Italy’s Giorgetti Is in Frame as Meloni Reset Speculation Mounts

(Bloomberg) -- Giancarlo Giorgetti’s future as Italian finance minister is at the center of mounting speculation in Rome about a prospective post-election reshuffle of Premier Giorgia Meloni’s coalition.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

A government reset looks increasingly likely if this weekend’s vote for the European Parliament upends the balance of power in Italy, people familiar with the matter said — even though Meloni has pledged to keep her team unchanged until 2027.

Giorgetti meanwhile has privately told allies that he doesn’t want to take the blame when Brussels comes calling for action to repair the public finances after the election, the people said, declining to be identified because such discussions are confidential.

Newspaper La Repubblica reported on Monday that Giorgetti was preparing Treasury staff for his exit and that he was considering taking a European Union job. A spokesperson for the minister denied that report. Giorgetti himself told newswire Ansa he isn’t planning on going to Brussels.

If it were to happen, the minister’s departure would make his job the first casualty of the newly worsened fiscal outlook for Italy that officials unveiled in April, when they acknowledged that a path of stable debt had now shifted to one where borrowings are set to increase for years to come.

A big win for Meloni’s Brothers of Italy party in the election, coupled with a loss for the League, of which Giorgetti is a member, could be one element paving the way for his exit.

The speculation shows how the government is approaching a turning point after putting off a reckoning on Italy’s deteriorating debt profile until after the ballot.

The premier herself has signaled no intention to back away from expensive promises to voters, including a tax cut on wages worth a combined total of €10 billion ($10.8 billion).

Under Giorgetti, an accountant by training who served as a minister under the prior government of Mario Draghi, Italy has pursued a policy of fiscal restraint accompanied by some loosening.

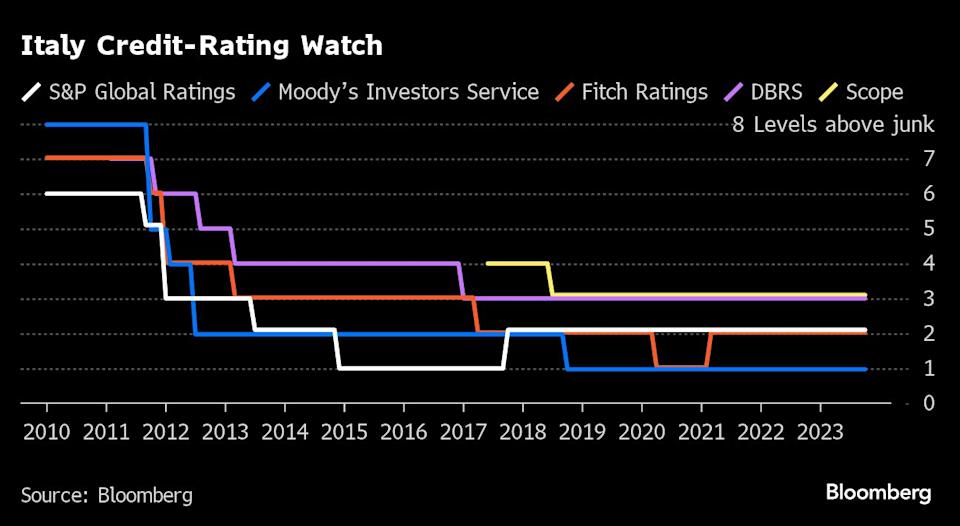

That bold approach appeared to pay off last year, when the country saw its debt fall more than expected, while Moody’s Ratings removed its threat of a downgrade to junk. Earlier in 2024, the spread of Italian bonds over German equivalents — a measure of risk in the region — fell to a two year low.

But Italy’s public finance outlook has now worsened considerably under the stress of higher borrowing costs and the legacy of a pandemic-era home-renovation incentive known as superbonus. While the government took action to limit its scope, the cost is now set to bloat the country’s deficits for years.

Debt as a percentage of gross domestic product is now set to rise from 137% to reach just short of 145% by 2029, according to the International Monetary Fund. Italy will overtake Greece to have the region’s biggest pile of borrowings within three years, Scope Ratings says.

With the country’s deficit set to exceed the EU’s red line of 3% until at least 2026, pressure from Brussels will soon increase.

That leaves Giorgetti increasingly squeezed between a rock and a hard place, as he seeks enough cash to pay for Meloni’s pledges while trying to limit the fiscal damage.

Just last week, Bank of Italy Governor Fabio Panetta underscored the challenge, warning that “careful choices are needed, especially on the expenditure side.”

Giorgetti’s exit would change the narrative of stability that the premier has prioritized for Italy. Last month, Meloni told a conference she was looking to keep her government for the entire length of her mandate, which is five years.

“I’ve never thought of a reshuffle — on the contrary, one of the objectives I’ve set for myself is to get to five years with the government I’ve named,” she said.

In truth, Giorgetti’s time in office so far has already put him close to the average length of tenure for his predecessors as finance minister in this current century.

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.