Aussie, Kiwi Set to Outperform Global Peers on Rates Hike Bets

(Bloomberg) -- Australia and New Zealand’s currencies are poised to outperform global peers as their central banks delay cutting rates, shielding the pair from rising political risks.

Most Read from Bloomberg

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

Morgan Stanley’s Wilson Says a 10% Stock Market Correction Is ‘Highly Likely’

Boeing to Plead Guilty to Fraud for Violating Deal Over 737 Max Crashes

Biden Narrows Gap With Trump in Swing States Despite Debate Loss

Biden’s Biggest Donors Left Powerless to Sway Him to End Bid

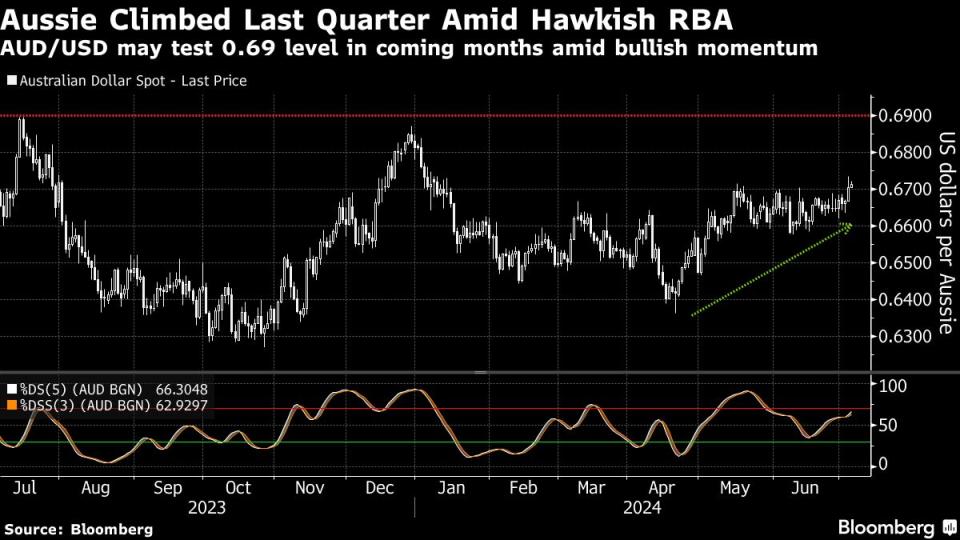

The typically risk-sensitive currencies were the top performers among a Group-of-10 peers last quarter, both climbing around 2% against the greenback despite a surge in volatility in global markets. Australia’s dollar closed 0.3% higher at 67.49 US cents on Friday, while New Zealand’s finished 0.5% stronger at 61.45 cents.

Rate hike bias from both the Reserve Bank of Australia and the Reserve Bank of New Zealand suggests the run may continue, offering protection from a strengthening greenback. The dollar surged 2% last quarter as traders shifted bets on Federal Reserve rate cuts, surprise elections in Europe and the outcome of a recent US presidential debate.

“Asia Pacific is the new haven trade,” said Nick Twidale, chief market analyst at ATFX, especially for the Aussie as the RBA has signaled rates could go either way while “every other central bank is saying they’re going down.” Twidale sees the Aussie testing 70 cents, and the kiwi at 62 cents in the coming months.

Traders have priced a just-under even chance that the RBA will increase interest rates at its next meeting following stronger-than-forecasted inflation in May. Meanwhile, the RBNZ is set to deliver its policy decision this week, as the central bank focuses on bringing inflation back within target even with an economy that has flipped in and out of recession.

Global currency volatility has steadily climbed since mid-May. The greenback has benefited from a global bond rout, sparked by France’s snap legislative elections that risked driving the country deeper into debt. Speculation that Trump may win the November US election also hit Treasuries as his inflationary policies pushed back bets on Fed easing.

“Aussie and kiwi could’ve done even better were it not for political uncertainty in Europe and the US,” said Carol Kong, a strategist at Commonwealth Bank of Australia. “The prospect of another RBA rate hike has been a tailwind for the Australian dollar and can potentially push it further up if a hike materializes.”

To be sure, the outperformance of both currencies may only be short lived. The greenback can reassert itself as markets position for a Trump victory, according to a note from Brown Brothers Harriman, while the macro outlook may recalibrate as political risks in Europe start to wane, according to Westpac Banking Corp.

“Short term yes; long term no,” said Martin Whetton, head of markets strategy at Westpac, referring to the prospect of Aussie and kiwi strength. “Short term, it is really quite marginal versus the dollar.”

Here are the key Asian economic data this week

Monday, July 8: Japan BOP current account balance, trade balance and labor cash earnings

Tuesday, July 9: Australia consumer and business confidence, Taiwan trade data, Philippines unemployment rate

Wednesday, July 10: Japan producer prices, New Zealand policy decision, China PPI and CPI, South Korea unemployment, Philippines trade data

Thursday, July 11: Japan machine orders, Malaysia policy decision, South Korea policy decision

Friday, July 12: India CPI and industrial production, Japan industrial production, Malaysia industrial production, Thailand reserves

Most Read from Bloomberg Businessweek

How Stocks Became the Game That Record Numbers of Americans Are Playing

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

©2024 Bloomberg L.P.