India Market Buzz: Blackstone’s Deal, Tighter Derivatives Rules

(Bloomberg) -- Before the trading day starts we bring you a daily digest of the key news and events that are likely to move markets.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

Macron Gambles on Snap French Election in Bid to Stop Le Pen

New York Fed Is Losing Talent and ‘Street Cred’ Under John Williams

Stock Rally Wavers in Fed Countdown as Euro Slides: Markets Wrap

Good morning, this is Ashutosh, an equities reporter in Mumbai. After the roller-coaster ride last week with the exit polls and national elections results, investors are hoping for a period of relative calm. Now that the new government is in place, the key drivers of sentiment this week will be the Fed rate decision, along with our inflation and factory output data.

Who gets the finance ministry in Modi 3.0?

The hottest topic among traders right now is who will be the next Finance Minister. There’s buzz in local media that Amit Shah, Prime Minister Narendra Modi’s trusted lieutenant, is among contenders for the role. Shah, who managed the home ministry for the past five years, has faced criticism for allegedly using investigative agencies for political purposes. On the other hand, Nirmala Sitharaman, the outgoing finance minister, is seen as a strong candidate for another term. Despite resisting calls to scrap additional taxes on stock gains, she has earned credit for steering the world’s fastest-growing major economy.

Green era under Modi faces red hot challenges

Decarbonization got a big push during Modi’s decade-long administration, and now he’s back with another five-year term, although with a weaker mandate. He’s under pressure to speed up progress toward existing green targets, including the pledge to hit net zero by 2070. The challenge? Balancing his green ambition with the growing demand for electricity while moving away from coal in favor of green technologies. It’s a tough act for the world’s most populous nation.

It’s raining block sales — and they’re getting bigger

The boom in tiny IPOs is now being followed by larger deals. The latest offering is from Bajaj Housing Finance, aiming to raise more than $700 million via initial share sales. While IPO activity is picking up, block sales are also red hot. Large investors, including company founders, have raised over $14.7 billion in proceeds so far this year. Blackstone’s offer to sell $800 million worth stake in BPO service provider Mphasis Ltd. is the latest, with the deal set to be executed today.

Analysts actions:

Ceat Raised to Reduce at ICICI Securities; PT 2,232 rupees

JSW Steel Raised to Buy at Motilal Oswal Securities

Supreme Industries Cut to Hold at Asian Markets; PT 5,265 rupees

Tips Industries Rated New Buy at Avendus Spark; PT 627 rupees

Three great reads from Bloomberg today:

Risk Appetites Roaring Anew in Wall Street’s Unflappable Markets

The World’s Flying Again and Jets Are Burning Fuel Like 2019

Singapore Banks Probe Rich Clients After Money-Laundering Case

And, finally..

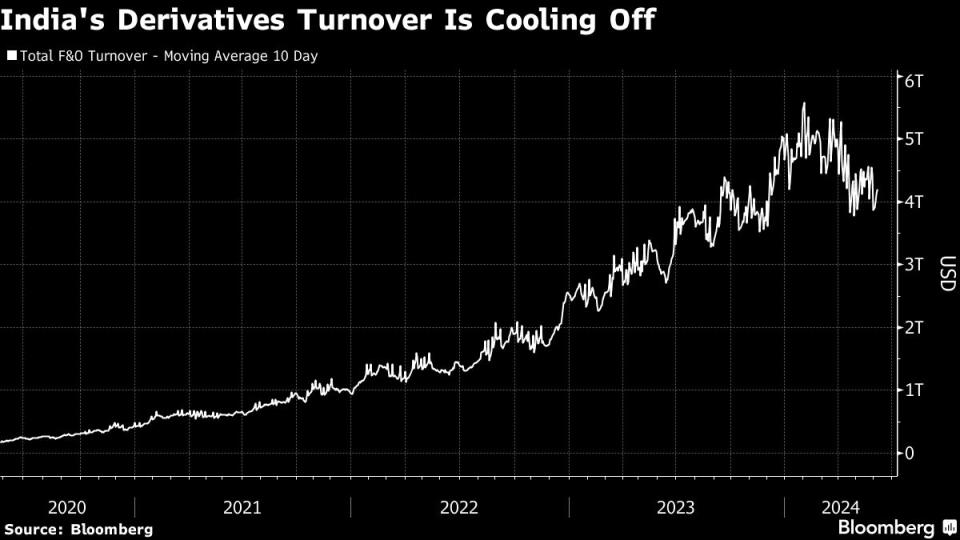

India’s booming derivative markets, powered by a surge in retail investors, are starting to worry the authorities. On the weekend, SEBI proposed new rules to eliminate low-turnover stock derivatives to curb market manipulation. With small-time traders making up a big chunk of the turnover that topped $5 trillion earlier this year, many expect the regulator to crack down even more to remove market froth.

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.