculture. Headline inflation has also picked up due to costlier food and services, meaning the central bank has limited room to cut interest rates. Put together, the data is a reminder of the difficult economic situation the next president will inherit.

Read more: AMLO Successor to Inherit Slowing Economy as Mexico Spark Fades

Government spending heading into the June 2 vote was expected to buoy the economy, with programmed increases to salaries and an early distribution of funds directed at pensioners to avoid conflicting with the election period. Yet that has not been enough to counter other factors that have dragged on activity.

“Inflation indeed has proved to be stickier, and this is not good,” said Jessica Roldan, an economist at Casa de Bolsa Finamex. “I’m more worried about what a slow beginning of the year for economic activity could entail for growth once the fiscal impulse fades away.”

Services posted 2.1% annual growth in the first quarter, helped in part by the government social programs, while agriculture expanded only 0.6% and manufacturing by 0.9%. Meanwhile, manufacturing shrank from the prior quarter.

The slowdown could also be seen in monthly economic activity, which rose 0.32% in March, down from a revised 1.53% in February, government data showed.

“The economy remains growing below potential and at the margin is decelerating, not accelerating as expected going into the June election,” said Carlos Capistran, the head of Mexico and Canada economics at BofA Securities.

Fruits and Vegetables

Meanwhile, early May inflation was driven up in part by sharp increases in the costs of fruits and vegetables, which surged 20% from the year prior. Services inflation hit 5.23% on an annual basis.

Core inflation, which excludes volatile items like food and fuel, slowed slightly to 4.31% compared to the year prior.

Some economists say the inflation uptick will be brief, especially as growth slows. The headline consumer price reading “is being contaminated by the non-core pressures, like fruits and vegetable prices, which could be short lived,” said Marco Oviedo, a strategist at XP Investimentos.

There are analysts who think that the economy could show some improvements in the second quarter, but worry about the post-election outlook.

What Bloomberg Economics Says

“Monthly data show Mexican growth is poised to gain momentum in the second quarter after a small advance in 1Q. Household consumption has extended its uptrend, while investment is leveling off from a downshift. We expect activity and domestic demand to rise at a more moderate pace than in 2023.”

— Felipe Hernandez, Latin America economist

— Click here for full report

Still, exporters have been worried about the strength of the Mexican peso, which has been among the best-performing emerging market currencies since the start of the year. High temperatures in Mexico have also created drought conditions across many states and electricity shortages, which could be reflected in economic data in the second quarter.

Economists in a Citi survey expect the central bank to cut interest rates by 25 basis points at its June meeting. The survey puts 2024 GDP growth at 2.2%, followed by 1.8% in 2025.

“The Central Bank is at a difficult spot,” said Roldan, from Casa de Bolsa Finamex. “On one hand it has maintained real rates super high. On the other, the stall in the improvement of inflation readouts makes it difficult to justify sizable rate cuts.”

--With assistance from Robert Jameson, Giovanna Serafim and Rafael Gayol.

(Recasts story to include Mexico inflation data and economist comments)

Most Read from Bloomberg Businessweek

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

©2024 Bloomberg L.P.