Trudeau’s Capital-Gains Tax Hike Faces Opposition in Canada Poll

(Bloomberg) -- More Canadians have a negative view of Prime Minister Justin Trudeau’s planned capital-gains tax hike than a positive one, while most lack confidence that housing will become affordable in five years, according to a new poll.

Most Read from Bloomberg

One Out of Every 24 New York City Residents Is Now a Millionaire

Trump’s Private Life Exposed in Intimate Stormy Daniels Testimony

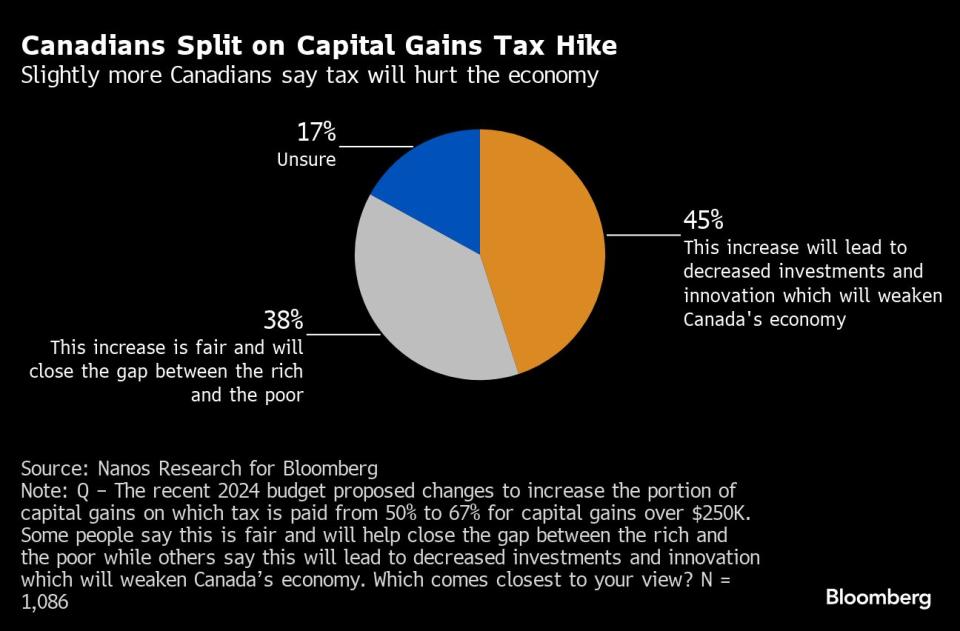

The survey by Nanos Research Group for Bloomberg News found that 45% believe the tax changes will lead to decreased investments and innovation, which will weaken the economy. Some 38% said the increase is fair and would close the gap between the rich and poor. The remainder were unsure.

The government’s budget, released last month, included plans to tax Canadian companies on two-thirds of their capital gains, up from half currently. The change will also apply to individual taxpayers when they have gains over C$250,000 ($183,000) in a year, although people will still be able to sell the homes they live in tax-free.

The money raised by the tax hike is to be spent on a number of programs, including initiatives to help younger people afford a home. But the poll suggests many are not swayed by the plan.

Debate over the capital-gains tax is likely overshadowing other elements of the federal budget. The post-budget tracking by Nanos suggests the opposition Conservatives continue to enjoy a lead of 18 percentage points over the ruling Liberals. An election is due in 2025.

“If the budget was intended as a potential reset of the Liberal government agenda in order to help close the gap with the Conservatives, the research suggests it is unlikely to succeed,” Nik Nanos, the firm’s chief data scientist and founder, said in an email.

The capital-gains increase sparked an outcry from businesses that warned the move would exacerbate the country’s investment and productivity woes. Finance Minister Chrystia Freeland has yet to introduce legislation to enact the tax change, but she has defended it as merely “asking those who are benefiting from the winner-takes-all economy to pay a little bit more.”

