Lagarde Signals ECB Cut in June With 2% Inflation in Sight

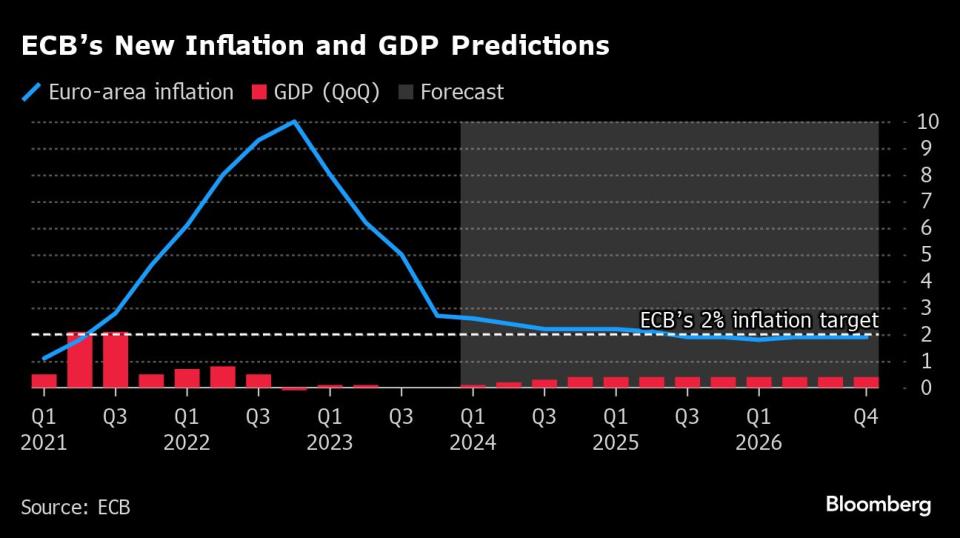

(Bloomberg) -- European Central Bank President Christine Lagarde indicated policymakers may be in a position to lower interest rates in June as fresh projections showed inflation hitting the 2% target in 2025.

Most Read from Bloomberg

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

Huawei Chip Breakthrough Used Tech From Two US Gear Suppliers

China Readies $27 Billion Chip Fund to Counter Growing US Curbs

How Trump’s Ex-Treasury Chief Landed 2024's Highest-Profile US Bank Deal

Stocks Climb on Bets Fed, ECB Closer to Rate Cuts: Markets Wrap

Speaking after policymakers left the deposit rate at 4% for a fourth straight meeting, Lagarde said there’s a definite slowdown in consumer prices but that she and her colleagues aren’t “sufficiently confident” at present to commence monetary easing.

“We clearly need more evidence, more detail,” she told reporters Thursday in Frankfurt, highlighting upcoming figures on wages. “We know that this data will come in the next few months. We will know a little more in April, but we will know a lot more in June.”

The ECB, like the Federal Reserve and the Bank of England, is contemplating when to sound the all-clear on inflation and begin undoing the unprecedented monetary tightening deployed to subdue it. While price growth in the 20-nation euro zone is nearing the target, officials there are wary of cutting too soon and want assurance that wage increases are under control.

