Investors Who Bought Encore Wire (NASDAQ:WIRE) Shares Five Years Ago Are Now Up 62%

The simplest way to invest in stocks is to buy exchange traded funds. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the Encore Wire Corporation (NASDAQ:WIRE) share price is up 62% in the last five years, slightly above the market return. Over the last year the stock price is up, albeit only a modest 3.4%.

See our latest analysis for Encore Wire

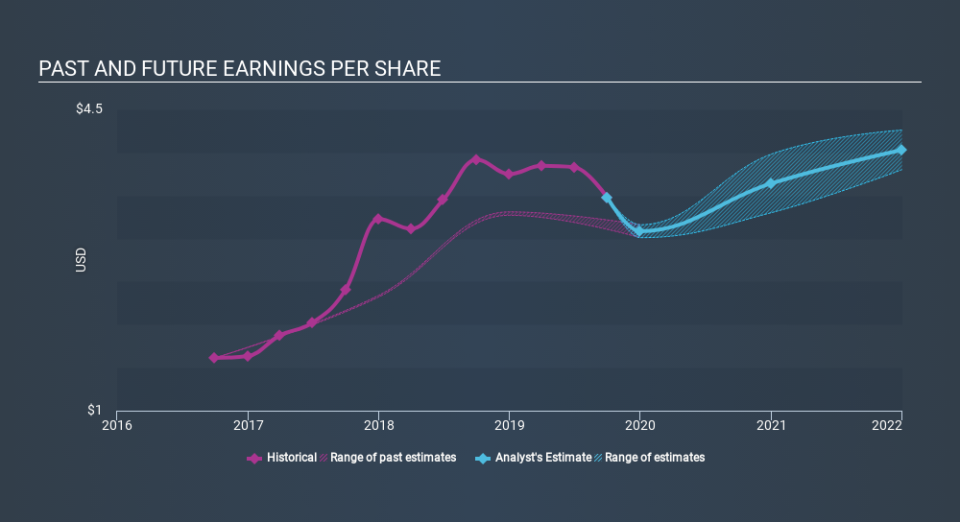

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Encore Wire achieved compound earnings per share (EPS) growth of 11% per year. This EPS growth is reasonably close to the 10% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Encore Wire's earnings, revenue and cash flow.

A Different Perspective

Encore Wire provided a TSR of 3.5% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 10% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Before spending more time on Encore Wire it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.