Europe’s Bank Stock Rally Threatened by Macron’s Election Call

(Bloomberg) -- For much of 2024, European bank stocks were the leaders of the region’s equities rally. Then French President Emmanuel Macron threw a spanner in the works.

Most Read from Bloomberg

CDK Hackers Want Millions in Ransom to End Car Dealership Outage

At Blackstone’s $339 Billion Property Arm, the Honeymoon Is Over

Wall Street’s Smart-Trade Brigade Thrashed Again on Stock Boom

Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns

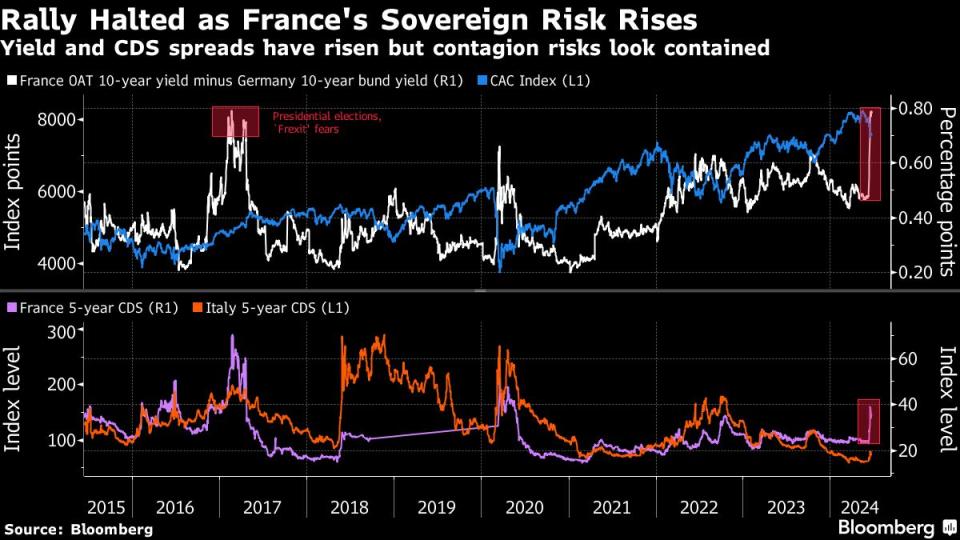

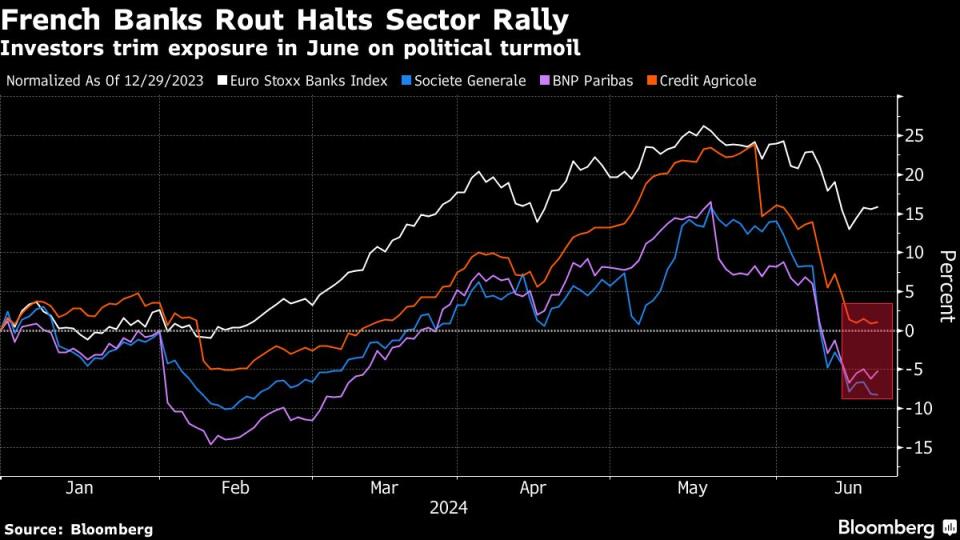

Since Macron called a snap election on June 9, lenders’ shares have slumped, relinquishing their position as Europe’s top-performing sector of the year. Investors who had championed banks’ high margins and hefty dividends are now trimming exposure, concerned about the sliding value of big holdings in French sovereign debt.

“The only main adjustments we’ve made in this context was to trim our exposure to French banks by 10% to 15% to manage portfolio volatility,” said Gilles Guibout, a portfolio manager at AXA Investment Managers.