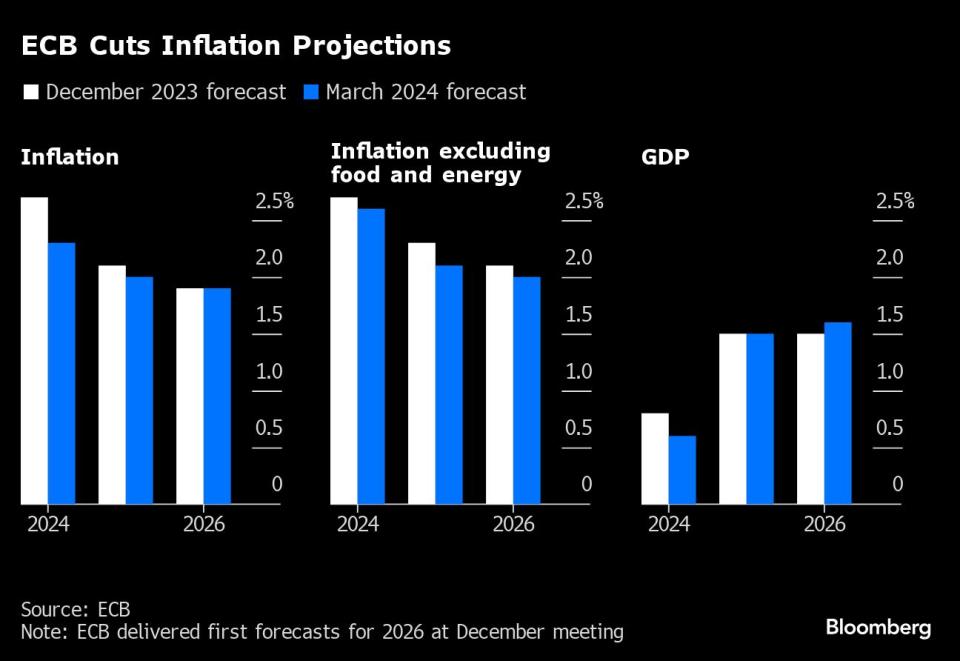

The ECB’s latest quarterly outlook offered strong encouragement, putting inflation at 2.3% this year — down from 2.7% in December — and revising the 2025 forecast down to 2%. For 2026, it’s still seen at 1.9%.

The economy, meanwhile, is predicted to expand by 0.6% in 2024 versus 0.8% previously.

The updated inflation projections will underpin investor expectations that a first rate cut will arrive in June. Markets are now pricing a full percentage point of ECB easing in 2024, while economists reckon there’ll be three cuts.

What Bloomberg Economics Says...

“Lagarde used the downward revisions to continue laying the groundwork for a rate reduction. However, she emphasized that the Governing Council cannot act until it has more data on wage growth.”

—David Powell and Jamie Rush. For full react, click here

While policymakers are more confident that inflation is receding sustainably, most agree with Lagarde that it’s too soon to declare victory and want to see more data backing the retreat before giving the green light for monetary loosening.

“We did not discuss cuts for this meeting,” Lagarde said. “But we are just beginning to discuss the dialing back of our restrictive stance.”

February inflation, at 2.6%, came in a touch stronger than expected — supporting those who don’t want to rush into lowering rates. A Nowcast compiled by Bloomberg Economics, however, shows March inflation at 2% — suggesting the ECB is closer to its target than it may think.

Whatever the reality, most policymakers are keen to examine the drip feed of wage data due over the coming months before acting. They even include doves like Greece’s Yannis Stournaras, who said recently that the ECB “won’t have enough information” to decide on cuts before June.

Moving that month could mean the ECB cuts rates before the Federal Reserve, with Chair Jerome Powell saying Wednesday that he “does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”

Responding Thursday to the idea that US policy will shape the thinking of officials in Europe, Lagarde reiterated that “the ECB is an independent central bank and will act independently.”

Lowering borrowing costs before the Fed, though, could be problematic, according to Allianz Chief Economist Ludovic Subran.

“What happens if the Fed doesn’t cut at all this year?” he told Bloomberg Television earlier Thursday. “That’s the big issue. This would be horrible for the ECB.”

--With assistance from Ben Sills, Greg Ritchie, Fergal O'Brien, William Horobin, James Regan, Bastian Benrath, Craig Stirling, Christoph Rauwald, Aaron Eglitis and Alessandra Migliaccio.

(Updates with Bloomberg Economics after seventh paragraph.)

Most Read from Bloomberg Businessweek

How Apple Sank About $1 Billion a Year Into a Car It Never Built

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

How Microsoft’s Bing Helps Maintain Beijing’s Great Firewall

©2024 Bloomberg L.P.