S&P Tracking South African Election for Investment Outlook

(Bloomberg) -- S&P Global Ratings said it’s closely monitoring the outcome of South Africa’s elections next week and subsequent government policies to address issues from crime to energy supply that have deterred investment.

Most Read from Bloomberg

Yellen Says Higher Path for Rates Boosts Need to Lift Revenue

What the Trump Jury Saw as Evidence Against Him in 12 Images

Tesla Shareholders Should Reject Musk’s Pay, Glass Lewis Says

Biden to End Tariff Exclusions on Hundreds of Chinese Products

“We have seen investors being a little bit more cautious this year because of the election uncertainty,” Zahabia Gupta, S&P’s primary South African credit analyst, said in an interview. “Post-elections, more political and policy stability could lead to increased investment activity.”

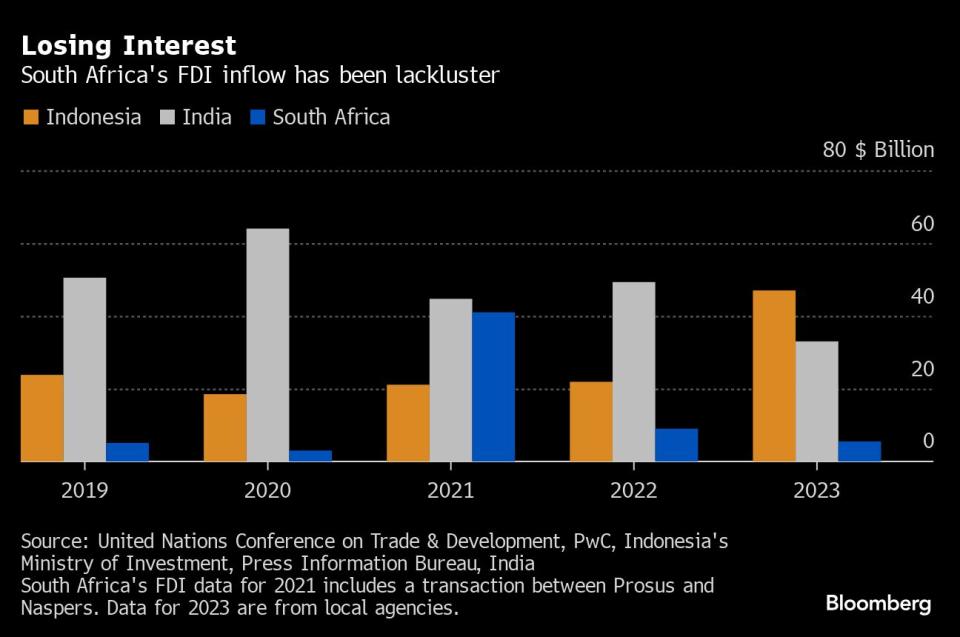

Foreign direct investment remains low, Gupta said, a troubling sign for a country with high development needs.

“Issues around energy supply, logistics, regulatory framework, red tape, and crime and corruption are major deterrents,” she said. “Growth in private and foreign investment would be positive for growth prospects, because investment is still not back to pre-Covid levels.”

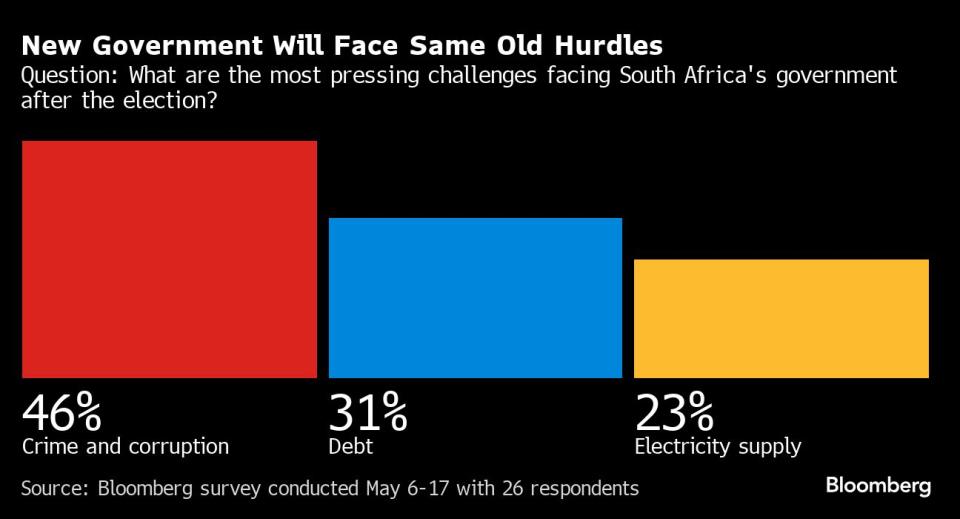

A Bloomberg survey of fund managers conducted in May found that crime, fiscal risk and electricity supply were the biggest concerns they had with regard to South Africa in the long term.

Read more: South Africa Election Rally Is Biggest Bet in Poll of Funds

Infrastructure bottlenecks in particular, especially in railway capacity and port congestion, remain significant constraints on growth, S&P’s Gupta said. S&P projects South Africa’s economy to grow 1.1% in 2024, with a slight increase to between 1.3% and 1.4% from 2025 to 2027.

The company’s base-case scenario sees the African National Congress entering coalition with a smaller party post May 29 vote, and a change in leadership following the elections would not necessarily lead to any immediate rating assessment change.

Bloomberg Terminal clients can click on ELEC ZA for more on South Africa’s elections

Last week, S&P affirmed South Africa’s rating at BB- — three levels below investment grade — with a stable outlook, saying that the rating’s strengths and weaknesses are broadly balanced. Future ratings adjustments will hinge on the country’s growth outcomes and its ability to manage fiscal and debt trajectories effectively, it said.

Sign up here for the twice-weekly Next Africa newsletter

(Updates with foreign direct investment chart after third paragraph)

Most Read from Bloomberg Businessweek

TikTok Video Playing on Finance Bro Stereotype Becomes a Viral Hit

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

©2024 Bloomberg L.P.