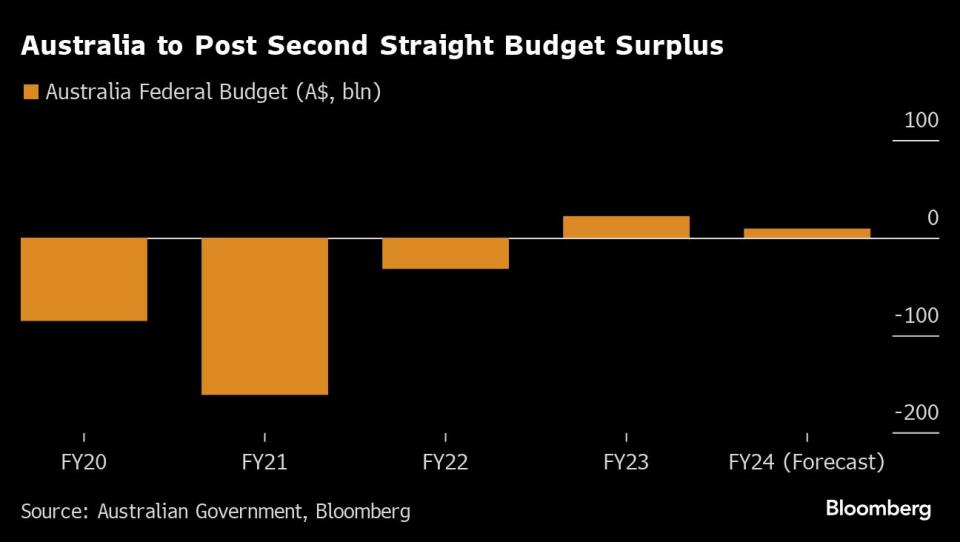

Australia to Record a Second Surplus, Bucking Global Trends

(Bloomberg) -- Australian Treasurer Jim Chalmers will announce the government’s books are in the black for a second straight year, putting the nation’s fiscal standing near the top of developed-world counterparts.

Most Read from Bloomberg

Trump Vows ‘Day One’ Executive Order Targeting Offshore Wind

Biden Accuses China of ‘Cheating’ on Trade, Imposes New Tariffs

Macron Puts French Banks in Play With Plan to Transform Europe

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

Five Under-the-Radar Billionaires Making Vast Fortunes in Modi's India

The underlying cash surplus will be A$9.3 billion ($6.1 billion), or 0.4% of gross domestic product, in the 12 months through June 30, Treasury said in a release ahead of Tuesday night’s budget. That compares with forecast deficits of 6% of GDP in the US and 3.6% in the UK this year.

“Another surplus is a powerful demonstration of Labor’s responsible economic management, which makes room for cost-of-living relief and investments in the future,” Chalmers said in the statement. “Despite the substantial progress we’ve made, spending pressures continue to intensify.”

Australia’s budget will swing back into the red in fiscal 2025 and remain there in 2026, with Treasury signaling a weaker outlook than its December forecasts. A Bloomberg survey showed the median estimate for fiscal 2025 is a A$14 billion deficit, swelling to nearly A$25 billion, or 1% of GDP, a year after.

The center-left Labor government faces an election in the next 12 months and has seen its standing in the polls erode in response to mounting voter discontent over rising prices and high interest rates. Chalmers has already flagged budget measures designed to address those concerns, including broad tax cuts and billions of dollars for housing.

“The main motivation behind this budget is people doing it tough,” Chalmers told Sky News. “There’ll be a tax cut for every taxpayer, but there’ll be additional cost of living help on top of that as well, at the same time as we try and build much more housing, because that’s one of the reasons why people are under so much pressure, that absence of housing.”

Typically, a budget surplus in Australia is a political victory for the government as it indicates strong economic oversight — even if driven by external forces such as higher commodity prices.

But with interest rates at the highest level since late 2011 and market pricing showing policy easing is unlikely before early 2025, the government is under pressure to respond.

It has flagged further measures to help cushion prices in the fiscal blueprint. Earlier this week, Treasury’s forecasts showed inflation will return to the Reserve Bank’s 2-3% target before the end of this year — 12 months earlier than the central bank’s prediction.

That’s been assisted by the government keeping fiscal policy aligned with monetary settings by running a budget surplus. The prudence has helped ensure Australia remains one of only a handful of economies with a coveted AAA credit rating from all three major agencies.

Chalmers has said the budget will prioritize inflation in the near-term and then aim to set the economy up for future growth.

It will feature a bigger boost for the critical minerals industry, he said this week. A central pillar will be a Future Made in Australia program, a suite of measures to stimulate high-tech and green manufacturing in a manner similar to the US’s Inflation Reduction Act.

“Responsibly managing the budget means we can deliver cost-of-living relief for Australians and invest in a Future Made in Australia,” said Minister of Finance Katy Gallagher. “We’ve put a premium on responsible economic management.”

--With assistance from Ben Westcott.

(Adds Chalmers comment in sixth paragraph, updates market pricing.)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

‘The Caitlin Clark Effect Is Real,’ and It’s Already Changing the WNBA

©2024 Bloomberg L.P.