Confetti, a team-building platform used by Apple, Google and Microsoft, raises $16M

Not many startups can claim Apple, Google, Microsoft, Amazon and Meta as paying customers, but Confetti can. And the list doesn't stop at a quintet with a collective market value of $10 trillion -- the New York-based company says it works with Zoom, Netflix, Stripe, TikTok, Shopify, Adobe, LinkedIn, HubSpot and 30% of the Fortune 500.

That's some 8,000 companies in total. Not bad going for an events and team-building startup blindsided by a pandemic that pushed much of its target market to hunker down behind closed doors, forcing Confetti to rebuild its business model in a matter of weeks.

Most companies would be happy to have just a couple of the trillion-dollar tech giants on Confetti's customer list, which is why it's particularly notable that a fairly under-the-radar startup can lay claim to so many big-name logos.

"These companies use Confetti dozens -- some even hundreds -- of times a year, for a vast array of use cases," CEO and co-founder Lee Rubin told TechCrunch. "Such as seasonal occasions like Halloween, Black History Month, holiday parties or goal-driven activities like competition-building, communication or wellness."

Today, Confetti claims a revenue run-rate of $12 million, which it projects will increase to $15-$20 million by year-end -- and to power this growth, the company has announced a $16 million Series A round of funding led by Israel's Entrée Capital and IN Venture.

How it works

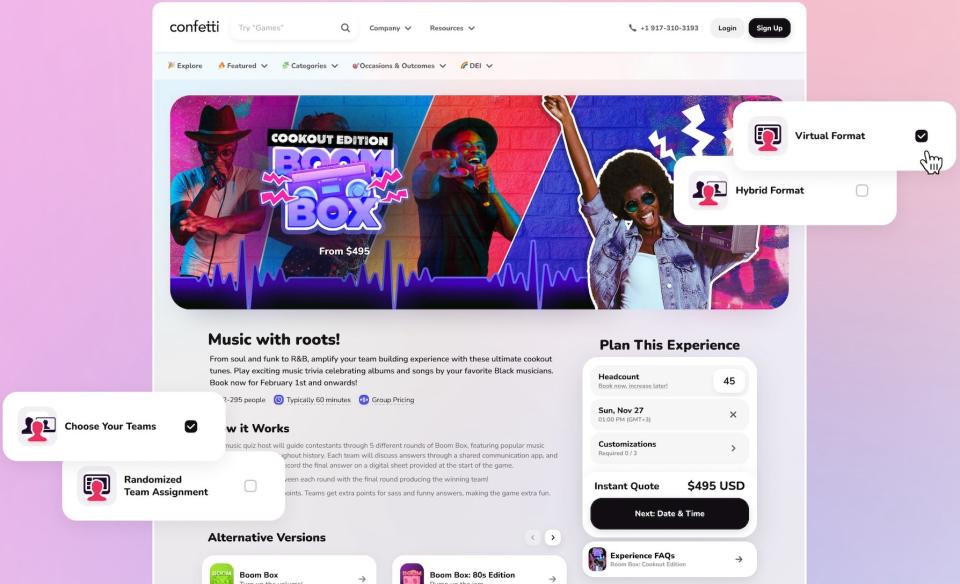

Example Confetti product page. Image Credits: Confetti

Companies use Confetti to bring team-building experiences to their remote teams, with support for hybrid too.

Want to foster camaraderie via virtual baking or cocktail-making? Confetti sorts it all out, including liaising with local suppliers and shipping ingredients direct to employees. Fancy some interactive games such as escape rooms, quizzes, Pictionary or charades? Again, Confetti sorts it all out -- all games are designed in-house, from ideation through to creation.

"The platform takes care of the entire event execution process," Rubin said.

This wasn't always the case though -- Confetti started out more as a marketplace connecting companies with event providers. However, that still bestowed a big responsibility on the organizer to join the dots and ensure a memorable event for all concerned -- this is why Confetti segued into more of an end-to-end platform that sorts it all out from start to finish.

"A marketplace only solves the issue of finding ideas and vendors to potentially provide them, but the entire burden of quality assurance, and event execution, still falls on the customer having to communicate directly with the vendor," Rubin said. "Additionally, most event providers are not corporate focused, they offer the same content to any group for any purpose. We understand that our customers need content that’s tailored to the cultural challenges they face in a work environment."

Rubin also draws analogies with how Netflix -- one of its customers -- started out as a content aggregator that transitioned into a content producer to give it greater control of the product it sells.

"[It's all about] creating the content from scratch, in a consistent way across all our experiences that’s tailored to building a remote or hybrid work culture," Rubin said.

Complexities

In a prior job, Rubin says she was tasked with organizing a team-building event, an endeavor that proved more difficult than she initially envisaged.

"At first, I thought it would be easy, but then I realized how many things go into it -- coming up with ideas, looking for vendors online, negotiating with them -- all with fingers-crossed that my team will have a good time," Rubin explained. "So I asked myself: Is there an easier way to create meaningful events that are simple to plan?"

