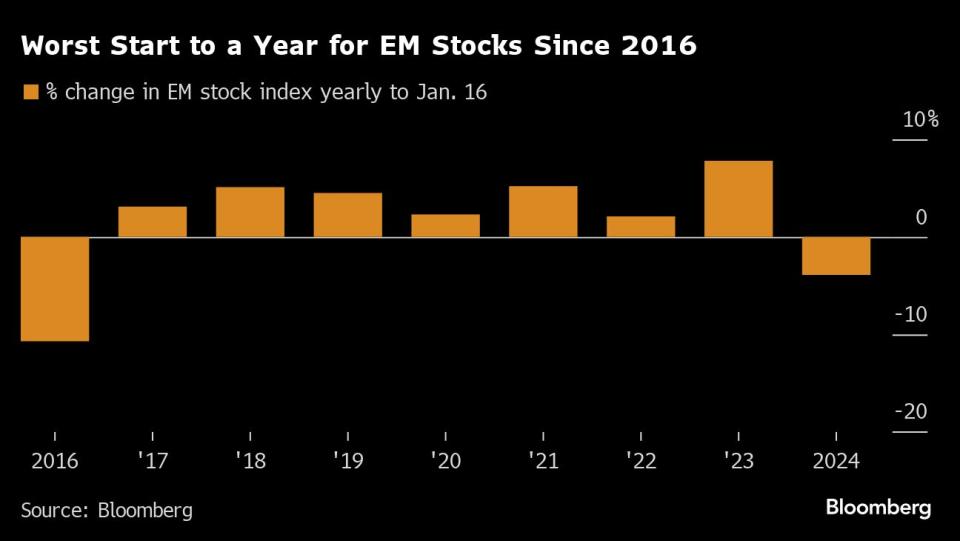

Emerging-Market Assets Drop on Doubts About Fed’s Rate-Cut Path

(Bloomberg) -- Emerging-markets assets fell on Tuesday, adding to the worst start to a year since 2016, amid doubts about whether the Federal Reserve will cut interest rates as deeply as markets have been expecting.

Most Read from Bloomberg

Stocks Drop as Solid Economic Data Lift US Yields: Markets Wrap

Musk Pressures Tesla’s Board for Another Massive Stock Award

Fed Governor Christopher Waller stoked such concerns by saying the central bank should take a cautious approach toward easing monetary policy, sending US Treasury yields higher.

MSCI Inc.’s index for developing-nation stocks dropped 1.7%, the most since Aug. 2, bringing its fall this year to 4.4%. Its counterpart for currencies slid 0.6%.

Waller’s comments fanned lingering worries that the markets swung too far by pricing in that the Fed will cut rates by some 1.5 percentage points by December. BlackRock Inc. Vice Chairman Philipp Hildebrand said Monday that bets on early rate cuts could prove excessive once inflation turns out to be stickier than anticipated.

Geopolitical tensions also added to a sour mood due to fears of supply-chain disruptions.

“Emerging-markets are struggling today as markets continue to digest the idea that the Fed is not ready to cut interest rates in March,” said Brendan McKenna, emerging market strategist at Wells Fargo in New York. “Repricing of Fed rate expectations is weighing on EM today, while geopolitical relations also remain tense and contributing to today’s underperformance.”

The Mexican peso was the worst-performing currency in the world, plunging 2% Tuesday. One possible explanation is that traders are pricing in a possible Donald Trump presidency after the Iowa caucuses on the assumption that this would be negative for the country.

“The market is pricing somewhat larger probability of disruptive policies like tariffs,” according to Erick Martinez, a strategist at Barclays in New York.

--With assistance from Philip Sanders and Zijia Song.

Most Read from Bloomberg Businessweek

Japan’s Market Roars Back to Life—With Old-Timers Leading the Way

Patti LaBelle Moves From Stage to Stove With a Recipe for Success

©2024 Bloomberg L.P.