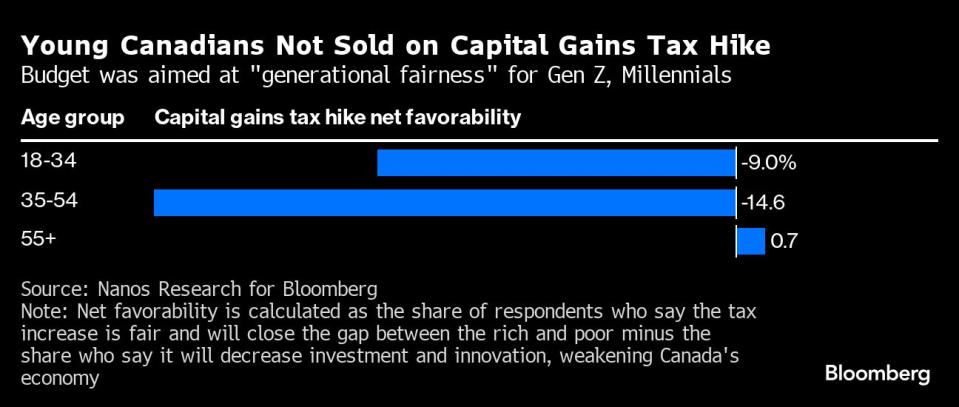

Residents of the Prairie provinces, home to Canada’s energy industry, were much more likely to say the changes would weaken the economy than those in Quebec or Atlantic Canada. Perhaps most troubling for Trudeau, the changes are less popular with younger Canadians than with older voters.

Read More: Young Canadians Feel Poorer in Warning Sign for Economy, Trudeau

Some 46% of Canadians ages 18 to 34 oppose the tax increase, a figure that rises to 48% for those aged 35 to 54, before falling to 41% among those over 55. The outcome is not what Trudeau and Freeland had hoped for from a budget aimed at “generational fairness.”

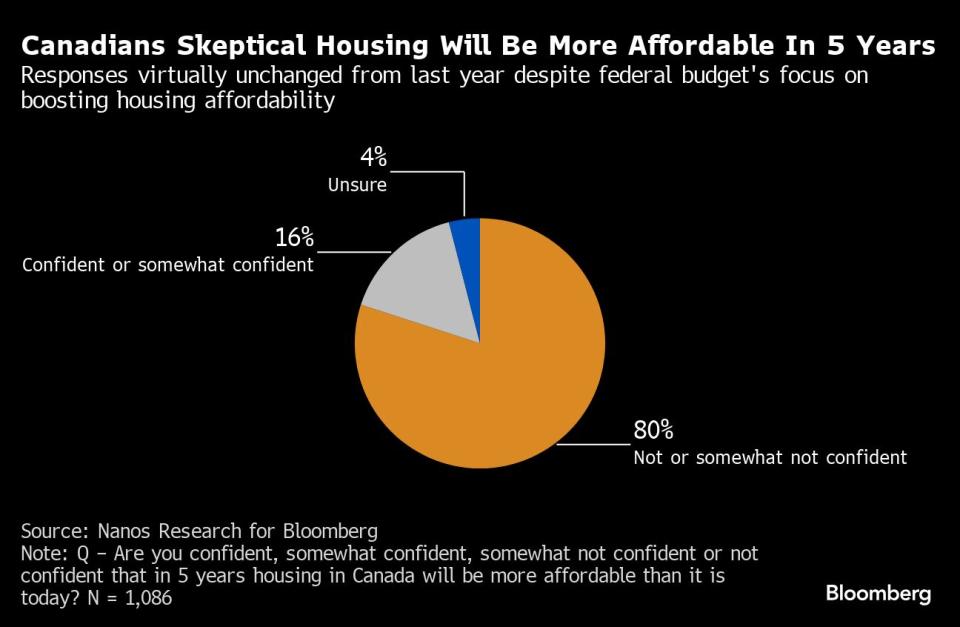

Support for Trudeau’s Liberals has been slipping among all age groups, but younger Canadians were crucial in clinching the party’s electoral majority in 2015. His budget included a new housing strategy, with plans to free up federal land for homebuilding and allow first-time buyers to pay off their mortgages over longer periods, in an effort to ease the housing affordability crunch.

But Nanos found that a large majority of Canadians of all ages — 80% — aren’t confident housing will be more affordable in five years. That’s similar to public opinion on the same question last year.

When broken down by age groups, some 82% of those aged 18 to 34 don’t believe housing will be more affordable in five years, compared with 77% of those over 55.

Nanos surveyed 1,086 Canadians by phone and online between April 28 and May 1. The poll has a margin of error of three percentage points, 19 times out of 20. The range of error may be wider when referring to subsets of the overall population because the sample size is smaller.

Most Read from Bloomberg Businessweek

A New Kind of Power Company Will Put a Battery in Every Home

Boom Times Are Over for Food Startups, But That’s a Good Thing

Chris Dixon’s Campaign to Overhaul Crypto’s Grifty Reputation

©2024 Bloomberg L.P.