And so in 2017, Rubin and her CTO co-founder Eyal Hakim launched Confetti, designed to remove the complexities of organizing team events and experiences. But that was seven years ago -- a lifetime away in terms of where the world was at with attitudes toward remote working. The pandemic forced pretty much every company to embrace remote work, meaning that Rubin and Hakim had to switch things up pretty quickly.

"When we started, we were solely focused on in-person events, helping companies organize events in the office," Rubin said. "When the pandemic hit, we quickly had to pivot, and after two exhausting weeks, our prototype was already up, running and ready to sell. I believe this quick shift is a testament to how startups must be able to stay agile and look at challenges as opportunities to grow beyond the original boundaries."

Moreover, the pivot seems to have been a net benefit for Confetti, in terms of enabling it to tap a much larger market.

"After switching to virtual events, we realized that this path was way more scalable -- you can serve customers around the world without relying on a physical presence," Rubin said. "So in a way, we really took the most out of the constraints the pandemic imposed on our business."

Prior to now, Confetti had raised around $2 million across various seed, angel and venture rounds, with backers including Correlation Ventures, Entrepreneurs Roundtable Accelerator and Delivery Hero co-founder and CEO Niklas Östberg. With another $16 million in the bank, Confetti is well-financed to "shape the future of remote-work culture," as the company puts it, and this will involve building products around a recurring revenue model with support for multi-team companies.

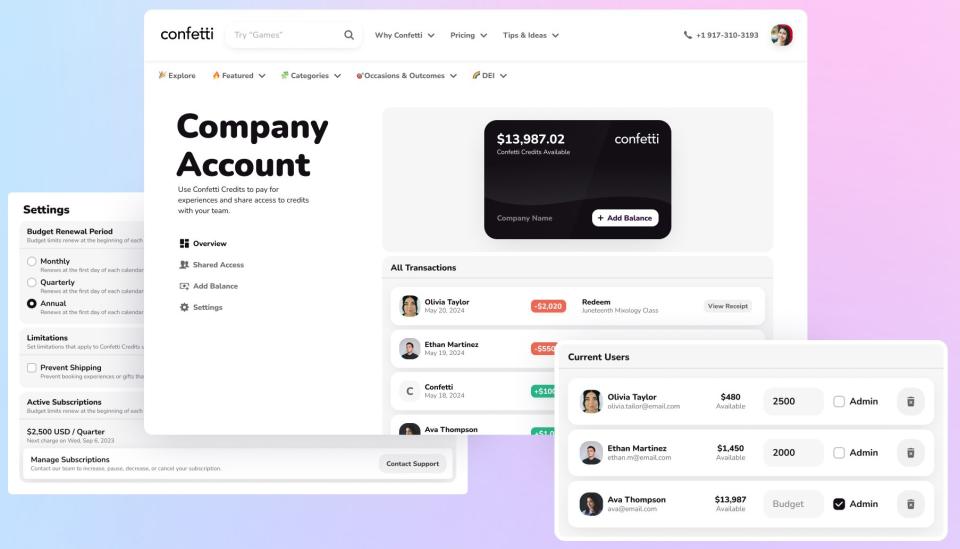

Company account

As Confetti began working with more companies, it came to realize that -- with bigger companies in particular -- there may be multiple different people from different teams using the Confetti platform. This was a consequence of the product-led growth strategy it had used from the get-go, which is partly why it has turned to dedicated sales teams to ensure a more cohesive "company" experience, replete with different pricing structures and packages to keep them coming back.

"Now that we have thousands of customers, we realized that within each company we often have many different employees who found us separately and are booking from us completely separately," Rubin said. "To offer our customers even more value, we decided to establish a sales team for the first time who would speak to decision-makers at these companies to offer them Confetti as a company-wide solution for their team-building strategy. With this, we introduced our new 'company plan,' which, compared to our pay-as-you-go plan, offers companies many additional benefits and incentives."

Company account example. Image Credits: Confetti

Today, a big part of Confetti's offering is automation -- workflows configured to remove many of the manual steps involved in organizing an event or team-building experience. For instance, once a company has provided all the required details for the booking, hosts are scheduled in (and paid on completion), virtual event rooms are set up, kits are scheduled for shipping and invites sent out, and feedback solicited.

It's this automation that Rubin believes is one of the elements that sets it apart from other players. However, it's worth noting that competitors such as Luna Park, Teambuilding.com, Outback Team Building and Marco Experiences also claim some of the very same prestigious customers that Confetti does, meaning that organizations aren't putting all their team-building eggs in the same basket.

So while there is competition, for sure, Confetti is pushing to position it as a stickier proposition for businesses -- particularly in the enterprise segment. While most of its experiences were historically charged on a per-event basis based on headcount, Confetti is pushing for more sustainable recurring revenue streams.

"We're already providing companies with options to purchase Confetti Credits, which can be used to buy experiences on our platform," Rubin said. "Additionally, we offer subscriptions to Confetti Credits (with incentives), enabling planners and companies to plan and execute their year-round virtual team-building strategy seamlessly. In 2024, we'll increasingly rely on packages and subscriptions, particularly as we scale our SLG [sales-led growth] motion."