French Fund Managers Seek Crisis-Proof Bargains After Stock Rout

(Bloomberg) -- French stocks are still looking fragile after a $200 billion wipeout, but some investors are seeking out bargains that can withstand election-related risks.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

VW Latches Onto Rivian in $5 Billion EV Pact to Regain Momentum

Nvidia Rout Takes Breather as Traders Scour Charts for Support

Julian Assange Leaves Court ‘Free Man,’ Ending 14-Year Drama

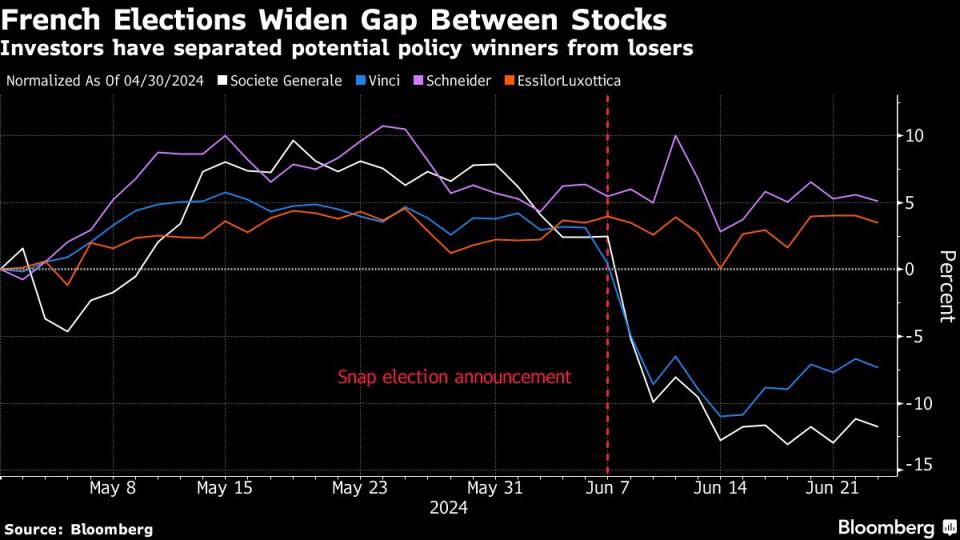

Fund managers have been adding exposure to stocks which have a high proportion of international sales and those in more defensive sectors. They’re positioning for more market turmoil after a slump prompted by President Emmanuel Macron’s snap election call, with polls showing Marine Le Pen’s far-right National Rally and the left-wing New Popular Front both winning more support than Macron’s group.

“We saw stocks being simply massacred and we took some positions,” said Ariane Hayate, a fund manager at Edmond de Rothschild Asset Management. She added exposure to “a building material company which typically has most of its profits in the US and Asia,” and took positions in defensive stocks within the consumer discretionary segment.

Axa IM fund manager Gilles Guibout has similarly reinforced his positions in French stocks with strong international exposure, while trimming his fund’s exposure to banks. Guibout also said the selloff in shares of some toll-road operators and other infrastructure firms has been overdone. Despite the fear of nationalization by the far right, their contracts with the government are solid, he said.

Shares in infrastructure and transport firms Eiffage, Aeroports de Paris SA, Bouygues SA, Getlink SE and Vinci — which generate up to 70% of their revenues in France, according to data compiled by Bloomberg — have slumped in the past two weeks.

While virtually the whole market has been caught up in the selloff, France’s ever-important luxury sector has been bouncing back. GAM Investments director Niall Gallagher said that his fund holds shares in globally-exposed French businesses including LVMH, Pernod Ricard SA and L’Oreal SA and that he hasn’t made any allocation changes since the snap election surprise.

Those businesses “aren’t really driven by French macro or politics. They’re driven much more by what happens to the US and the Asian consumer,” Gallagher said. For another of his holdings, Schneider Electric SE, the electrification trend is more important than domestic politics, he said.

Others have a wait-and-see approach ahead of the vote, which takes place over the next two weeks. Macron losing control of parliament would hinder his pro-business agenda, while other investor concerns include risks around tax hikes, higher borrowing costs and possibly even nationalizations.

“We’re waiting for the results of the elections. For now it’s too early given the uncertainty,” said Harry Wolhandler, head of equities at Meeschaert AM. He’s not planning on doing any bargain hunting just yet after cutting his exposure to domestic French stocks, including financials and renewables, after the election was called.

Most agreed that the market is in for a rough ride, whatever the outcome. French blue-chip stocks on the CAC 40, which has just 20% revenue exposure to the country’s economy, fell more than 6% in the week after Macron called the election. Some sectors, like banks, are still firmly lower.

Other stocks, including packaged foods company Danone, pharmaceuticals giant Sanofi, Gucci owner Kering SA and Schneider Electric, have bounced back.

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.