Mexico’s Peso Leads Emerging FX Out of Post-Election Rout

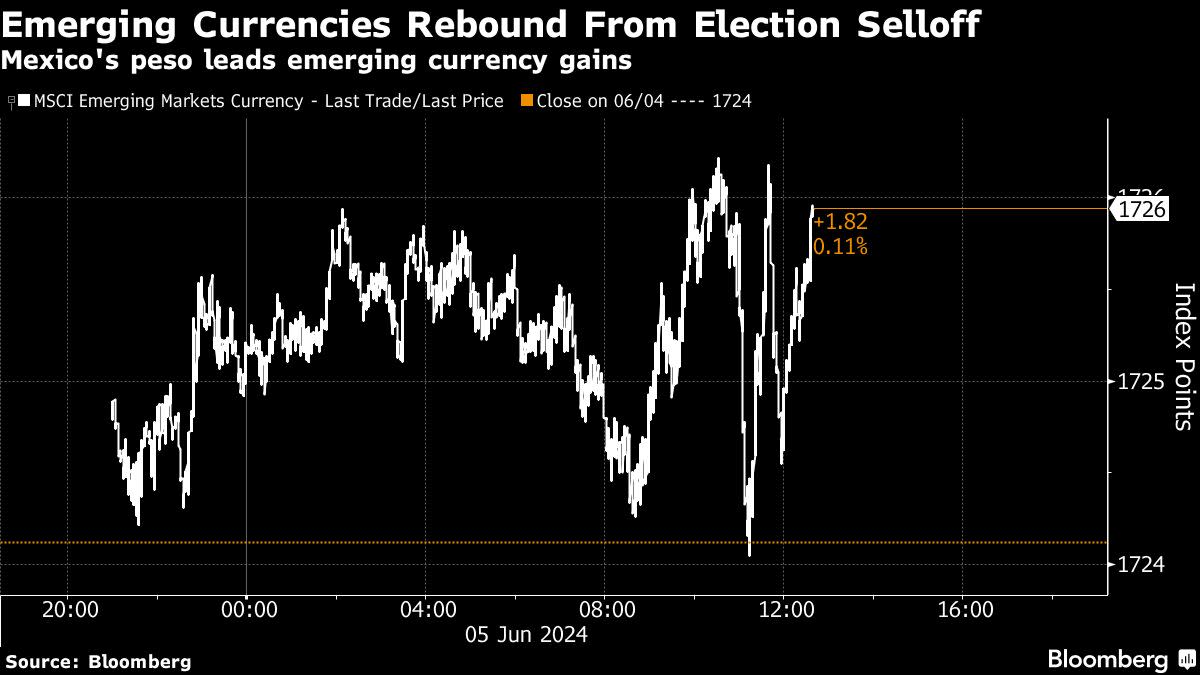

(Bloomberg) -- Emerging-market assets showed signs of a rebound after a selloff triggered by election results in some of the world’s biggest developing economies.

Most Read from Bloomberg

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

A Struggling Business Park Deals a Blow to Singapore's Regional Hub Ambitions

‘Everything Is Not Going to Be OK’ in Private Equity, Apollo’s Co-President Says

Mexico’s peso led peers higher, gaining as much as 2.1% against the greenback on Wednesday after a two-day slump left it at the lowest since November.

The peso “has scope to retrace its post-election result losses,” said Elias Haddad, senior strategist at Brown Brothers Harriman. The country should continue to have real interest rates that are “among the highest in the EMFX universe,” which should support the currency, he added.

Investors appear to be taking a step back and reassessing the magnitude of changes that may follow Claudia Sheinbaum’s landslide victory in presidential elections. The vote results — which gave the ruling Morena party a strong mandate to push through a swath of constitutional reforms — were one of a handful that caught investors off guard in the past week. Surprise outcomes in races in South Africa and India also helped fuel a fresh round of selling amid renewed political uncertainty.

India’s rupee strengthened against the dollar on Wednesday, as Prime Minister Narendra Modi secured crucial backing from two key allies in his coalition, allowing him to remain in power. South Africa’s rand, however, bucked the trend and was among the world’s worst-performing developing currencies. The move comes after the African National Congress said it’s considering a government comprising several parties, rather than a tie-up with the business-friendly Democratic Alliance.

Stocks, Credit

An index for emerging-market stocks rose 1%, boosted by Asian tech companies. Emerging-market traders largely shrugged off data that showed the US services sector expanded in May by the most in nine months, powered by the largest monthly gain in a measure of business activity since 2021. Separate figures highlighted that hiring at US companies grew at the slowest pace since the start of the year.

In credit markets, Sri Lanka and a group of creditors are in advanced talks over a deal aimed at restructuring the nation’s debt with bilateral lenders, according to people familiar with the matter.

African nations are tapping public debt markets for the first time in roughly two years as they seek to ride a return in investor confidence. Kenya plans another early buyback of its Eurobonds, the World Bank said Wednesday, a day after Senegal became the fourth sub-Saharan African nation to issue debt this year.

Serbia, meanwhile, announced a $1.5 billion inaugural sustainable bond as an improving economy and prospects of a potential rating upgrade lured investors.

--With assistance from Giovanna Bellotti Azevedo.

Most Read from Bloomberg Businessweek

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Sam Altman Was Bending the World to His Will Long Before OpenAI

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.