If You Had Bought Palo Alto Networks (NYSE:PANW) Shares Three Years Ago You'd Have Earned 61% Returns

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, Palo Alto Networks, Inc. (NYSE:PANW) shareholders have seen the share price rise 61% over three years, well in excess of the market return (33%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 10% in the last year.

See our latest analysis for Palo Alto Networks

Palo Alto Networks wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Palo Alto Networks' revenue trended up 22% each year over three years. That's well above most pre-profit companies. While the compound gain of 17% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Palo Alto Networks. If the company is trending towards profitability then it could be very interesting.

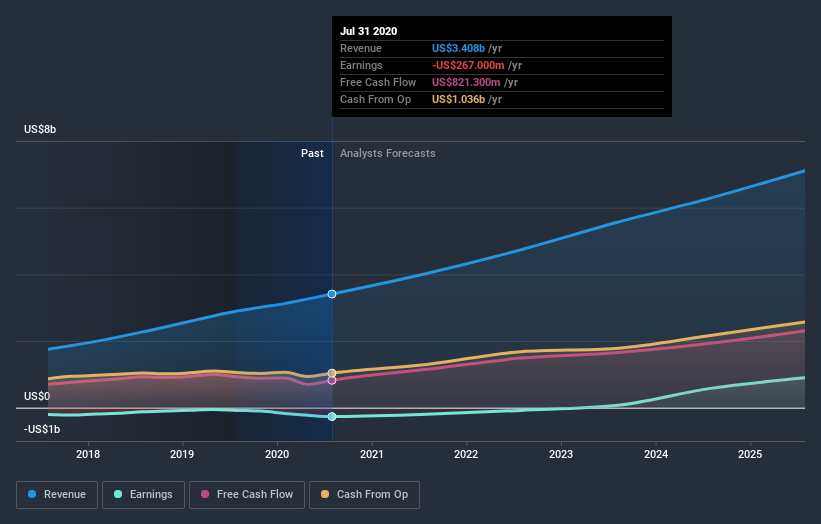

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Palo Alto Networks

A Different Perspective

Palo Alto Networks provided a TSR of 10% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 8% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Palo Alto Networks , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.