France's EDF to pursue UK nuclear plan despite CFO's exit

By Benjamin Mallet and Geert De Clercq

PARIS (Reuters) - French utility EDF said it would push ahead with a plan to build nuclear reactors in Britain, despite its finance director quitting over the risk he sees it poses to the company's future.

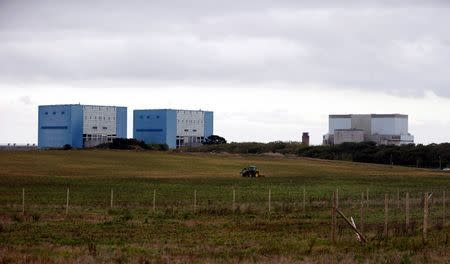

France and Britain also pledged their support for EDF's 18 billion ($26 billion) Hinkley Point project in southwest England, which their leaders last week called a pillar of the countries' relationship.

With the nuclear industry in the doldrums following the 2011 Fukushima disaster and fierce competition from Russian firms in emerging markets, the UK contract is the only real market for France's nuclear industry and critical for Areva, which designed the reactors EDF plans to build in Britain.

Sources said chief financial officer Thomas Piquemal had resigned over concerns the project would put too much stress on EDF's balance sheet. Piquemal was not available for comment.

An EDF strategy committee followed by a board meeting on Tuesday is set to discuss the Hinkley Project, but is unlikely to make a final investment decision, sources close to EDF said.

The Hinkley Point nuclear plants would produce about 7 percent of the UK's power needs and are crucial for British energy security, but even more so for France's nuclear industry.

Most of France's 58 nuclear reactors were started in the 1980s and will produce power well into the next decade, which means its nuclear industry has no domestic market for new reactors in the coming decade.

"The entire future of the French nuclear industry rests on Hinkley Point, that is why the political pressure to go ahead is so high," a source close to the company said on Monday.

The project was first announced in October 2013, but a final investment decision has been repeatedly delayed as EDF struggled to find partners and financing.

As EDF's business outlook and finances deteriorated over the past two years, the project has faced opposition from unions and within EDF's board.

Sources familiar with the situation said Piquemal shared those concerns and that was why he had quit.

One source with knowledge of the atmosphere at board level described a "battle for influence at the top of the company" over "decisions taken outside the business" -- a reference to political and diplomatic aspects of the project.

MULTIPLE CONCERNS

"The CFO was pushing for a three-year delay to make a final decision on this project, while (CEO Jean-Bernard) Levy, urged by the French government, was pushing for a short-term decision," said Bryan Garnier analyst Xavier Caroen.

Shares in 85 percent state-owned EDF closed 6.7 percent lower on Monday. They have lost half of their value in the past year over worries about Hinkley Point and other projects.

One analyst said Piquemal's resignation raises questions about EDF's commitment to return to positive cash flow by 2018, a key plank of Piquemal's financing strategy.

While EDF is profitable, its heavy investments weigh on cash flow and it has had to borrow billions of euros in recent years just to pay dividends, pushing net debt to over 37 billion euros.

When Hinkley Point was announced in 2013, EDF planned to take a minority stake, but only Chinese utility CGN signed up for a one-third stake in Oct. 2015, forcing EDF to fund the rest.

Since then, EDF has had to bail out Areva by taking over its reactor unit, while plunging power prices and new competition pushed its 2015 profit down 68 percent.

In response, EDF has cut its dividend and announced plans to sell assets, but analysts have long doubted all these measures would suffice to fund Hinkley Point.

"If there was a rabbit in EDF's hat, Piquemal would have pulled it out," one source close to the company said.

EDF's finance head for France, Xavier Girre, will take over from Piquemal in an interim capacity.

($1 = 0.7056 pounds)

(Additional reporting by Alexandre Boksenbaum-Granier in Paris and Karolin Schaps in London; Writing by Andrew Callus; Editing by Keith Weir and Alexander Smith)