The problem is that an election win for either the far-right or left — both ahead of Macron’s party in polls and promising bigger spending — could strain the country’s stretched public finances, leading to higher financing costs for banks. Each small increase in short-term funding rates could knock around 2% off earnings for French banks, according to analysts at Keefe, Bruyette & Woods.

The concerns have led to a selloff in French sovereign debt, of which the country’s banks held around €584 billion ($624 billion) as of December, according to Natixis Research. Societe Generale SA was the most exposed, and that’s the stock hit particularly hard by the fallout, down 19% in June.

“We think the selloff in French banks was driven more by top-down macro considerations — like higher cost of equity, triggered by political uncertainty,” said Morgan Stanley analysts Giulia Miotto and Vishal Shah, who rate BNP Paribas SA and Societe Generale as equal-weight and Credit Agricole SA as underweight. “We think French banks could continue to be weak until we know the election results on July 7.”

According to a Bank of America Corp. European fund manager survey in June, the proportion of European investors that see regional banks as attractive has fallen to 45%, while more than a third now expect the sector to come under pressure. That’s led positioning to fall to a net 5% overweight, compared with 12% in May.

Still, there are few signs of panic in broader markets. While the risk premium of French bonds over their safer German peers has spiked to the highest since 2017, a French sovereign bond sale on Thursday saw solid demand, while a gauge of the country’s default risk has jumped but seems relatively contained.

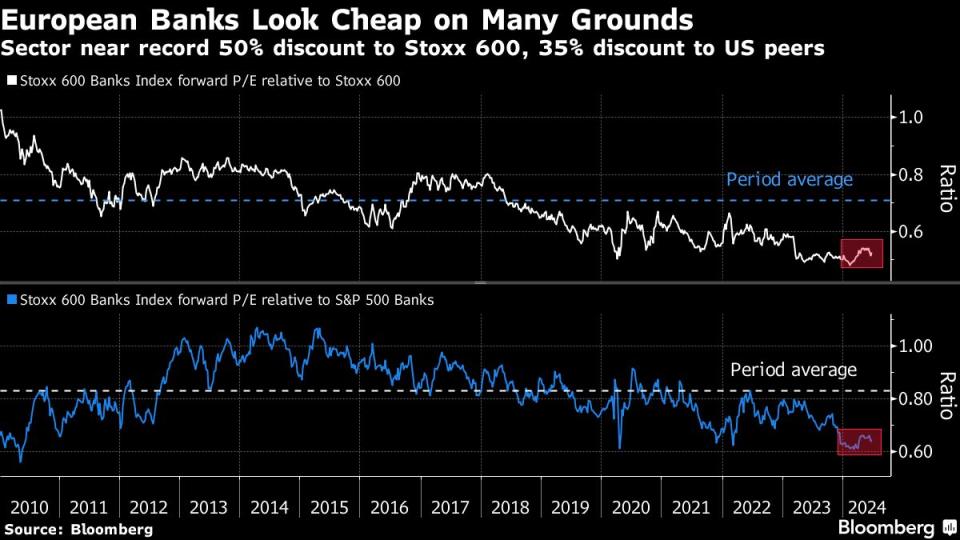

That means some see the potential for a recovery in bank stocks. Analysts are generally reluctant to change their estimates, which on average give the sector 21% upside to price targets, based on the consensus.

“Our view is that the politics-driven selloff on the French banks is overdone,” said Jefferies analyst Joseph Dickerson, who now has an overweight rating on all three major lenders after upgrading Credit Agricole.

He sees a revenue-driven turn in earnings momentum and the potential for a higher-for-longer rates scenario that would benefit them. While there are post-election risks, such as for a French bank tax and a delay to a European banking union that could have knock-on ramifications for mergers and acquisitions, he thinks these are surmountable issues.

For those eyeing an opportunity to buy the dip, valuations remain low relative to history. The sector’s forward price-to earnings ratio is about 7 times, near a 50% discount to the broader market. Capital returns to shareholders are another bright spot for the sector.

Barclays Plc analysts including Flora Bocahut expect banks they cover in the region to distribute a cumulative 31% of market capitalization over the next three years, via a mix of dividends and buybacks.

“Political risk was assumed to be fairly low and the past few weeks has shown that is perhaps not true,” said Andrew Stimpson, head of European banks research at Keefe, Bruyette & Woods. “For now, this is more a bump in the road rather than the end of the road.”

--With assistance from Alexandre Rajbhandari and Julien Ponthus.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.