Should You Be Adding American Homes 4 Rent (NYSE:AMH) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like American Homes 4 Rent (NYSE:AMH). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for American Homes 4 Rent

How Fast Is American Homes 4 Rent Growing Its Earnings Per Share?

Over the last three years, American Homes 4 Rent has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that American Homes 4 Rent's EPS have grown from US$0.24 to US$0.27 over twelve months. I doubt many would complain about that 14% gain.

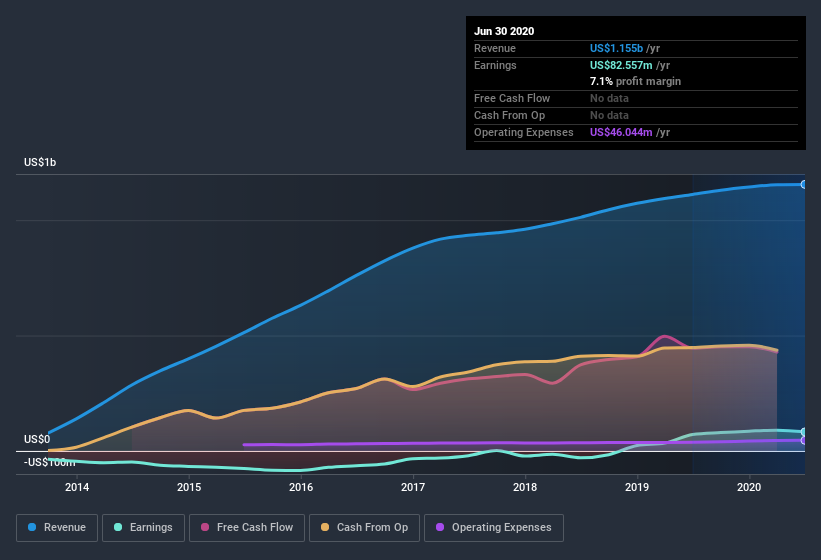

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. American Homes 4 Rent maintained stable EBIT margins over the last year, all while growing revenue 3.9% to US$1.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of American Homes 4 Rent's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are American Homes 4 Rent Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -US$5.9m worth of shares. But that's far less than the US$93m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the American Homes 4 Rent's future. We also note that it was the , Tamara Gustavson, who made the biggest single acquisition, paying US$31m for shares at about US$28.40 each.

The good news, alongside the insider buying, for American Homes 4 Rent bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$1.3b. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, David Singelyn is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations over US$8.0b, like American Homes 4 Rent, the median CEO pay is around US$11m.

The American Homes 4 Rent CEO received total compensation of just US$1.5m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add American Homes 4 Rent To Your Watchlist?

One important encouraging feature of American Homes 4 Rent is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. You still need to take note of risks, for example - American Homes 4 Rent has 3 warning signs (and 1 which is concerning) we think you should know about.

The good news is that American Homes 4 Rent is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.